Market Recap – August 23/17

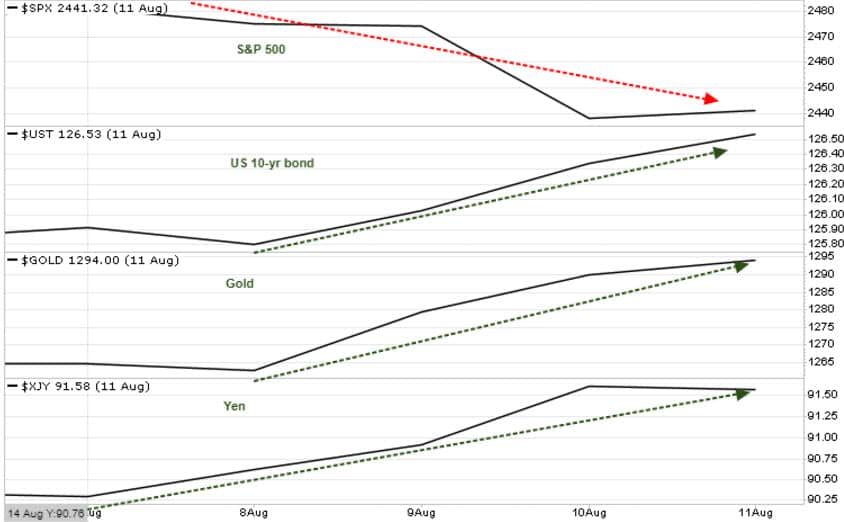

After its strong rally Tuesday, the S&P 500 pulled back slightly today, based on Trump’s comments about shutting government down and abandoning NAFTA. It remains in its near-term downtrend channel.

Looking at what sectors have been the market leaders, we can see that while S&P 500 is up about 12% in the past year, it has been the technical stocks that outperformed at over 24%, while energy and agriculture were down 8.4% and almost 12% respectively.

Our models call for the S&P 500 to bounce off the 2400-2415 support level, but should that level be breached, and we get a more substantial correction, then we would look for those high performance tech stocks to get hit harder.

The Canadian TSX Index was able to eke out a gain of .52%, but remains in the downtrend channel it has been in since late April.

In Asia we saw the Shanghai Index was basically flat, and continues its bullish trend.

The Japanese Nikkei gets a slight bid, but continues to suffer as the Yen appreciates, making Japanese exports more expensive for foreign buyers.

In Europe, the German DAX, as with most Euro stocks, remains in the downtrend that it has been in since mid June. The Euro’s strength hurts exports.

The London FTSE is trying to take advantage of the Pound weakness, but still remains in its downtrend channel.

Gold is making another attempt to break through powerful resistance at the 1280-1307 level. Gold has made 5 runs at this resistance since last July, when it set its recent high at 1367. Gold closed today at 1294.70, so we will soon see if this time it will be successful.

With currencies, the $US looking to form a base after dropping almost 10% since the start of the year. We are buyers above .94.

The $CAN keeps pushing to the strong resistance level at .80 after being technically very overbought at the start of August. Longer-term we are looking for the $US to regain strength, so Canadians would want to look to convert to $US anytime we see the $CAN over .80. Potential upside to .85.

The Euro was up slightly today. Longer-term, we are very bearish on the Euro, and expect that 2018 will be a much different picture for the Euro. Europeans will want to start to convert to $US on this strength. Strong resistance at 1.18-1.20.

The Yen has temporarily replaced the $US as the safe-haven currency play for investors. It is coming up to strong resistance at .92. Longer-term, we are bearish on the Yen.

The British Pound continues to struggle, having fallen through recent support at 1.285. It remains vulnerable to further weakness at 1.27 and 1.262.

Stay tuned!