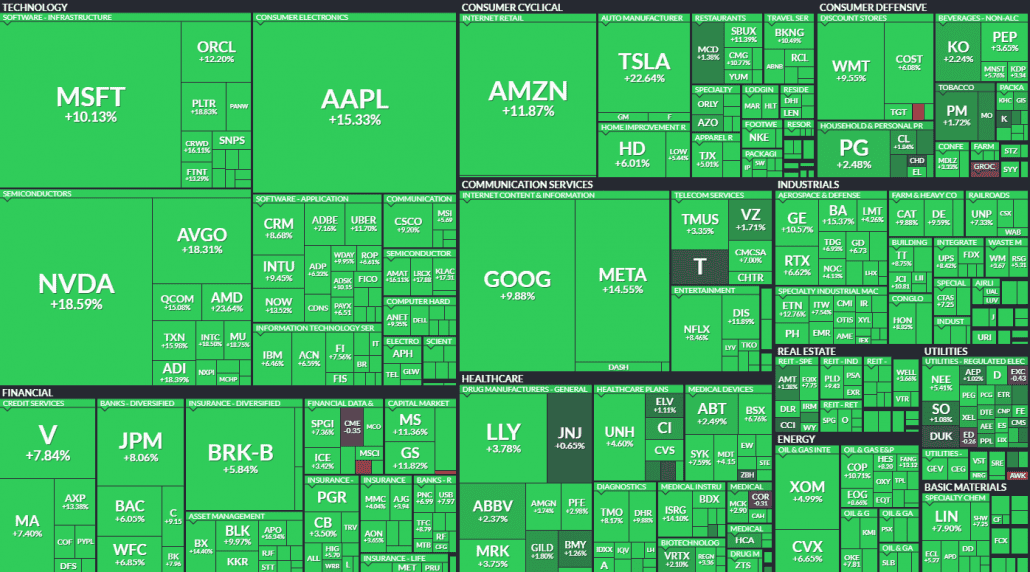

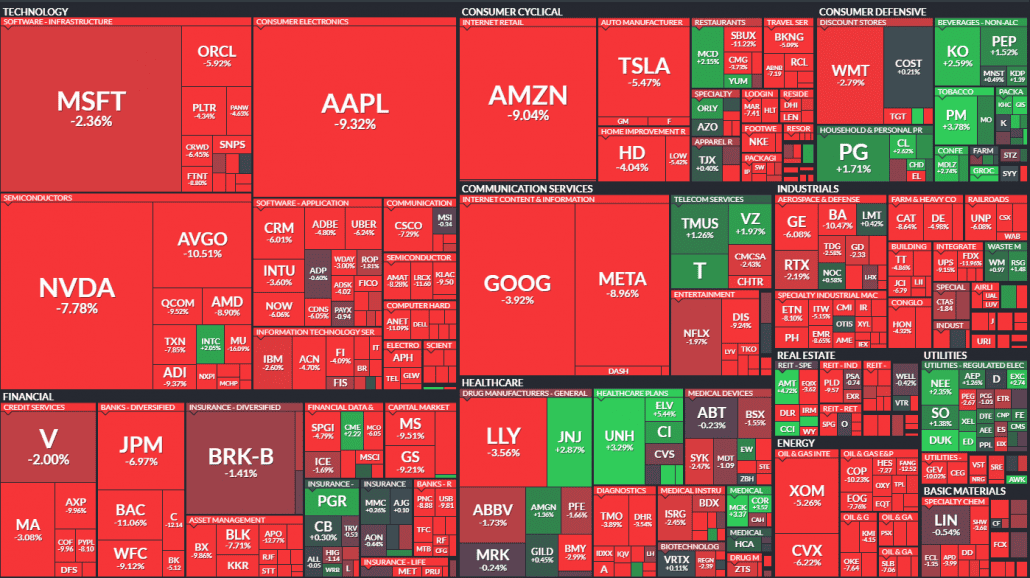

Markets Slide as Political Turmoil Erodes Confidence

Global equities tumbled Monday, driven by political instability, policy uncertainty, and rising trade tensions. Trump’s threat to fire Fed Chair Jerome Powell further undermined confidence in the Fed’s independence and the broader US financial system.

