Evaluating Greenland’s Role in a Tight Global Uranium Market

/in Investing in Commodities, The Trend Letter /by Trend LetterInvestors fearing that uranium mining in Greenland might depress market prices should consider several critical factors, including the current global supply shortfall, and an expanding supply-demand gap,

Addressing Investor Concerns About Greenland’s Uranium Impact on Prices

Current Uranium Market Dynamics

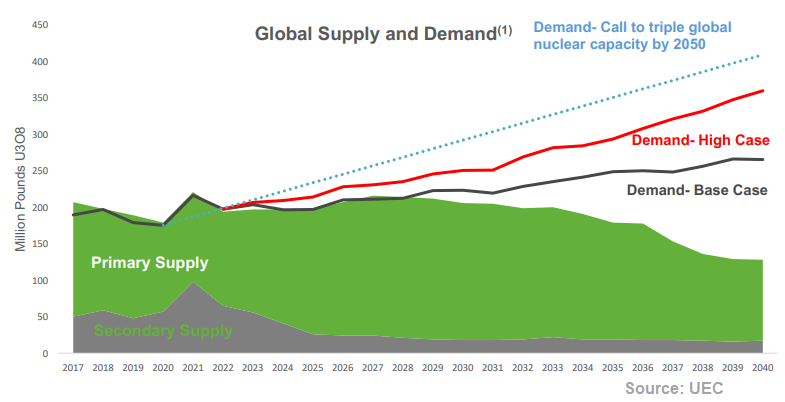

The uranium market is grappling with a pronounced supply deficit. In 2024, production reached only 89% of the global reactor requirement, leaving a substantial shortfall. Additionally, secondary supplies—which have traditionally filled the gap—are vanishing quickly, with commercial inventories falling from 65 million pounds in 2021 to just 17.5 million pounds in 2024. Notably, 2024 was expected to mark the last year when these secondary reserves offer any significant support.

Growing Supply-Demand Gap

This shortage is poised to worsen over the coming decade. Paladin Energy forecasts an annual deficit exceeding 50 million pounds of uranium, emphasizing the deepening imbalance between supply and demand. Utility companies, in response, are increasingly committing to long-term contracts, a clear indicator of their concerns about future supply shortages.

Reasons to Invest in Nuclear Energy

Long-term investments in nuclear energy continue to be attractive for several key reasons:

- Stable and Reliable: Nuclear plants operate 24/7, ensuring a continuous and dependable power supply irrespective of weather conditions.

- Low Greenhouse Gas Emissions: With a carbon footprint between 15 and 50 grams of CO₂ per kilowatt-hour, nuclear energy is a much cleaner alternative to fossil fuels, currently preventing about 1.5 gigatonnes of global emissions each year.

- Growing Public Support: Global sentiment toward nuclear energy is on the rise, with even environmental advocates increasingly in its favor—an encouraging sign for future projects.

- International Commitment: At COP28, more than 20 countries, including Canada, the US, France, and the UK, endorsed the Declaration to Triple Nuclear Energy, underscoring strong governmental backing for nuclear expansion.

- Significant Growth Potential: With 440 operational nuclear plants worldwide, tripling capacity would require 1,320 reactors. Given that 65 reactors are under construction and 110 are planned, an additional 1,145 reactors would be needed to reach this goal—even halving the target would necessitate 570 new reactors. Such an expansion would dramatically boost uranium demand.

- Economic Benefits: Studies suggest that investments in nuclear energy can spur economic growth, potentially increasing GDP by 0.2% to 3% in countries that prioritize nuclear power.

Greenland’s Uranium Potential and Challenges

Although Greenland is known to possess significant uranium reserves, several obstacles hinder any near-term market impact:

- Political and Regulatory Hurdles: A 2021 ban by Greenland’s government prohibits uranium exploitation above 100 ppm, posing a formidable barrier.

- Environmental Concerns: Local opposition driven by environmental and community interests has led to stringent restrictions on uranium mining.

- Extended Development Timeline: Even if these challenges were overcome, new mining operations in Greenland would likely require many years—possibly a decade or more—to become operational.

Market Implications for Investors

Considering the current market conditions, several key implications emerge for investors:

- Persisting Supply Deficit: The ongoing and projected shortages indicate that uranium prices are more likely to rise in the near to medium term.

- Limited Short-Term Impact from Greenland: Given the regulatory and developmental challenges, Greenland’s uranium reserves are unlikely to affect the market significantly in the short run.

- Surging Demand: With over 60 new reactors under construction globally and increasing support for nuclear energy, demand for uranium is set to grow substantially.

- Importance of Diversification: Recent geopolitical shifts underline the necessity of diversified supply sources to ensure long-term energy security.

Conclusion

Investors concerned that Greenland’s potential uranium production might lower prices should instead consider the current severe supply deficit, the rapid depletion of secondary reserves, and the forecasted surge in global demand. With ambitious international plans to expand nuclear capacity and a pressing need for new reactor construction, additional uranium supply—even from Greenland—will likely be absorbed by the market, thereby supporting, rather than reducing, uranium prices. New sources of uranium will be crucial in meeting the growing global demand for nuclear fuel.