Market Notes – September 1/23

Some investment news for those looking to invest in gold, invest in stocks, or currencies, and commodities.

Each week the Trend Letter, displays weekly heat map of the S&P 500. It is a great visual of the equity market that holds stocks many North Americans own. Each of the 500 stocks is shown in a box, & the size of the box represents its market valuation, and the colour of each box tells you how that stock did, GREENS being gains & REDS being losses.

As we can see, for the week, big tech stocks led the way higher. There was also a lot of green throughout most other sectors, with utilities and healthcare being the main exceptions.

On the daily heatmap a bit of a different story, with some big tech in red.

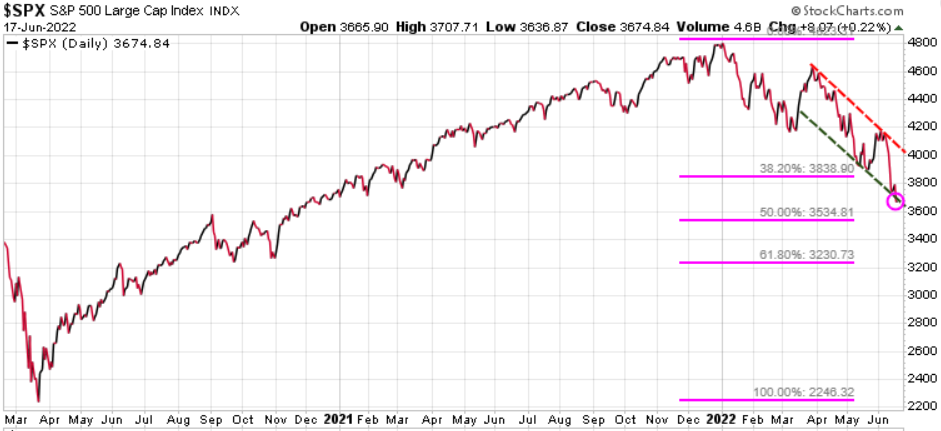

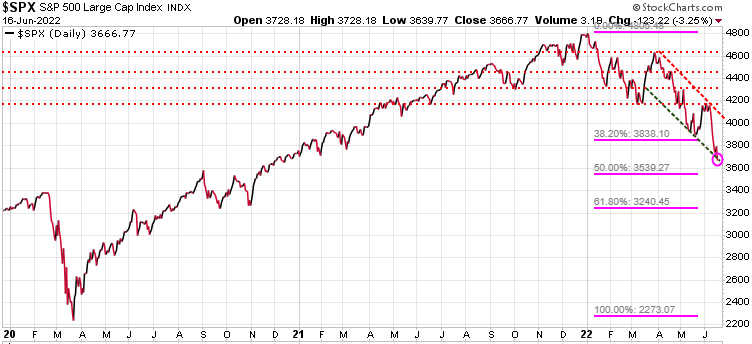

Looking at the BIG picture, the S&P 500 is still solidly in a long-term uptrend channel, since 2009. If we were to test the initial support level of that long-term uptrend channel, we would see a correction to the 4000 level, which would be a ~11% decline from the current 4500 range

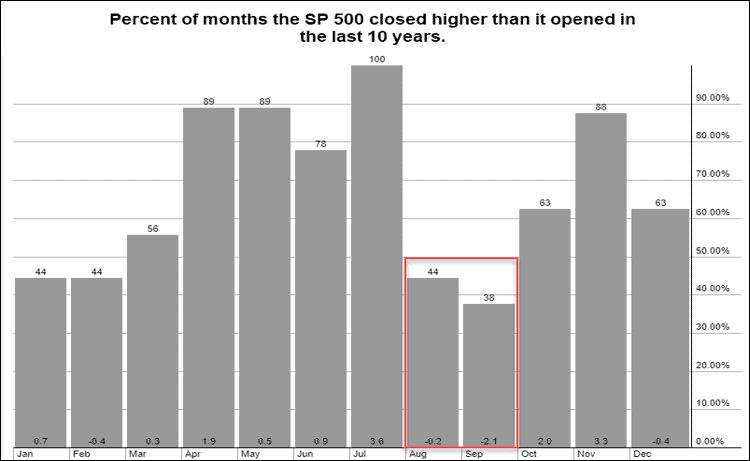

Based on seasonality, September is the weakest month for the S&P 500.