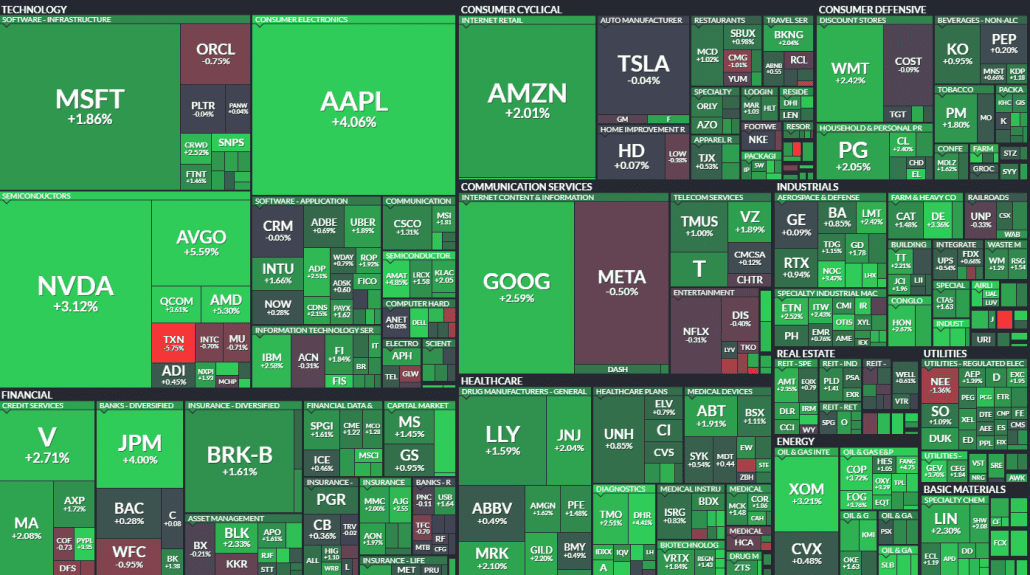

The S&P 500 heatmap was a sea of red, with Netflix a rare bright spot. Major tech names led the decline: Tesla (-5.75%), Nvidia (-4.51%), Salesforce (-4.45%), and Meta (-3.51%).

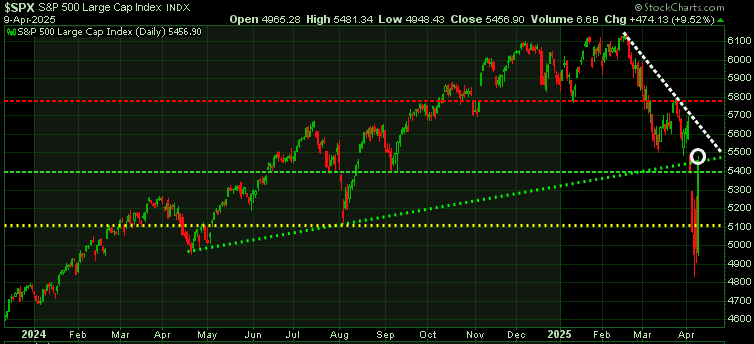

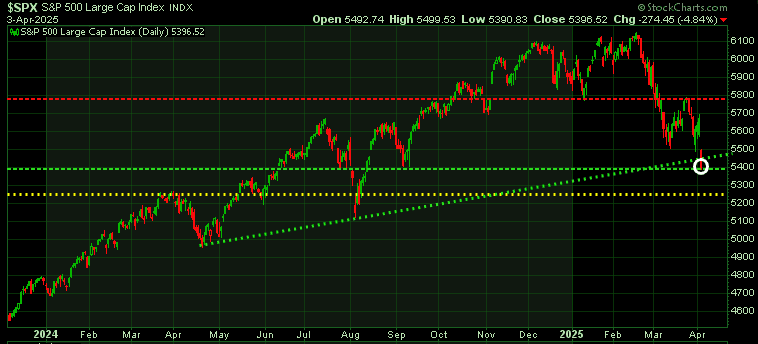

S&P 500 Technical Analysis

For the S&P 500, initial resistance is at 5,500 (lower red horizontal line); a break above that opens the door to 5,700 (upper red horizontal line). Support sits just under 5,000 (upper green horizontal line), with 4,800 (lower green horizontal line) as a key weekly level to watch.

Any positive trade deal headlines could spark a bounce this week, but further US–China escalation would cap upside potential. The longer uncertainty lingers, the greater the damage to the global economy, and declining business and consumer confidence is a long-term drag on equities.

For short-term traders, a dip to 5000 could trigger a bounce, but any rebound is likely capped at 5400.

