Market update – DeepSeek Hits Big Tech

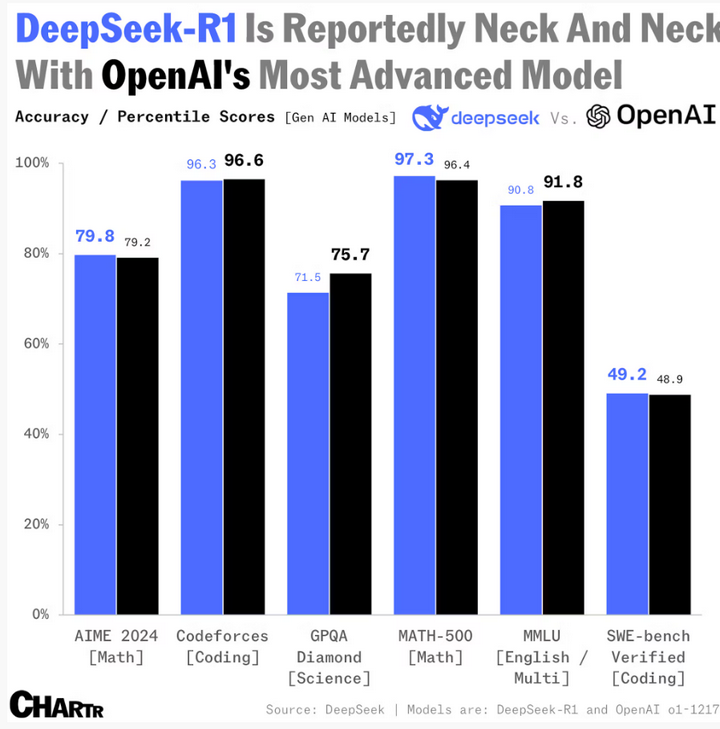

DeepSeek announced that its R1 model rivals OpenAI’s o1-mini, unveiled in September, while training costs for its latest model totaled $5.6 million—far lower than the $100 million to $1 billion cited by Anthropic CEO Dario Amodei for similar projects. The company trained its V3 model using just over 2,000 Nvidia chips, compared to the tens of thousands typically required for comparable AI systems.

The company said training one of its latest models cost $5.6 million, compared with the $100 million to $1 billion range cited last year by Dario Amodei, chief executive of AI company Anthropic.

“This new AI challenger has spooked investors,” said AJ Bell investment director Russ Mould. “Its assistant is free, operates on lower-cost chips, and uses less data—posing a serious challenge to Western AI leaders.”

DeepSeek’s rapid rise is escalating the AI rivalry between the US and China, particularly in light of Stargate—a US-based joint venture by OpenAI, SoftBank, Oracle, and MGX to expand data center capacity.

The news of DeepSeek’s emergence sent shockwaves through the market, with chipmakers suffering significant losses on fears that the availability of lower-cost alternatives will erode their pricing power. This pressure contributed to a notable sell-off in the Nasdaq tech index.

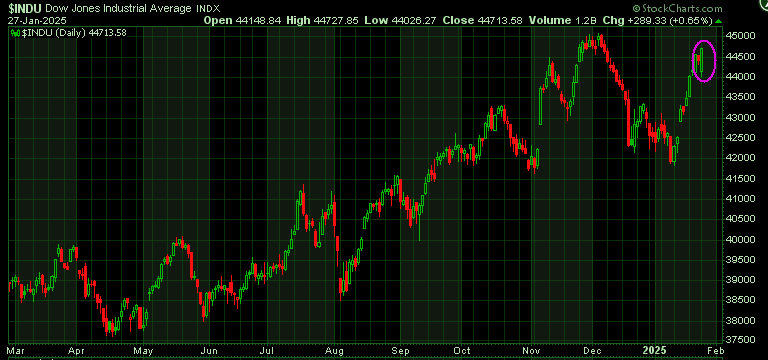

Conversely, industrial companies poised to benefit from more affordable AI solutions experienced gains, as reflected in the rally of the Dow Industrial Average Index. This market reaction underscores the shifting dynamics in the AI landscape, where cost-efficient technologies are reshaping winners and losers.

Stay tuned!