If we do get a decent correction in September, it could provide a good buying opportunity. Sectors that have looked good are oil, uranium, tech, gold, base materials and even cannibals cannabis, what with US health dept urging the DEA to relax restrictions. We will see if these will remain strong after Labour Day, or if the negative September seasonals take over.

What we do at Trend Letter is track those key support & resistance levels, looking for changes in trend, and then and alert subscribers when trends change.

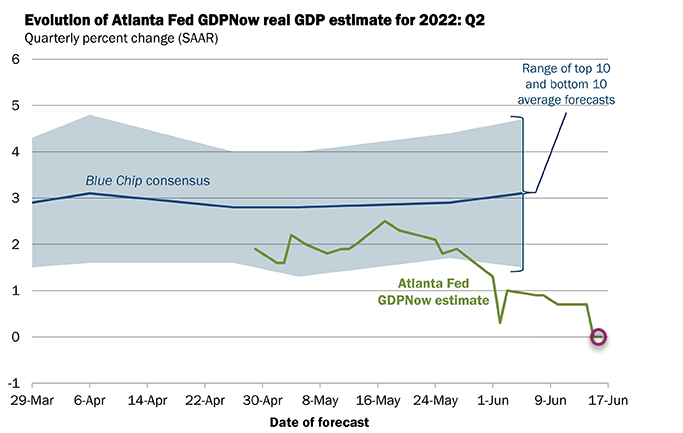

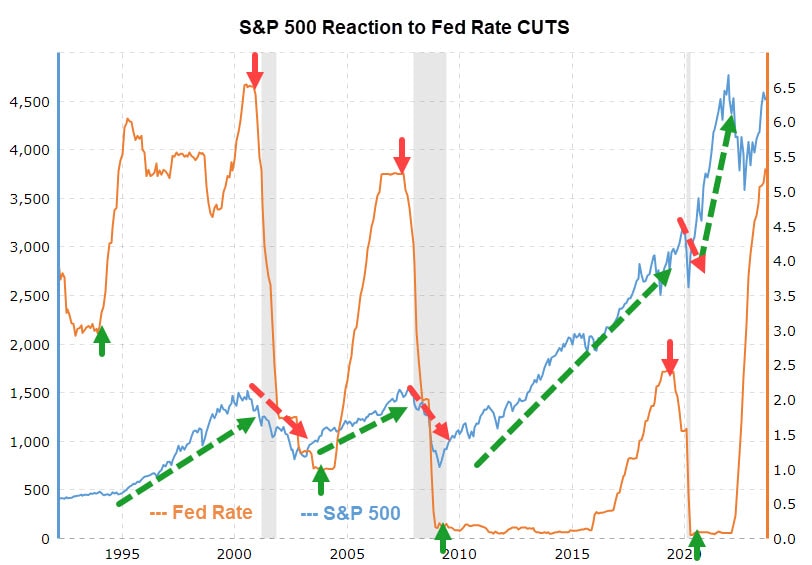

In Martin’s interview with Jim Goddard on This Week in Money on Friday (interview start at 44:39), he promised to show the chart below. If we look at the last number of times the Fed CUT rates recently, so 2000, 2007 and 2020…each time was driven by the economy falling into a recession (grey shaded bars). And when they CUT rates (red arrows) the S&P 500 had sharp declines. In each of those CUTTING phases it was not until the Fed STOPPED cutting rates that the S&P 500 started to recover (green arrows).

For those investing in gold, the key numbers are::

- Near-term resistance is 2000, 2040, then 2070, which was that double top in April-May

- Next key support level is 1915, 1900, 1880, then & really strong support at 1825