Bond Yields Rising

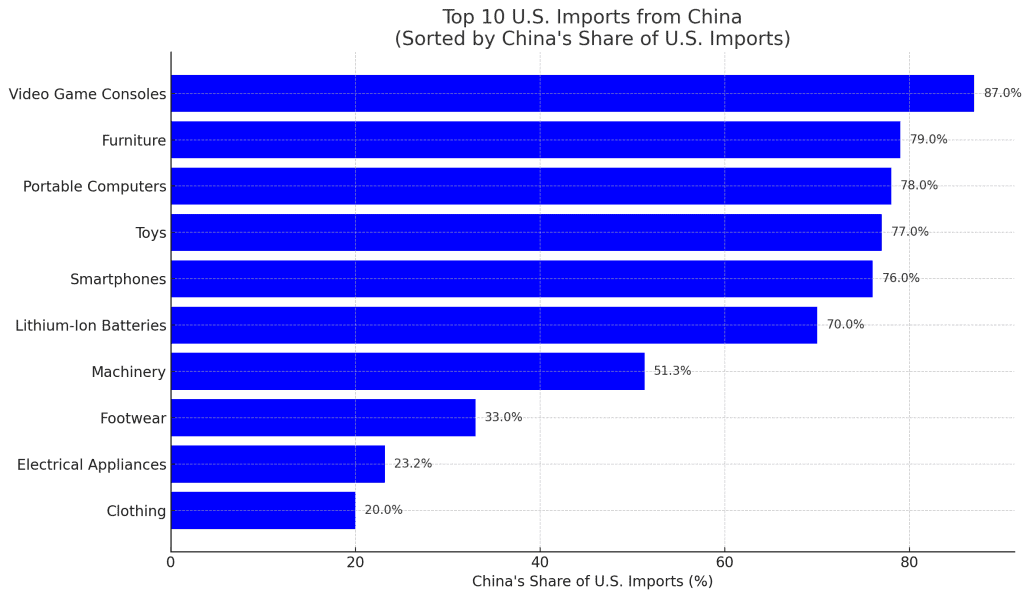

Yields jumped on inflation fears, declining foreign demand, and policy chaos:

- Tariff Shock: Trump’s April 2 tariffs first triggered recession fears, then inflation worries—pushing yields higher.

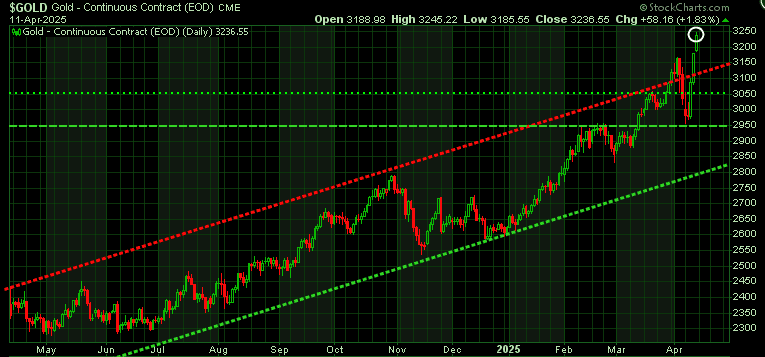

- Foreign Selling: China and Japan cut Treasury purchases, while weak auctions and hedge fund deleveraging sent the 10-year yield to 4.5% intraday (April 8). Many allies, frustrated with Trump, see little reason to back U.S. debt.

- Economic Risk: Higher yields threaten U.S. debt servicing ($37T) and consumer borrowing, deepening financial stress.

Flight to Safety

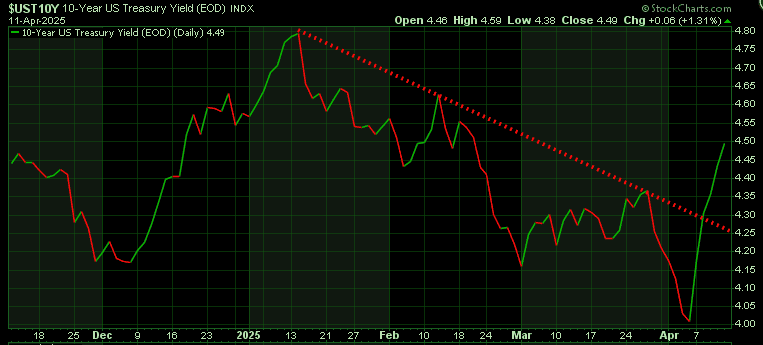

Gold hit a fresh all-time high at $3,422, now up 31% year-to-date, on pace for its best annual gain since 1979. Though technically overbought, it remains the go-to safe-haven. Trade war fears are driving investors, hedge funds, and central banks to unload US assets and pile into gold.

The primary retail buyers are in Asia.

Looking back to gold’s 2011 high, we see it trading within two parallel channels. The last time we saw intersecting channel, it marked a major low in late 2022 (lower white circle).

With the lines crossing again near current levels (upper white circle), this could signal a potential short-term top. A meaningful pullback from here could present a solid buying opportunity.

Bitcoin Rallies as Dollar Slides

Bitcoin posted its strongest day in weeks, fueled by a combination of macro pressures and renewed institutional interest. Confidence in traditional assets took a hit as Trump’s attacks on the Federal Reserve and its leadership weakened the US dollar, driving investors toward Bitcoin as a hedge. Meanwhile, institutional demand picked up, highlighted by Japan’s Metaplanet buying 330 additional BTC and strong inflows into US Bitcoin ETFs.

Bitcoin is now testing initial resistance at $88.3K, with major resistance at $92.5K – the same level that served as strong support from November through December.

Keep your head on a swivel – this is far from over!

Stay tuned!

Martin