Emotion is most investors worst enemy, as herd following is too powerful for most to avoid. It is the reason that retail investors buy most at the top, and least at the bottom in a market cycle. It is a basic swing between fear and greed. As the markets continued to rise, we saw investor sentiment quickly rising as more and more investors who were on the sidelines felt they were missing out, so greed drove them to jump in. The Fear of Missing Out (FoMO) creates anxiety for those who see how the markets are rising, and hear others discuss how their portfolio is thriving. They finally can’t stand it any longer, and jump in, right at the top.

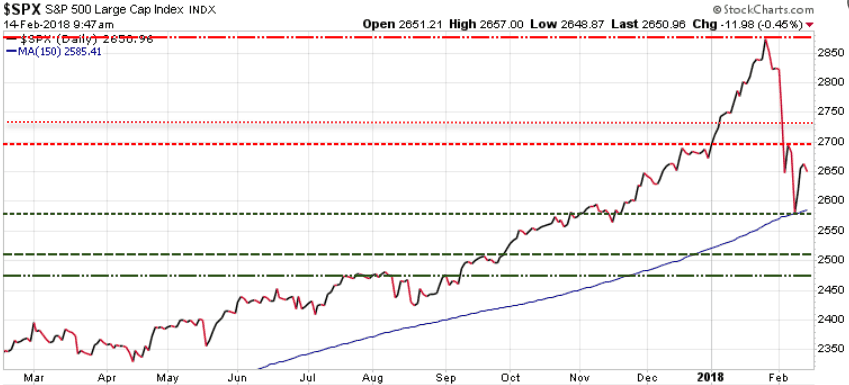

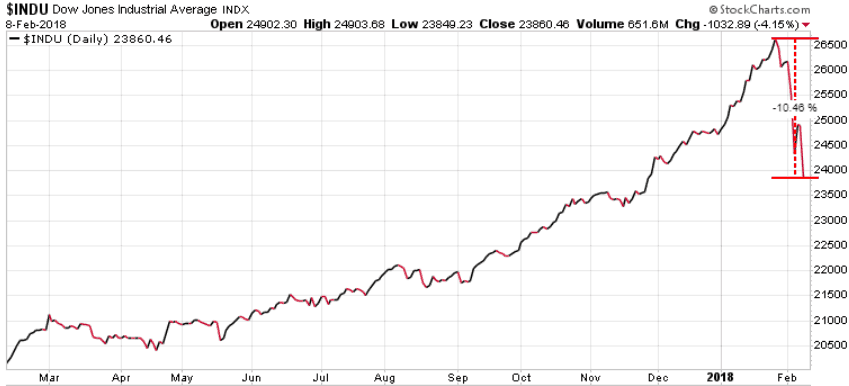

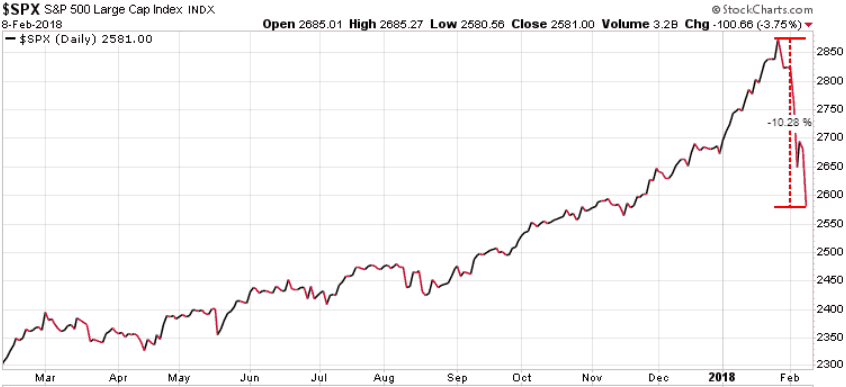

