Crypto update – January 24/18

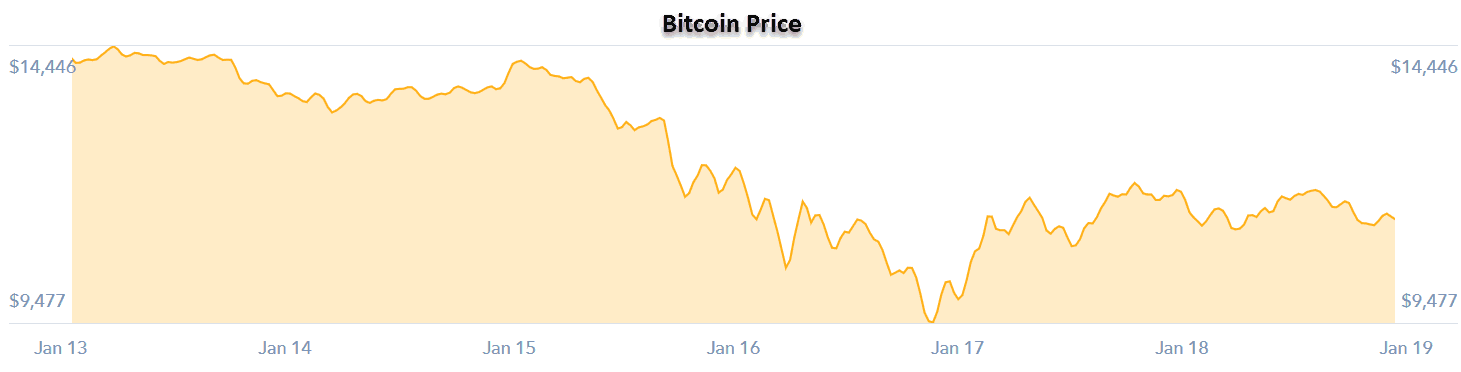

Last week’s volatility is more proof that the crypto currency (CC) markets are indeed the “wild west” … or the “wild east”. This volatile week was mainly a reaction to government statements and actions. Both China and South Korea have been pondering what to do about crypto currencies for a while and last week began issuing statements that clearly indicate that they are concerned. It doesn’t seem to matter if the government is democratic or socialist, they all want to control the money, in order to levy taxes, control markets, and stay in power.

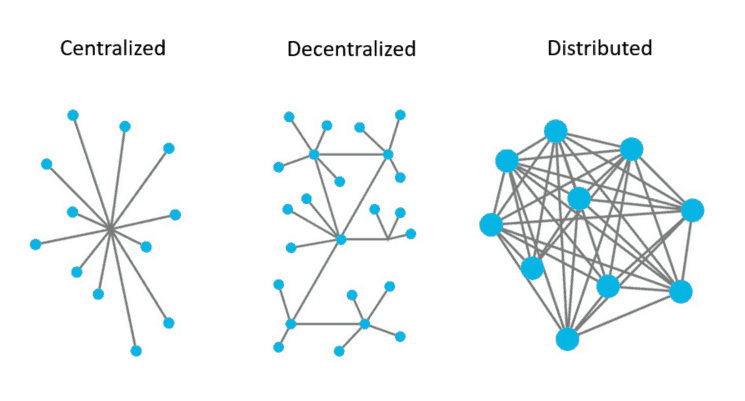

Crypto currencies are resistant to manipulation, so China has now banned CC trading and South Korea is moving to implement strict regulations and implement proper taxation. The CC markets reacted to these government activities by moving sharply downward. Up until recently, South Korea and China were home to some of the largest CC exchanges in the world, and this is now changing, as many exchanges are relocating offshore. Many clients simply use the internet to continue doing business with these same exchanges, now located offshore, but China goes even further by piling on additional internet restrictions that block access to the offshore exchanges.

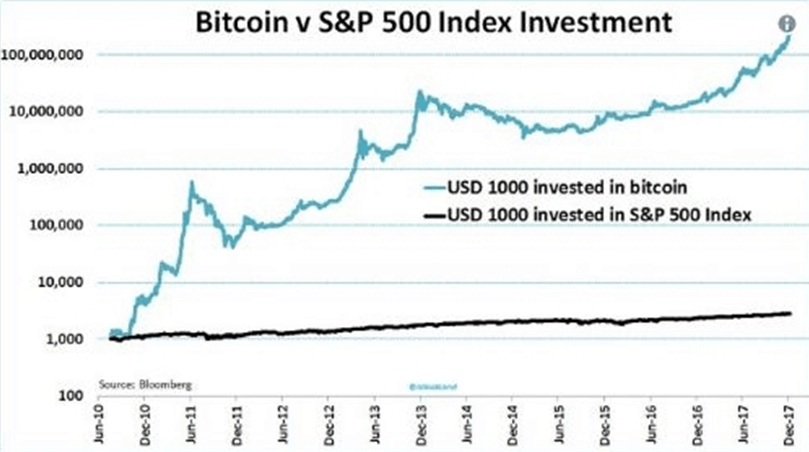

From the outset, we have cautioned readers about extreme volatility in this market, while acknowledging the other side of the crypto coin – – very real opportunities to generate extreme profits. Crypto Trend is your guide to avoid the pitfalls and zero in on the winners, remembering that all markets are volatile to a degree. With the CC market, the degree is high, but downturns are inevitable in every market, and even “healthy” – – like a forest fire, that on first blush looks to be all devastation, but in reality provides some crucial benefits, like removing dead and decaying vegetation, stimulating new growth, and triggering some plants to release seeds. The CC marketplace is frenzied, and we have seen moves in this market that are extraordinary, with projects initiated that have no long-term future, yet they generate market values in the millions of dollars. This is the kind of market where a guide is essential in order not to invest in deadwood projects. This is also the kind of market where a good fire once in a while serves to rid us of the deadwood. With a competent guide, frenzy is set aside, and useful, actionable assessments and research are provided, leading to understanding, confidence, and investment success. There is no need to just throw a few frenzied darts at the wall – let Crypto Trend be your guide.

Crypto Trend Premium

The volatile week had a negative impact on our portfolio, but we are still on average, up 61% for our 5 recommendations to date.

We are increasing the scope of Crypto Trend & Crypto Trend Premium to include technology companies that may not be directly involved in blockchain projects, but are positioned indirectly to benefit from the blockchain technology. In addition, we will include companies that are positioned to profit from other game changing technologies such as 5G, which will revolutionize mobile communications.

We are currently evaluating a number of companies and hope to have more recommendations out to subscribers soon.

If you are ready to make a speculative investment into these disruptive technologies, and want to receive all current and future recommendations from Crypto TREND Premium, we are keeping our Early Bird Special offer open for a little longer, to give our readers the opportunity to get started at a $175 discount, meaning you pay only $525.00 . To take advantage of this special offer, click here.

Stay tuned!