Market Pulse – July 18/25

Equities & Major Indices

- The S&P 500 and Nasdaq set new record highs early in the week, before slipping on profit-taking ahead of key earnings reports.

- The Dow Jones Industrial Average also edged lower in the final sessions.

- Despite Friday’s dip, the Canadian TSX posted a weekly gain of around +1.1%, marking a year-to-date increase of ~11%.

- June retail sales rose +0.6% month-over-month, exceeding forecasts and reinforcing consumer strength and economic momentum.

- Strong earnings from major names like Netflix boosted midweek sentiment.

- Market gains faded late in the week amid renewed tariff concerns as Trump threatened even more tariffs on the EU.

(Click on images for larger view)

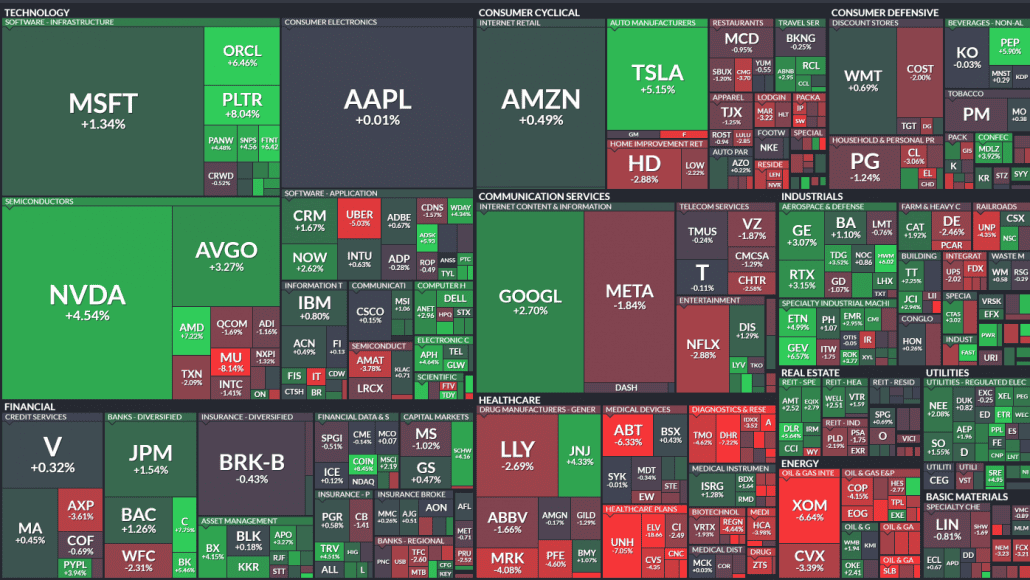

The S&P 500 heatmap shows Big Tech continuing to lead market performance.

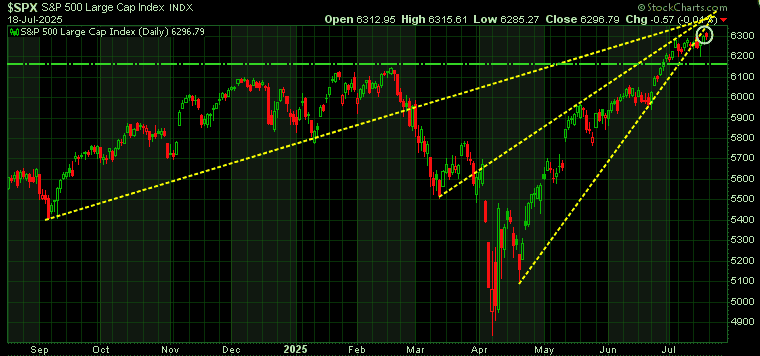

Technical analysis of S&P 500

The S&P 500 is testing a key resistance convergence zone, with three short-term resistance levels (yellow lines) in play. So far, it hasn’t been able to break through. A clean breakout above this zone would be a bullish “blue sky” signal. However, if the index retreats, watch the green horizontal support line. If support fails, a deeper correction could follow.

Key Support Levels:

• Initial support: 6150

• Secondary support: 5940

Historic ‘Crypto Week’ in Washington

Lawmakers discussed and advanced several industry-defining bills, including the Anti-CBDC Surveillance State Act, the GENIUS Act, and the CLARITY Act, aiming to provide clearer regulation for cryptocurrencies and stablecoins.

