Markets Now Move at Trump’s Whim

Forget AI hype. Forget earnings. These days, stock prices hang on one thing: what President Trump says next. His words spark chaos, drive momentum, and overshadow everything else.

After announcing ‘reciprocal tariffs’ on April 2, markets plunged for four straight days. Then, at 1:18 PM today, he took to social media to say he’s ‘substantially lowered’ those tariffs to 10% for a 90-day negotiating window. At the same time, he doubled down on China—raising their tariff rate to 125%.

The market reaction? Instant. Explosive. Stocks ripped higher with near-record gains on a massive 30 billion shares traded. It wasn’t earnings, data, or innovation that moved the needle—it was a single post.

Key Highlights:

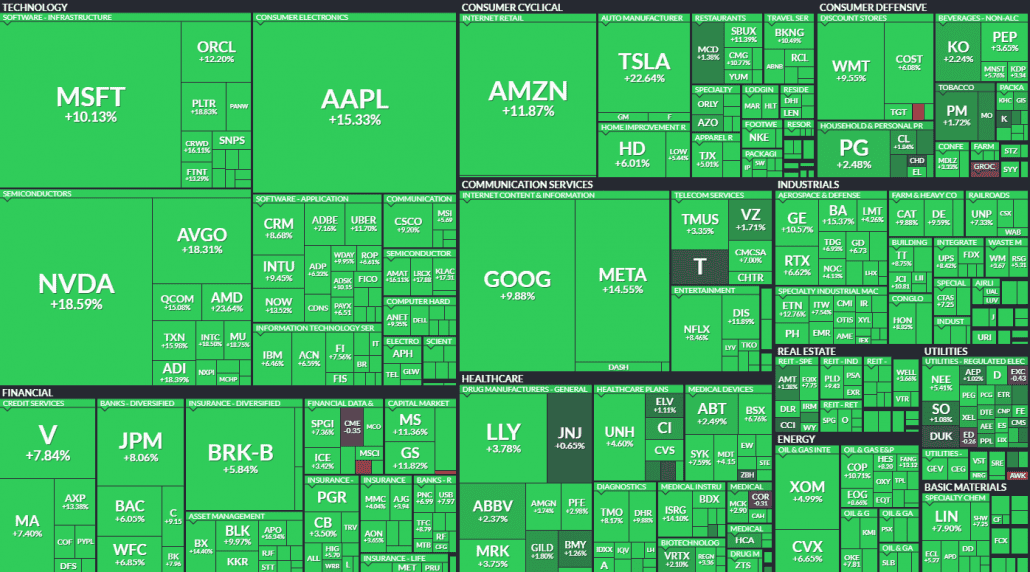

- Major Index Performance:

The Dow Jones Industrial Average surged nearly 3,000 points, or 7.87%, to close at 40,608.45—its largest percentage gain since March 2020. The S&P 500 jumped 9.52% to 5,456.90, notching its best single-day performance since 2008. The Nasdaq led the charge, skyrocketing 12.16% to finish at 17,124.97. - Sector Performance:

Technology stocks fueled the rally, with Apple climbing over 15% and Nvidia surging nearly 19%. Tesla saw a sharp gain of more than 22%. Defensive sectors, including health insurance and defense, also posted solid gains following favorable policy developments.

We’ve reached the point where markets no longer move on earnings, revenue growth, or even AI hype. Now it’s all about what the President says—and the reactions are massive. One post, one offhand announcement, and stocks either soar or sink.

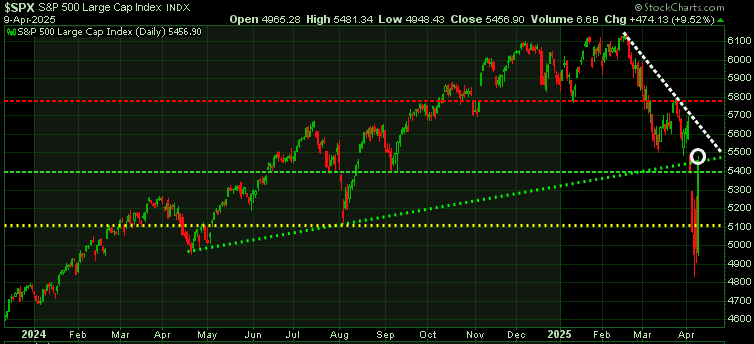

Today’s violent rebound, coming right after a steep selloff, draws uncomfortable parallels to past meltdowns—think the Dotcom Bust or the Financial Crisis—when similar sharp swings masked deeper instability..

Wild Ride: 533-Point Swing Sets Up Key Test

Today’s massive intraday move—from a low of 4,948 to a high of 5,481—was a jaw-dropping 533-point swing. The next key resistance? The white downtrend line, hovering around the 5,500 level.

A Trader’s Dream Day—But Caution Still Rules

Today was a gift for short-term swing and day traders. Some of the biggest rallies happen in bear markets, and this was a textbook example.

While there may be a bit more upside in the near term, uncertainty still looms large—and markets hate uncertainty. Relief rallies can be powerful, but let’s be clear: we’re still in a downtrend – at least for now. The S&P 500 needs to push through 5500and hold above that level.

Stay tuned!