- If it does drop to 1825, that would likely trigger several new BUY alerts

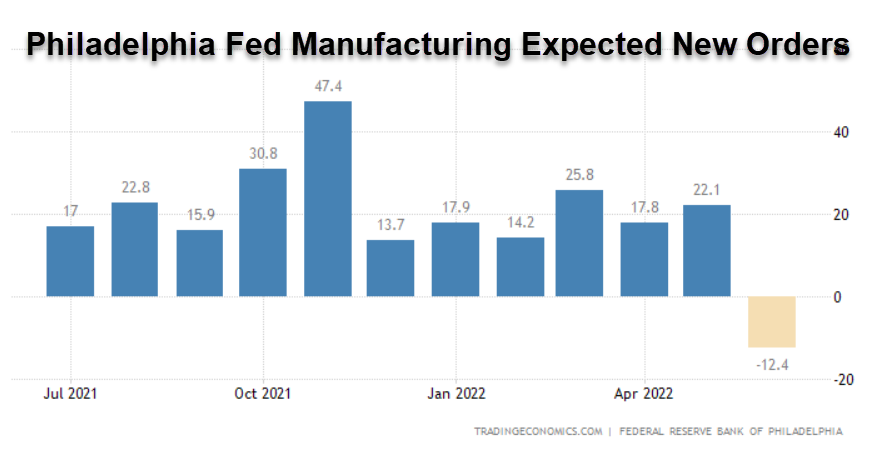

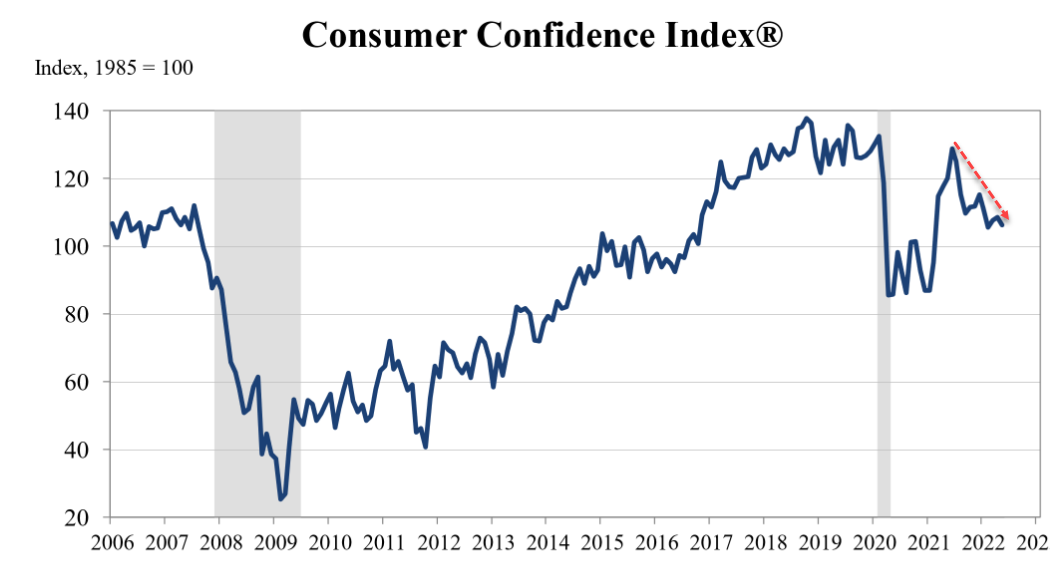

In Martin’s interview with Jim Goddard, he explained why he still feels a recession is very possible. He outlined the two key leading indicators, the inverted yield curve and the Conference Board’s Leading Economic Index (LEI). Both of these have an almost perfect record in forecasting recessions. Both are forecasting a recession coming soon.

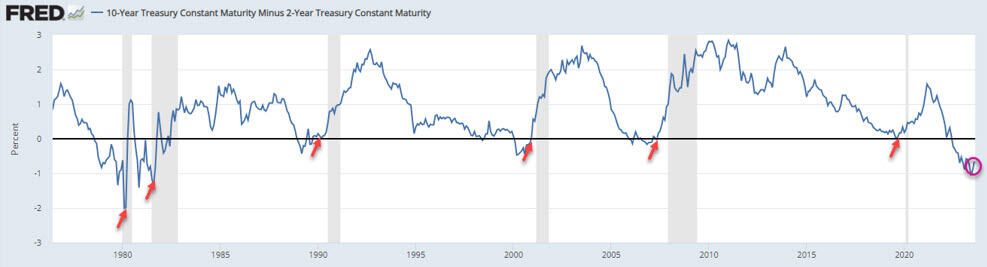

A yield curve is inverted when short-term yields are higher than long-term yields. An inverted yield curve is a leading indicator of a recession and since 1955 (68 years), there has been only one time where the yield curve inverted without there being a recession.Recently, the yield curve is the most inverted it has been in over 40 years. Recessions don’t start when the yield curve inverts, but rather when it starts to ‘uninvert’ (red arrows).

This chart clearly shows that for each of the last 6 recessions, they all started after the yield started to rise. Today, the yield curve is starting to ’uninvert’ (circle).