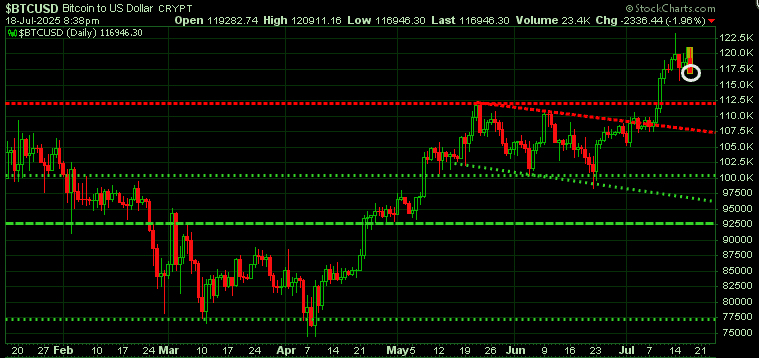

The entire cryptocurrency market cap surged past the $4 trillion milestone, reflecting broad optimism and a fresh bull run across digital assets.

Bitcoin touched new all-time highs above $123,000, but dropped on Friday, it dropped over $2,300. Here’s a thought – Are we about to see a classic ‘buy the rumor, sell the fact’ in crypto? We’re seeing a surge of companies trying to copy MicroStrategy’s game—selling you a $5 bill for $10, wrapped in hype and buzzwords, hoping you won’t realize the value gap until it’s too late.

Recent examples, including the underwhelming CEPO debut could be a warning sign. You can now buy crypto assets directly, and at-par, while some stocks are trading at huge premiums to their real crypto holdings, which historically isn’t sustainable.

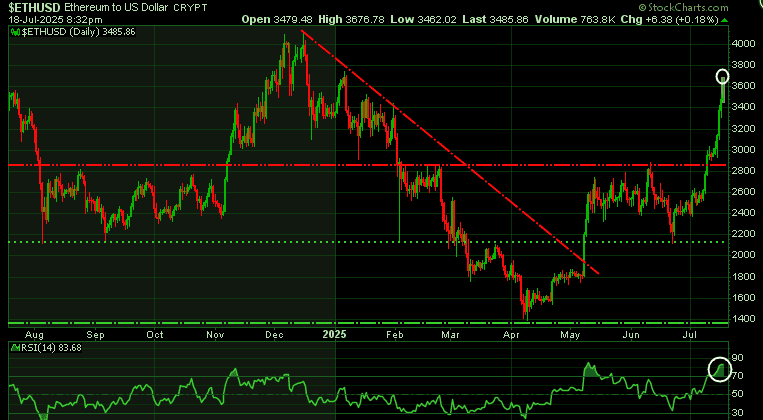

While 96 of the top 100 coins appreciated over the week, Ethereum (ETH) stole the spotlight with even stronger relative performance.

Profit-taking risk is high as the emotional mood in crypto has flipped from despair to euphoria in just three months. We would not be surprised to see Bitcoin pull back and test $110K level.

Big picture – traders and institutions seem to be loading up on hard, unmanipulable assets ahead of a possible Fed shakeup. If Trump installs an ultra-dove chair and pushes rates down to 1% while unleashing another wave of liquidity, crypto could rip higher—fast.

Currencies

After a steep decline the $US broke through its downtrend line (diagonal red line) in early July. Initial resistance will be 99.60 (red horizontal line).

