Nvidia Breaks Support – Is a Tech-to-Commodities Shift Underway?

Here are two key charts to focus on this week.

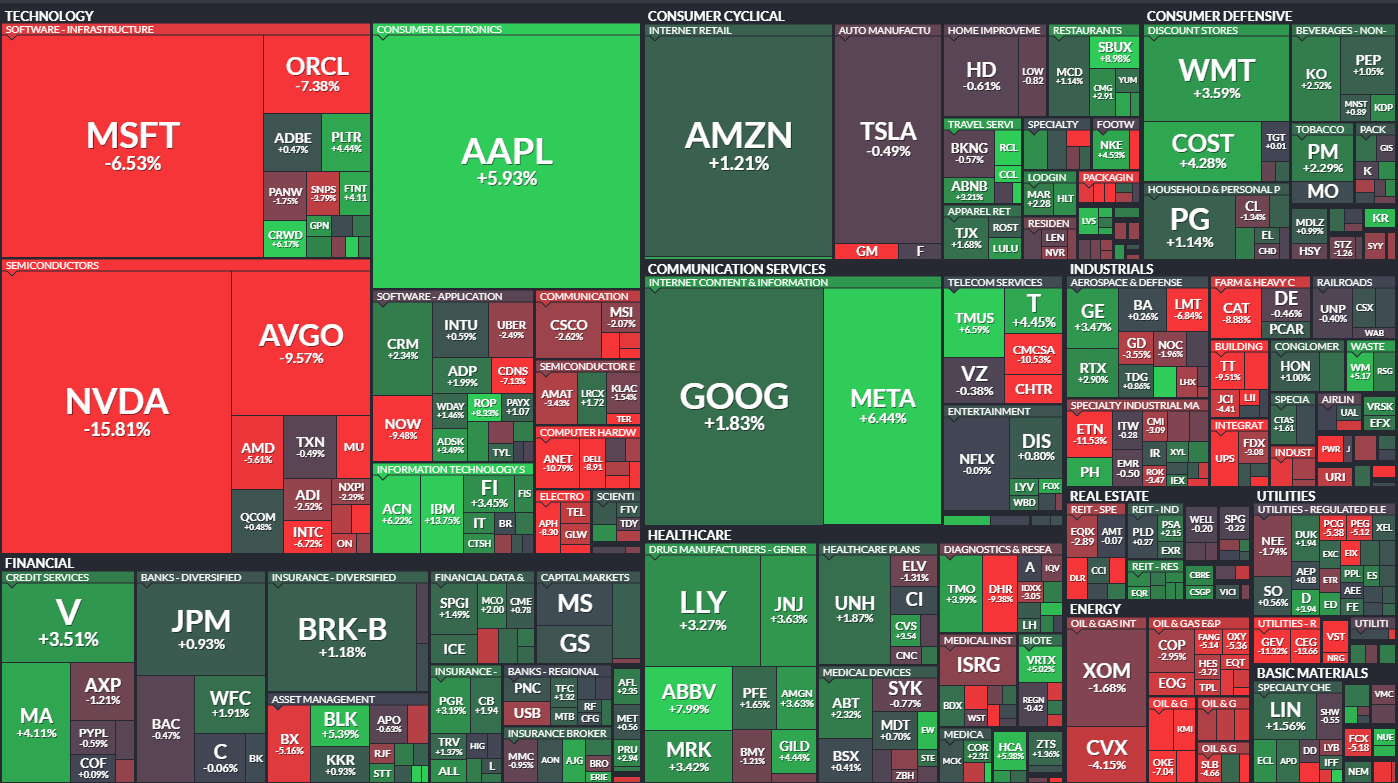

First, we examine the S&P 500 heat map, which highlights last week’s biggest losers—many of which were major tech stocks. Among them, Nvidia stood out as the biggest tech loser of the week.

By now, the impact of DeepSeek on the AI modeling landscape is widely recognized. For those looking for more insight, we recently published a blog titled ‘The Rise of DeepSeek: Redefining the Future of AI.‘

We’ve been tracking Nvidia’s potential decline since mid-November and revisited the topic after its Outside Reversal on January 7th. As outlined in our last update, ‘Market on Edge: Is Nvidia Signaling a Bigger Pullback Ahead?‘ the stock has now broken below its near-term support at 135.00, with the next key level to watch at 98.00.

This movement is worth watching closely, as it could validate our forecast of a rotation out of high-flying tech stocks and into commodities—potentially fueling the next major rally.

As usual, we will have full coverage of all the markets in Sunday’s issue of the Trend Letter

Stay tuned!