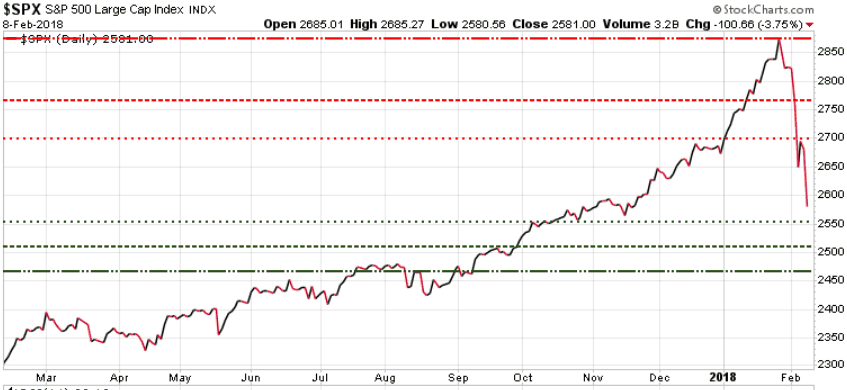

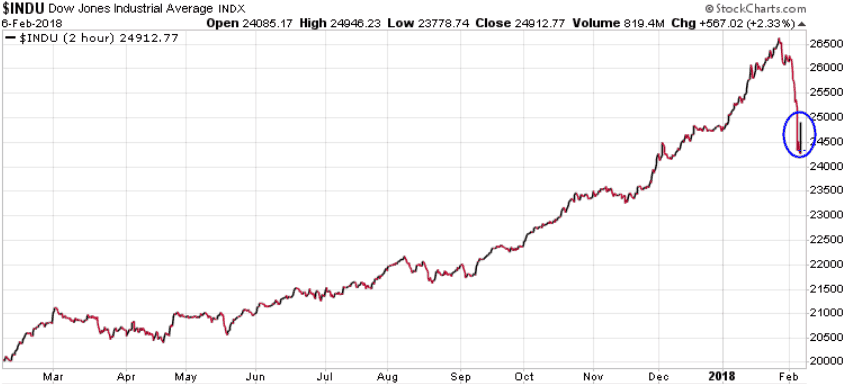

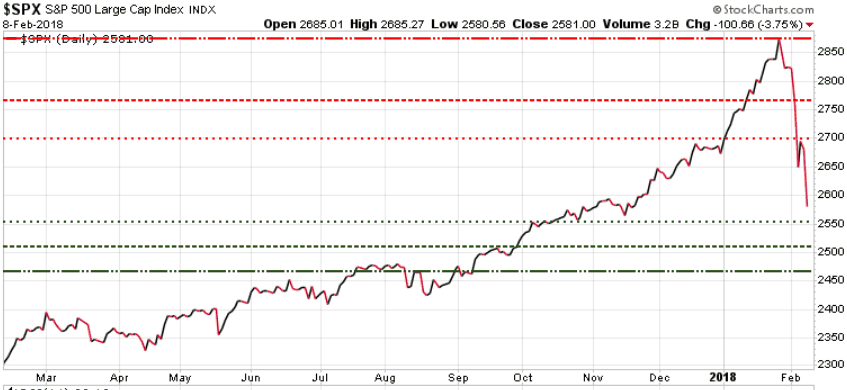

Back on January 23rd we posted a blog titled “Markets keep rising…do you have an exit strategy?”In that blog we showed four technical indicators that warned of a looming market top. Sure enough, three days later the equity markets hit their high and have been falling ever since. After today’s massive decline, markets are now officially in a correction (defined as a decline of 10% or more).

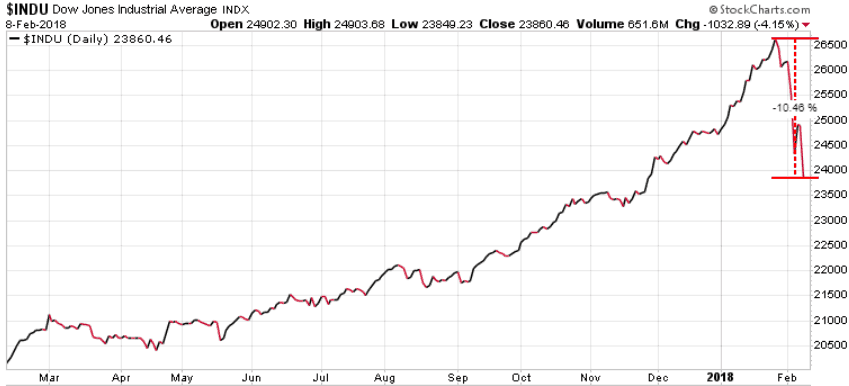

After Monday’s record setting sell-off of 1,175, the Dow had another huge decline today, as it plunged another 1,032. Since the January high, the Dow is down over 2,700 points, and 10.46%.