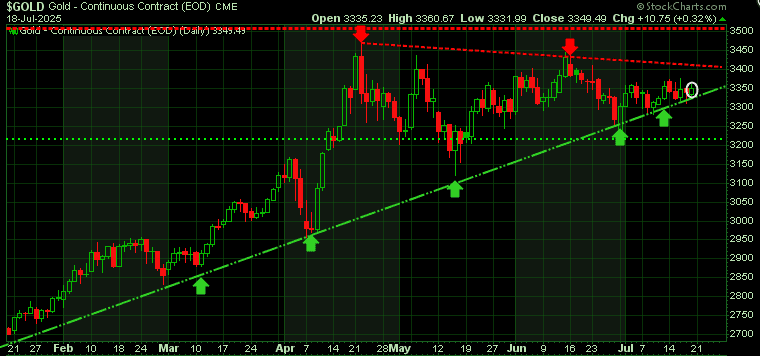

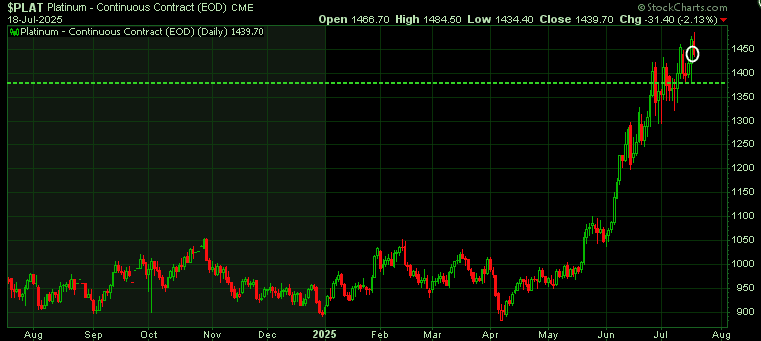

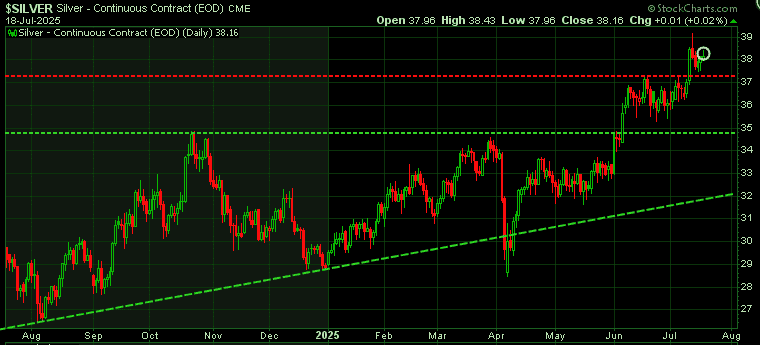

Precious metals

Gold hasn’t done much this week, meandering sideways. Gold is in a wedge pattern and has been trading sideways, testing the lower rung of that wedge (green diagonal line).

Platinum has pulled back a touch, taking a breather from its amazing rise since April. If we see a continued pullback, watch for support at 1370.

Silver has been acting as the metallic version of Ethereum

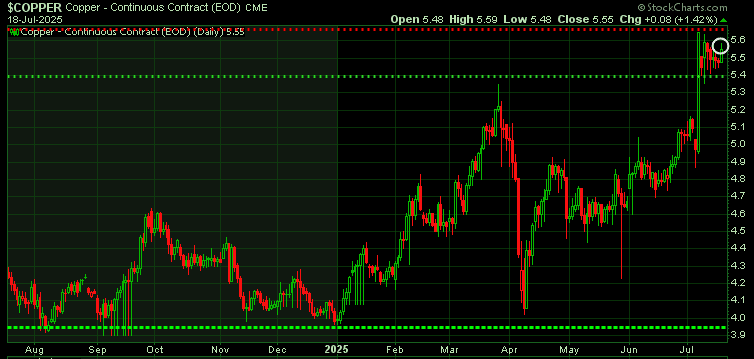

Commodities

Copper spiked after Trump announced 50% tariffs last week. This week, it started to pullback, but closed Friday near an all-time high.

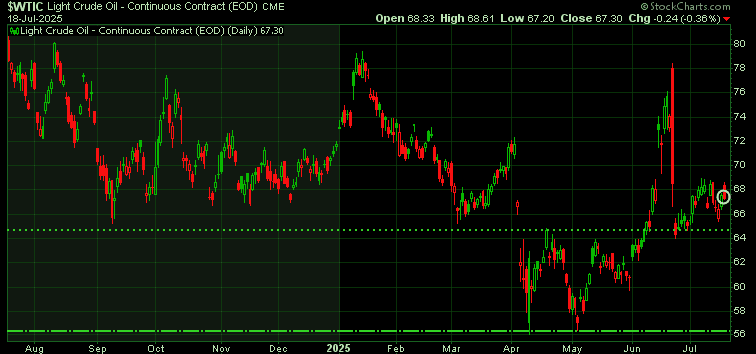

Oil has been trading in a range between 68.80 and 64.80 for the last 5 weeks. While we could have another black swan event that would push oil higher, unless we get one, we should see oil pull back.

There is plenty of oil available—enough in storage to last 50 days—and more supply from OPEC, the US, and Canada is on the way. European sanctions on Russian oil aren’t very effective, since Russia can sell at a discount elsewhere. If US policy pushes prices lower, it could trigger another oil price crash – in the short term. Long -term, we are bullish.

That’s a wrap!

Martin