Trump’s Victory Fuels Market Frenzy: Today’s Charts

The S&P 500 soars: The stock market skyrocketed with Trump’s victory and the Republicans securing the Senate and poised to claim the House.

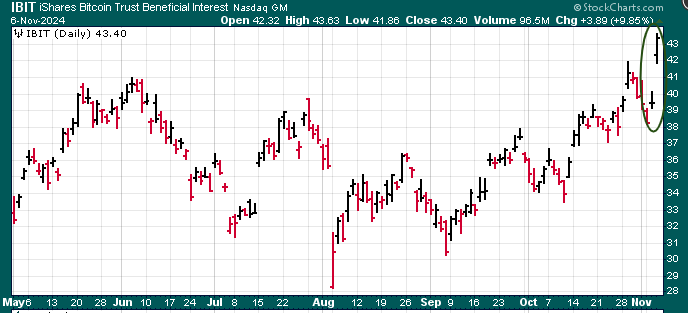

Bitcoin soars to new high: Bitcoin surged past $75,000, driven by Trump’s pledge to establish the US as a leading crypto hub. This rally reflects heightened investor optimism around a potential crypto-friendly regulatory environment under the new administration.

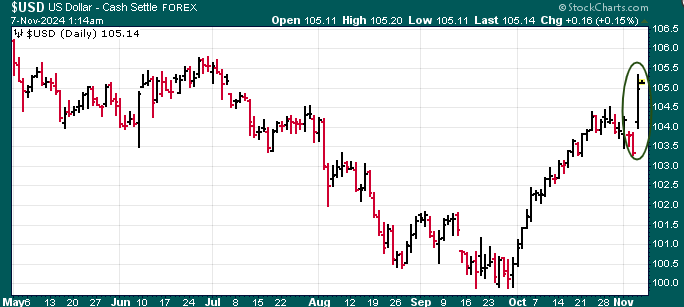

US Dollar blasts higher: The dollar marked its strongest day since 2022 on a strong stock market and rising yields.

Bank stocks rally: Bank stocks soared as investors anticipated deregulation and economic growth under the new administration. Major institutions saw substantial gains, with JPMorgan Chase leading the way, up 13% today.

Gold falls: With a huge rally in the US dollar, gold got clobbered, down 73.00 for the day.

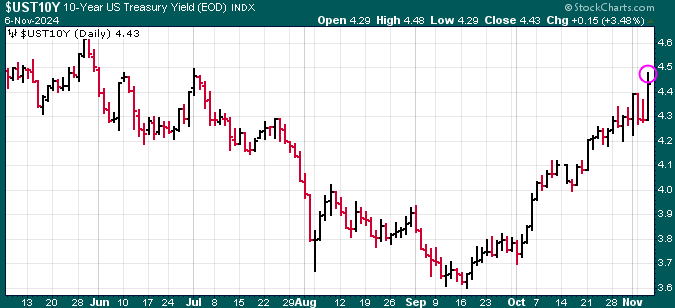

Bond market turmoil: While Trump’s policies are welcomed by the stock market, the bond market is reacting less favorably. Expectations of lower tax revenues and higher government spending point to rising deficits and ballooning debt. As inflation expectations climb, the value of fixed-income investments erodes, pushing investors to demand higher yields, which drives bond prices down. This dynamic reflects concerns over inflation and fiscal imbalances under the new administration.

Green stocks get hammered: Companies in the green energy sector saw sharp declines, with solar stocks such as Sunnova Energy plummeting—Sunnova dropped a staggering 51% today. This sell-off underscores investor concerns about reduced environmental policy support under Trump’s administration, casting uncertainty over the future of renewable energy initiatives.

Market insights: This political landscape gives Trump significant leeway to implement his pro-business agenda—lower taxes and reduced regulations—which investors see as fuel for market growth and economic expansion. The rally reflects Wall Street’s optimism about a policy environment favoring corporate earnings and business-friendly reforms.