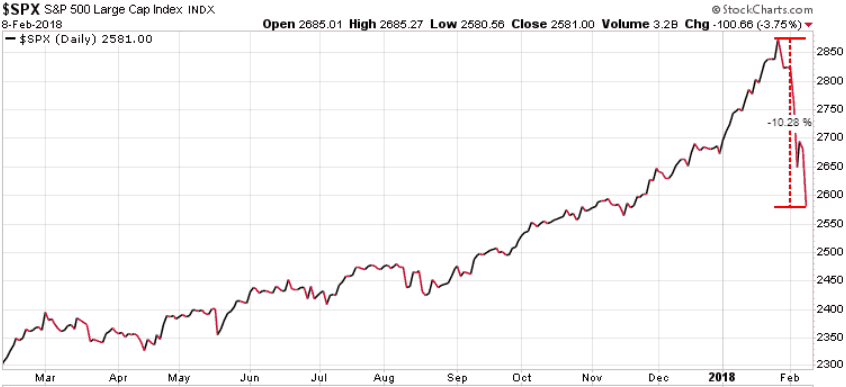

The S&P 500 was down 100.66 points today, and is also now in correction territory, down 10.28% from its January high.

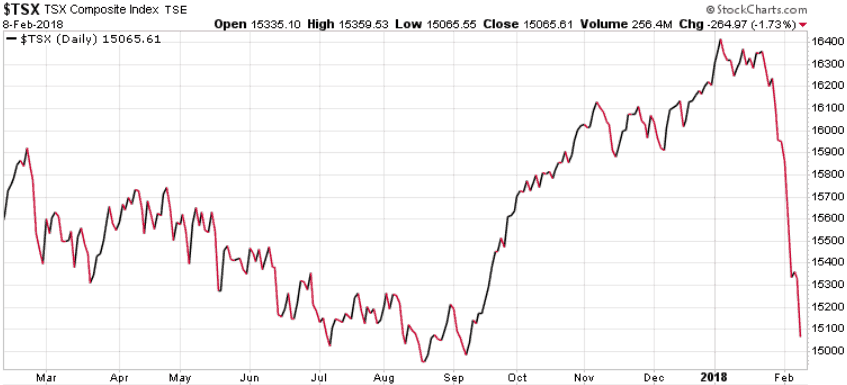

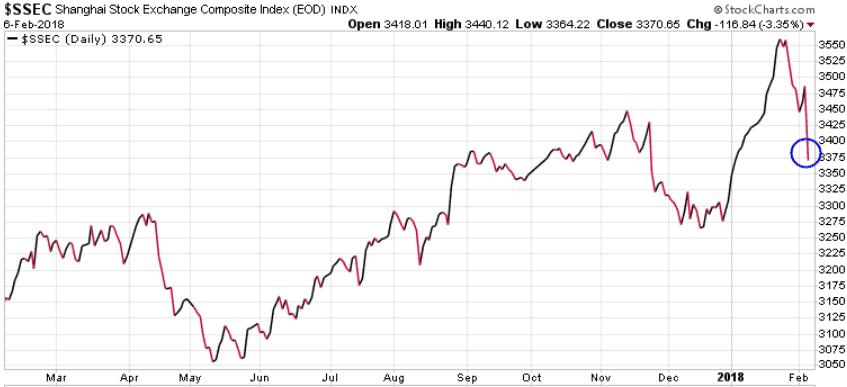

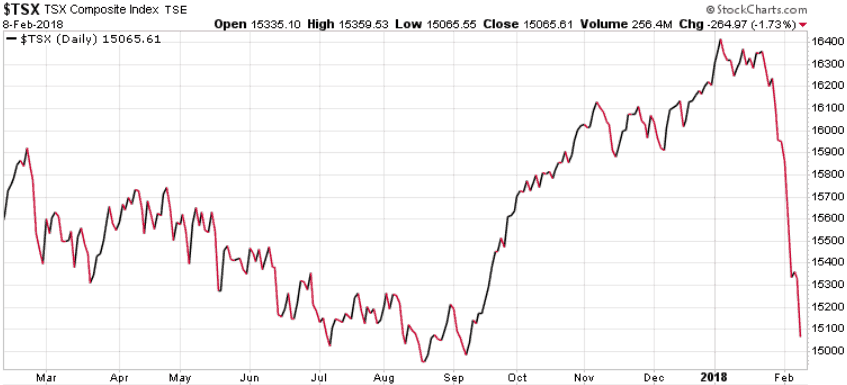

