Markets Tumble – What’s Next for the S&P 500?

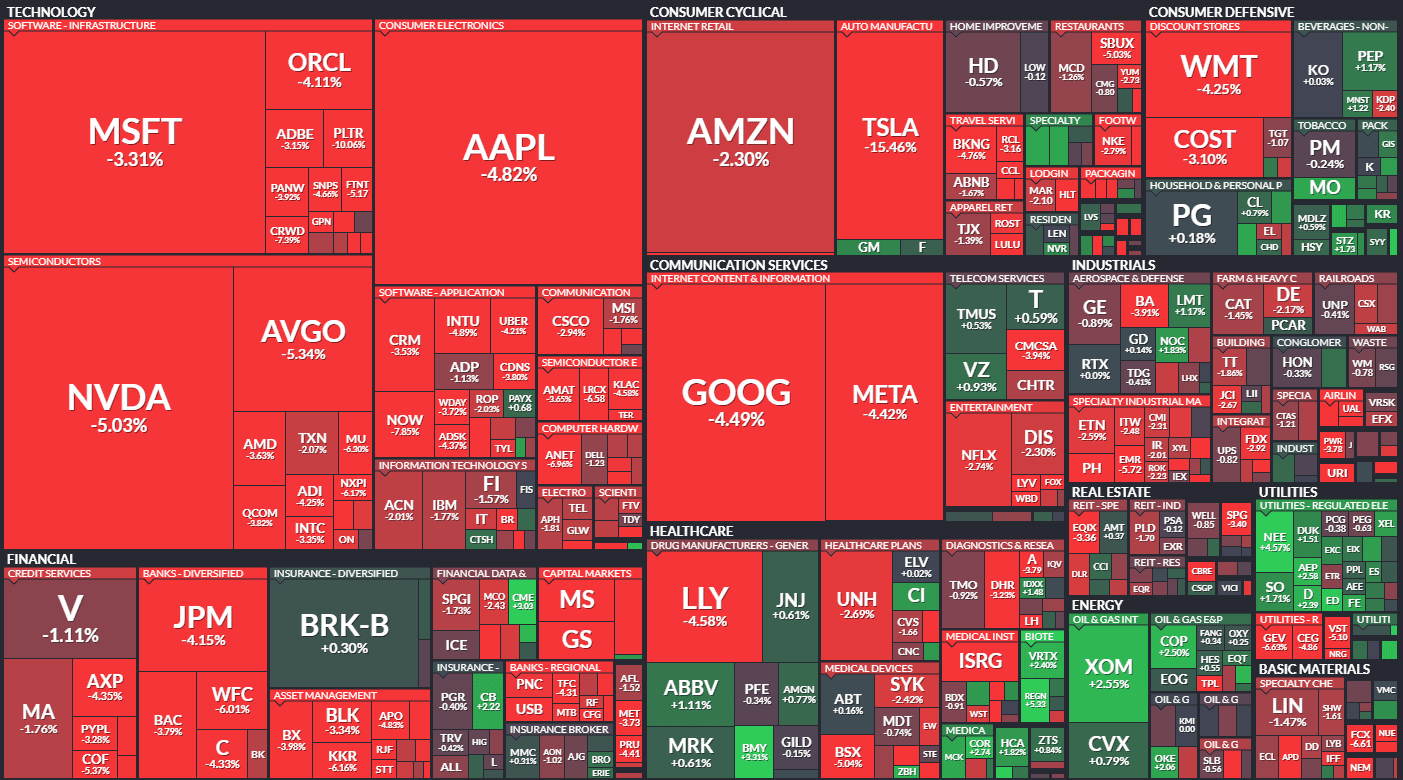

The heat map of the S&P 500 shows widespread declines across sectors, with technology stocks particularly hard hit. The ‘Magnificent Seven’ companies, including Tesla (-15%), Broadcom (-5.34%) and Nvidia (-5.03%) experienced significant losses.

The notable declines experienced by the equity markets were primarily driven by escalating recession fears and uncertainties surrounding US trade policies.

- Dow Jones Industrial Average: Fell 890 points (2.1%) to 41,911.71.

- S&P 500: Dropped 155 points (2.7%) to 5,614.56.

- Nasdaq Composite: Plunged 728 points (4%) to 17,468.32.

These declines were exacerbated by Trump’s recent comments declining to rule out a potential recession, intensifying investor concerns.

Technical Analysis of the S&P 500:

The S&P 500 has now dropped below its 200-day moving average (DMA) and key support at 5,670. The critical question is whether this breakdown will be confirmed by a close below this level tomorrow. A confirmed close beneath this support could signal a deeper market correction, with the next key support level just below 5,400 (second green horizontal line).

However, if the S&P 500 manages to rally and close back above 5,670, we could see a short-term rebound. While this wouldn’t necessarily mark the ultimate market low, it would indicate a potential relief rally. To confirm a more sustained recovery, the index would need to reclaim its position within the uptrend channel (yellow lines) that it fell out of two weeks ago. This would require a rally back to the 6,000 level (red horizontal line).

Both Trend Technical Trader and Trend Letter had anticipated these sharp market declines and issued hedging positions to safeguard subscribers in advance.

If you’re looking for guidance in navigating these volatile markets, now is the perfect time to consider subscribing to our services. Our mission remains to help investors make informed decisions during uncertain times.

To support this, we’re reopening our Special Offers from the WOFC 2025 Conference, providing 33%–57% off regular subscription rates. Click here to take advantage of these exclusive discounts!

Keep your head on a swivel!

Martin

Trend News