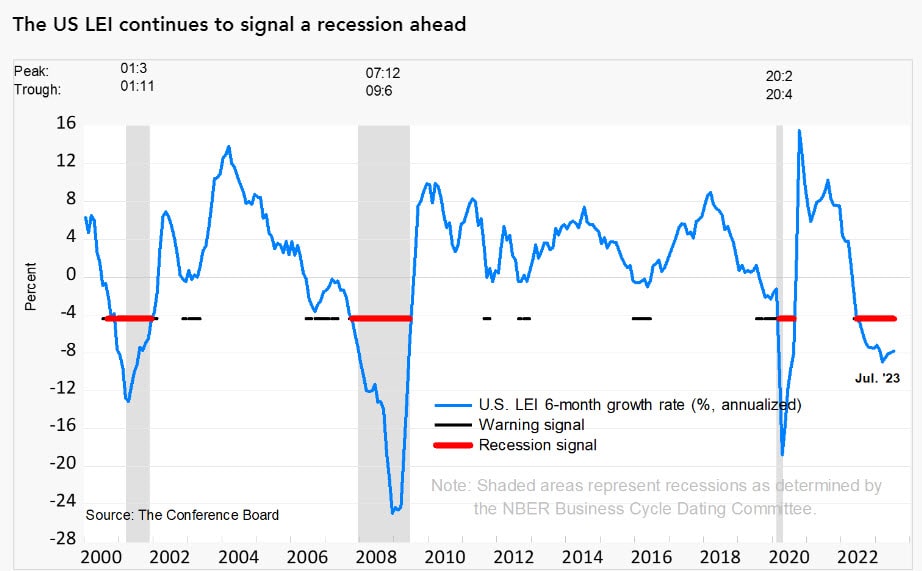

The other indicator with a near perfect record of forecasting a recession is the Conference Board’s Leading Economic Index, which looks at 10 components across the US economy. That index, again in its latest report last week, is firmly saying a recession is coming.

Oil has had a great week after dropping down to the 80.00 level, it has rallied big time this week, and closed Friday at 85.55. The big bump this week came after a massive 11.5 million barrel drawdown in US crude inventories. Also, we have the Saudi Arabia production falling and they, plus potentially Russia, are expected to extend the production cuts into the end of October.

Stay tuned!

We are offering discounted prices for our three services and with each new subscription this week, we will donate $100 to Special Olympics. See Special Offers below.

Trend Letter:

Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the markets are going, and it has explained in clear, concise language the reasons why. Using unique and comprehensive tools, Trend Letter gives investors a true edge in understanding current market conditions and shows investors how to generate and retain wealth in today’s climate of extreme market volatility.

A weekly publication covering global bonds, currencies, equities, commodities, & precious metals. Publishes every Sunday evening, covers equites, currencies, precious metals, commodities, and bonds. Each weekly issue is about 50 pages, mostly charts, with key bullet points to make easy to understand. A 10-15 min read

Timer Digest says: “Trend Letter has been a Timer Digest top performer in our Bond and Gold categories, along with competitive performance for the intermediate-term Stock category.”

Technical Trader:

Trend Technical Trader (TTT) is a premier hedging service, designed to profit in both up and down markets.

TTT isn’t just a hedging service. Its timing strategies have returned fantastic gains on the long side. See examples here

Included is our proprietary Gold Technical Indicator (GTI).

Trend Disruptors:

Disruptive technology trends will propel our future and the reality is that no industry will go untouched by this digital transformation. At the root of this transformation is the blurring of boundaries between the physical and virtual worlds. As digital business integrates these worlds through emerging and strategic technologies, entirely new business models are created.

Trend Disruptors is a service for investors seeking to invest in advanced, often unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Quantum Computing & many more.

All subscriptions in $US

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | $349.95 | $250 | Trend Letter $349.95 |

| Technical Trader | $649.95 | $349.95 | $300 | Trend Technical Trader $349.95 |

| Trend Disruptors | $599.95 | $349.95 | $250 | Trend Disruptors $349.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $549.95 | $699.95 | Trend Letter & Technical Trader $549.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $549.95 | $649.95 | Trend Letter & Trend Disruptors $549.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $549.95 | $699.95 | Technical Trader & Trend Disruptors $549.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $649.95 | $1,199.90 | Trend Suite: TL + TTT + TD $649.95 |