The Canadian TSX Index continues to be one of the worst performing markets in the world.

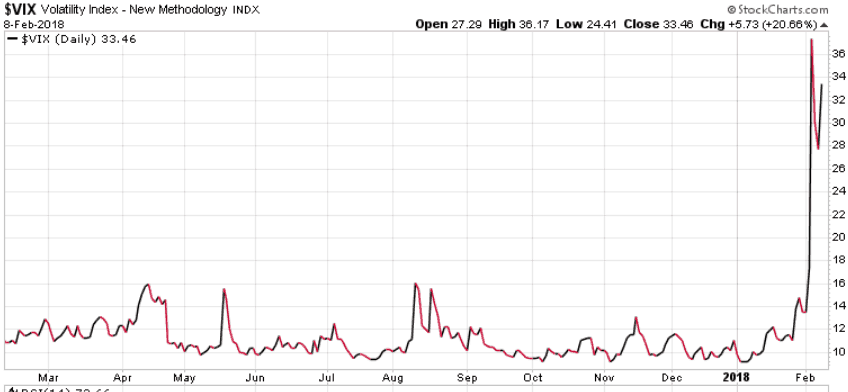

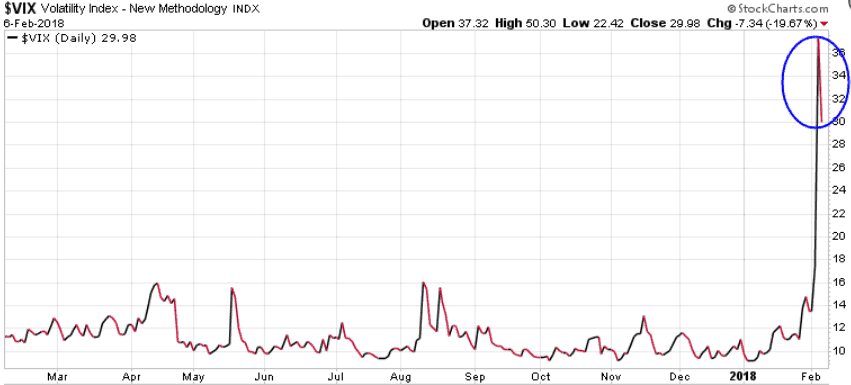

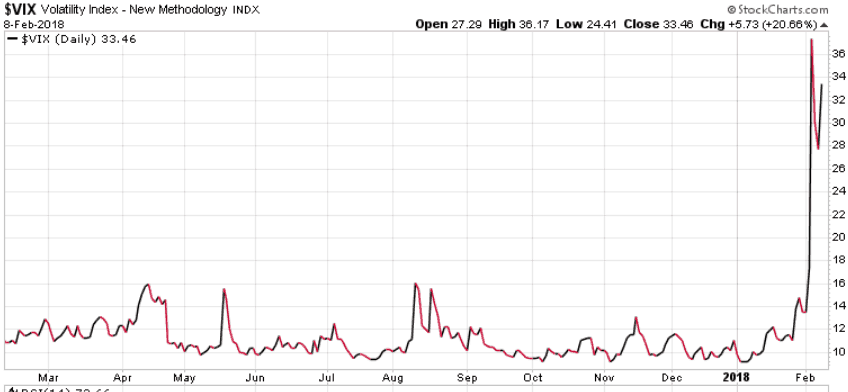

After a 15 months of ‘risk-on’ sentiment, volatility came back with a vengeance in the last week.

