Markets Rally, Bonds Break, Gold Soars—What You Need to Know

Markets End Volatile Week with a Strong Rebound – April 11, 2025

Markets capped a wild week with a strong finish, shrugging off trade war shocks and riding a wave of optimism:

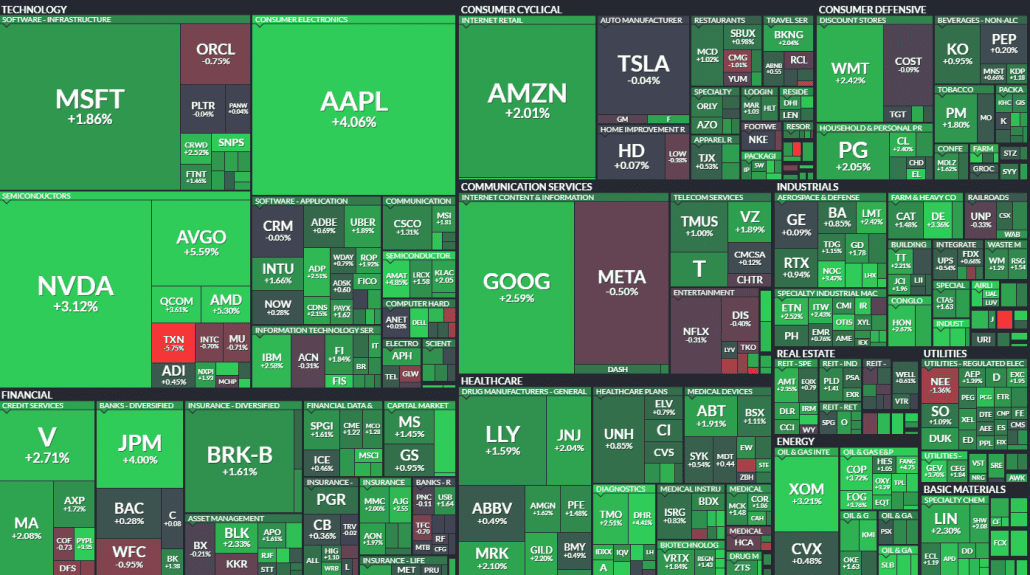

- Stocks Bounce Back: After days of volatility, the Dow surged 600 points (+1.6%), the S&P 500 climbed 1.8%—its best week since October 2023—and the Nasdaq jumped 2.1%, led by a tech resurgence.

- Trade War Tensions: Markets were rattled by China’s retaliatory tariffs of up to 125% and President Trump’s aggressive 145% hikes on Chinese imports. Yet, solid bank earnings and cooling inflation helped restore investor confidence.

- Flight to Safety: Gold soared to a record high as a safe-haven play, while 10-year Treasury yields surged to 4.53%, approaching multi-decade highs.

- Tech Leads Recovery: Mega-cap tech stocks including Nvidia, Microsoft, and Tesla staged a strong rebound after Thursday’s sharp selloff.

Despite intense geopolitical and market pressure, Wall Street closed the week with notable strength, showing surprising resilience. The S&P 500’s performance for the week ending, was its strongest since November 2023. Here is today’s heat map:

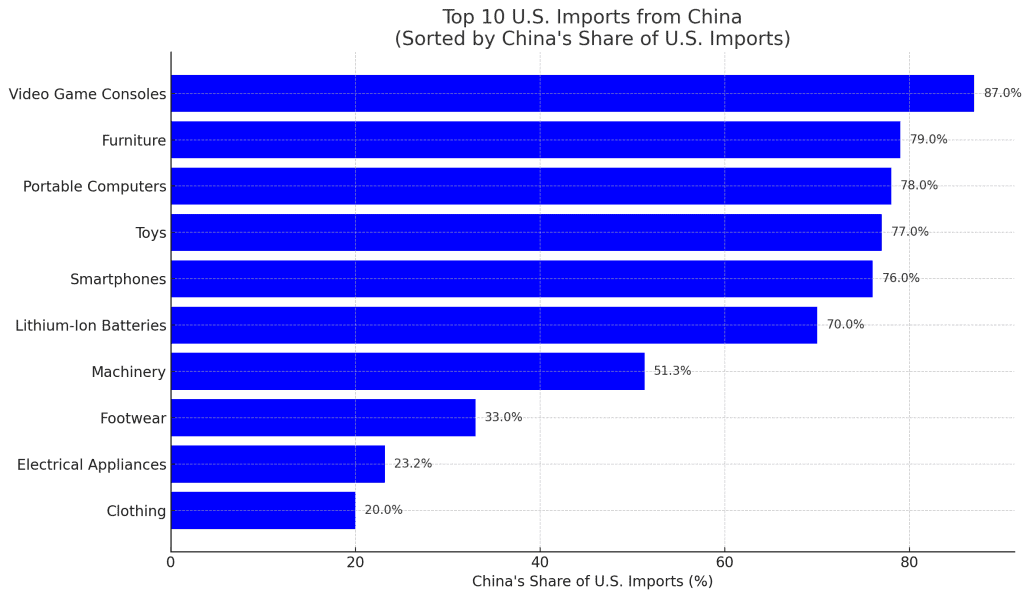

How 145% Tariffs on Chinese Imports Could Shock U.S. Consumers

With over 70% of key consumer goods like smartphones, furniture, and video games sourced from China, tariffs could trigger sharp price hikes across everyday essentials.

