Election Month Market Moves: Setting the Stage for 2025

November 2024 brought a whirlwind of market activity following the Trump election, with standout performances setting the tone for what could be the next big trading themes. Here’s a condensed look back—and some thoughts moving forward.

Market Highlights Post-Election

- Explosive Gains: Ethereum (+49%), Bitcoin (+42%), natural gas (+26%), cloud storage (SKYY) (+17%), broker-dealers (IAI) (+16%), and software (IGV) (+15%), stole the show.

- Broad Rally: Oil and gas (XOP), financials (XLF), the Russell 2000 (+11%), and internet stocks (FDN) (+10%) showed strong follow-through.

- Trading Targets: These sectors could lead the next wave of performance—we want to keep an eye on the frontrunners.

Trump-Era Market Signals

- VIX Decline: A drop from $23 to $13.70 eased market fears, clearing the way for equity gains.

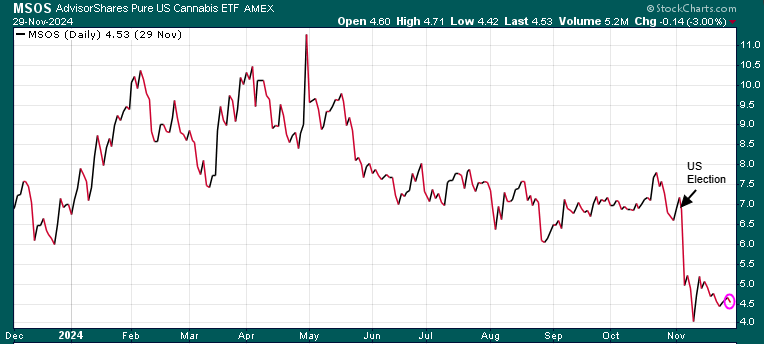

- Sector Laggards: Cannabis stocks (MSOS, -37%) and solar energy (TAN, -9%) faced heavy losses amid Trump’s pro-energy, anti-renewables stance.

Key Risks and Observations

- Semiconductors are a source of concern: Semi ETF SMH up 50% YTD but was down ~9% in November.

The Playbook

- Trump Trade Momentum: Bitcoin (IBIT), software (IGV), S&P 500 (SPY), financials (XLF), broker-dealers (IAI), cloud storage (SKYY), and consumer discretionary stocks are leaders who we need to keep watching.

- Tactical Approach: Wait for pullbacks, manage risk, and position for continued strength into 2025.

The market has identified its current leaders. As the Santa Claus rally approaches, expect continued momentum, but post-inauguration, market euphoria may cool off. That pull back could present a good buying opportunity.

Stay tuned!