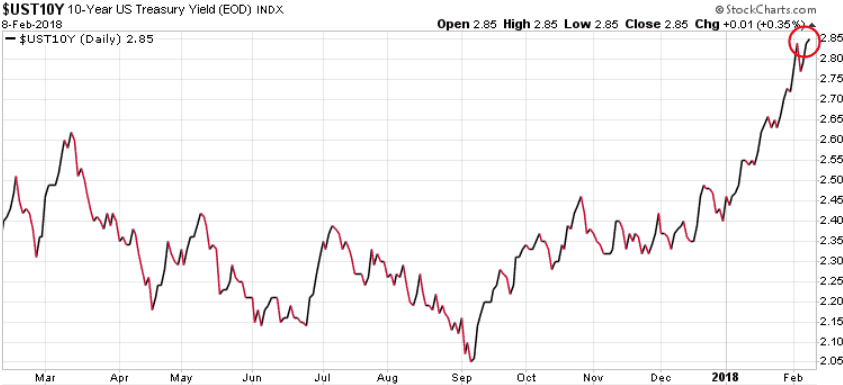

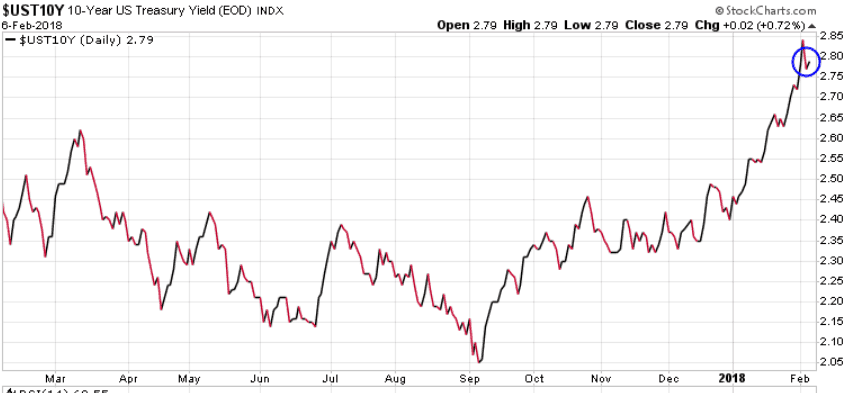

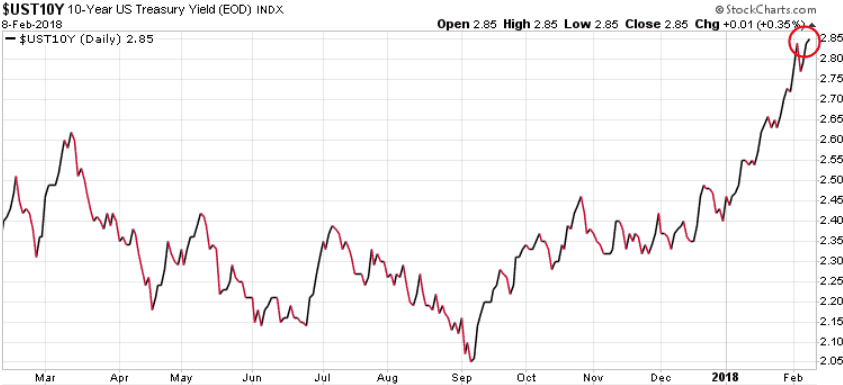

With inflation expectations, capital is flowing out of bonds, pushing yields higher. The 10-year US Treasury yield is now 2.85%. As we get closer to 3%, we will see some capital move out of riskier corporate and junk bonds, into the ‘perceived’ safer government bonds, paying 3%.