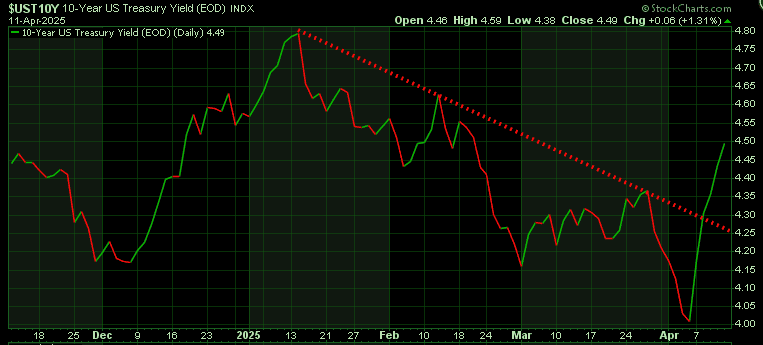

Bond Market Flashing Red: Why Yields Are Surging Despite Stock Market Weakness

There’s a notable shift in Trump’s focus this term compared to his first. Back then, he constantly cited the stock market as proof of a strong economy. This time, he’s barely mentioned it.

Instead, the emphasis is on policy—tax cuts, deregulation, spending restraint—and notably, lower borrowing costs. His Treasury Secretary, Scott Bessent, a former hedge fund manager, has made it clear: the goal is to bring down the 10-year Treasury yield.

But the market isn’t cooperating.

The 10-year yield, which dipped to 3.7% on April 4, has surged to nearly 4.5%—an 80 basis point jump in just one week. That’s the opposite of what Trump and Bessent want. Rising yields suggest the bond market expects higher inflation, even as economic growth slows—a recipe for stagflation.

Stagflation puts the Fed in a tough spot. Cutting rates could fuel inflation, but rising yields make borrowing more expensive for consumers, businesses, and the government.

So why are bonds selling off while stocks are falling? Isn’t the bond market supposed to be a safe haven?

The first part of the answer answer lies in the scale of US borrowing. The government needs to issue $7–8 trillion in new debt this year to fund ongoing deficits and refinance maturing debt. With annual deficits exceeding $2 trillion and total debt above $37 trillion, supply is overwhelming demand.

Layer in the geopolitical angle: the US and China are in a full-blown trade war. China—America’s second-largest foreign bondholder—has leverage. If China were to start selling US Treasuries while the US is issuing trillions more, bond prices would plunge and yields would spike.

Plus, many US allies aren’t exactly eager to support bond auctions while facing tariffs of their own. Why help fund a government that’s targeting your economy?

If yields continue climbing toward 5% or higher, it could spell serious trouble for the US economy—and likely drag the stock market down with it.

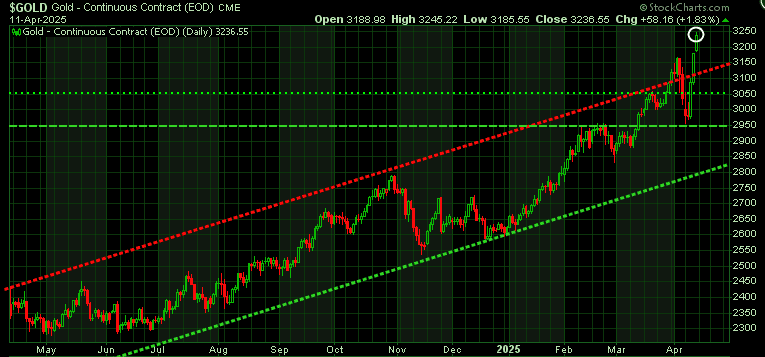

Gold Surges to New Highs as Safe Haven Demand Soars

Gold is ripping higher—up $70 today to a fresh all-time high of $3,250.

Just last week, it dipped to $2,970 during a broad market panic that triggered liquidation across all assets—gold included. It was a classic case of the baby getting thrown out with the bathwater. But that selloff didn’t last. Investors quickly stepped back and asked: What are the real safe haven plays right now?

Treasuries? The yen? Neither offer the confidence they once did. Bitcoin has been trading more like a tech stock than a store of value. That leaves gold—and it’s showing why it still holds safe-haven status.

Notably, gold doesn’t look like a crowded trade. COT data last Friday showed net-long positions at year-over-year lows, a bullish contrarian signal.

Yes, gold is expensive relative to other assets:

- The gold/oil ratio is at 53:1 (vs. a historical average of ~20:1).

- The gold/silver ratio has ballooned to 103:1 (vs. a long-term norm around 50–60:1).

But these extreme ratios reflect deep global uncertainty. The West’s seizure of Russian reserves and removal from SWIFT showed that financial infrastructure can be weaponized. That sent a clear message to countries like China, Russia, and Iran: don’t trust the West—buy gold.

Add in today’s escalating trade wars and rising geopolitical risk, and it’s no surprise that central banks are aggressively adding to their gold reserves. Retail investors are following suit, looking for a hedge amid global turmoil.

Key levels to watch:

- Resistance: $3,300

- Initial support: $3,050

- Major support: $2,960 (last week’s low)

For now, gold remains in a strong uptrend. It may pause or consolidate, but there’s little to support a bear case in the near term.

Stay tuned!