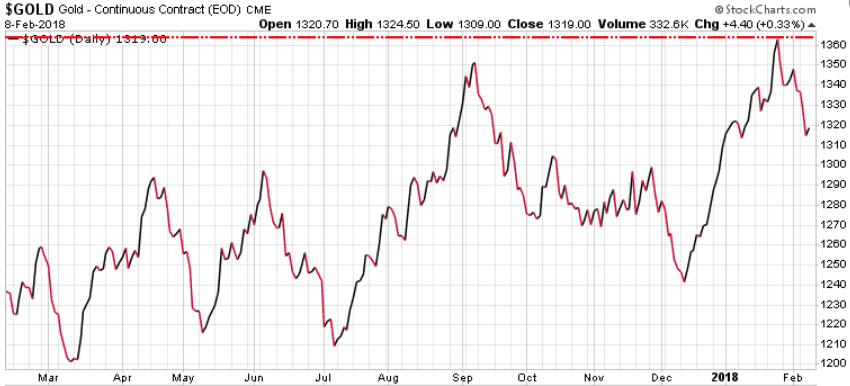

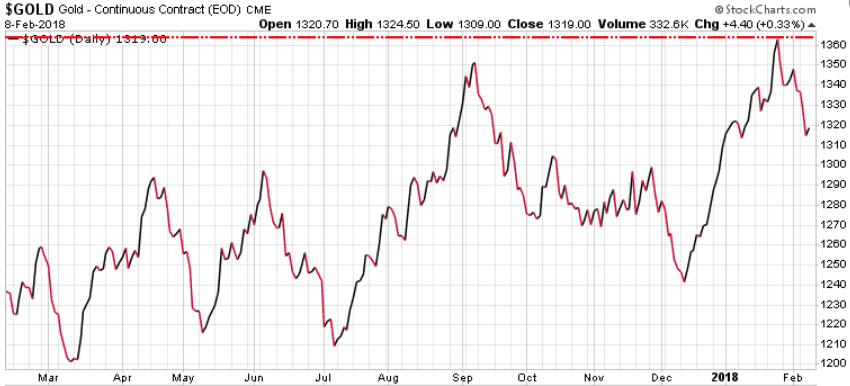

With the equity markets crashing, gold is not acting as a safe haven. This fits with our model’s forecast that gold’s time will come, but not just yet. It will rise as the confidence in government declines. That time is coming, be patient. We will discuss gold in a future blog.

We understand that severe moves like we have seen in the last week can be very hard to watch, especially if you did not have a strategy to survive such a move. We have been warning for a couple of months that the further this bull market rises without at least a meaningful pull back or correction, the deeper and quicker that decline would be.

Below are the numbers to watch as wee move forward. Before we get to those, take a moment and think about what your strategy is to protect your wealth. We are still quite bullish for the equity markets, but that doesn’t mean that we have no strategy to protect ourselves for violent down moves such as we are seeing today. In fact, our hedging service Trend Technical Trader (TTT) has a number of positions that are profiting from these downside moves.

For those of you who have not yet taken us up on these offers, seriously consider doing so…it’s your money – take control!

Good deal – We are offering you The Trend Letter at $230 off the regular price of $599.95, now just $369.95. Click here to take advantage of this offer.

Good deal – We are offering you Trend Technical Trader (TTT ) at $250 off the regular price of $649.95, now just $399.95. Click here to take advantage of this offer.

Great deal – We are offering you both The Trend Letter & Trend Technical Trader at $600 off the regular price, now just $649.95. Click here to take advantage of this offer.

What to watch for:

We continue to see early/mid March as a Key Turning Point, producing either a near-term top or bottom. The next few weeks could be extremely volatile, so pay attention.

Bullish scenario: In the bullish scenario we need to see the S&P 500 make an immediate move higher to close above 2700, 2765, and then push back through its January high of 2875.

Bearish scenario: In the bearish scenario we need to see the S&P 500 drop below 2555, 2510, and then 2465.

The markets have gone from extreme overbought sentiment, to now slightly oversold, so we could see some bottom fishing, as aggressive investors try to catch a falling knife. We forecast that while 2017 was a very quiet and calm year for the markets, 2018 is going to be a wild one. It is certainly starting off that way.

Stay tuned!