The Wild West Crypto show continues – and our 5 picks have an average monthly gain of 109%

Here is a question that comes up often: How do I choose which crypto currency to invest in – aren’t they all the same ?

There is no doubt that Bitcoin has captured the lion’s share of the crypto currency (CC) market, and that is largely due to its FAME. This phenomenon is much like what is happening in national politics around the world, where a candidate captures the majority of votes based on FAME, rather than any proven abilities or qualifications to govern a nation. At Crypto Trend we acknowledge Bitcoin’s FAME, which in many ways is well earned. Bitcoin is the pioneer in this market space and continues to garner almost all of the market headlines. This FAME does not mean that it is perfect for the job, and it is fairly well known that Bitcoin has limitations and problems that need to be resolved, however, there is disagreement in the Bitcoin world on how best to resolve the problems. As the problems fester, there is ongoing opportunity for developers to initiate new coins that address particular situations, and thus distinguish themselves from the approximately 1300 other coins in this market space. Let’s look at two Bitcoin rivals and explore how they differ from Bitcoin, and from each other:

Ethereum (ETH) – The Ethereum coin is known as ETHER. The main difference from Bitcoin is that Ethereum uses “smart contracts” which are account holding objects on the Ethereum blockchain. Smart Contracts are defined by their creators and they can interact with other contracts, make decisions, store data, and send ETHER to others. The execution and services they offer are provided by the Ethereum network, all of which is beyond what the Bitcoin or any other blockchain network can do. Smart Contracts can act as your autonomous agent, obeying your instructions and rules for spending currency and initiating other transactions on the Ethereum network.

Ripple (XRP) – This coin and the Ripple network also have unique features that make it much more than just a digital currency like Bitcoin. Ripple has developed the Ripple Transaction Protocol (RTXP), a powerful financial tool that allows exchanges on the Ripple network to transfer funds quickly and efficiently. The basic idea is to place money in “gateways” where only those who know the password can unlock the funds. For financial institutions this opens up huge possibilities, as it simplifies cross-border payments, reduces costs, and provides transparency and security. This is all done with creative and intelligent use of blockchain technology.

At Crypto Trend we strive to provide you with up to date and useful information in the quest to understand this new world of crypto currencies. The mainstream media is covering this market with breaking news stories almost every day, however, there is little depth to their stories … they are mostly just dramatic headlines.

The Wild West Crypto show continues…

The 5 stocks crypto/blockchain picks are up an average of 109% since December 11/17. The wild swings continue with daily gyrations. Yesterday we had South Korea and China the latest to try to shoot down the boom in cryptocurrencies.

On Thursday, South Korea’s justice minister, Park Sang-ki, sent global bitcoin prices temporarily plummeting and virtual coin markets into turmoil when he reportedly said regulators were preparing legislation to ban cryptocurrency trading. Later that same day, the South Korea Ministry of Strategy and Finance, one of the main member agencies of the South Korean government’s cryptocurrency regulation task force, came out and said that their department does not agree with the premature statement of the Ministry of Justice about a potential cryptocurrency trading ban.

While the South Korean government says cryptocurrency trading is nothing more than gambling, and they are worried that the industry will leave many citizens in the poor house, their real concern is a loss of tax revenue. This is the same concern every government has.

China has grown into one of the world’s biggest sources of cryptocurrency mining, but now the government is rumoured to be looking into regulating the electric power used by the mining computers. Over 80% of the electrical power to mine Bitcoin today comes from China. By shutting down miners, the government would make it harder for Bitcoin users to verify transactions. Mining operations will move to other places, but China is particularly attractive due to very low electricity and land costs. If China follows through with this threat, there will be a temporary loss of mining capacity, which would result in Bitcoin users seeing longer timers and higher costs for transaction verification.

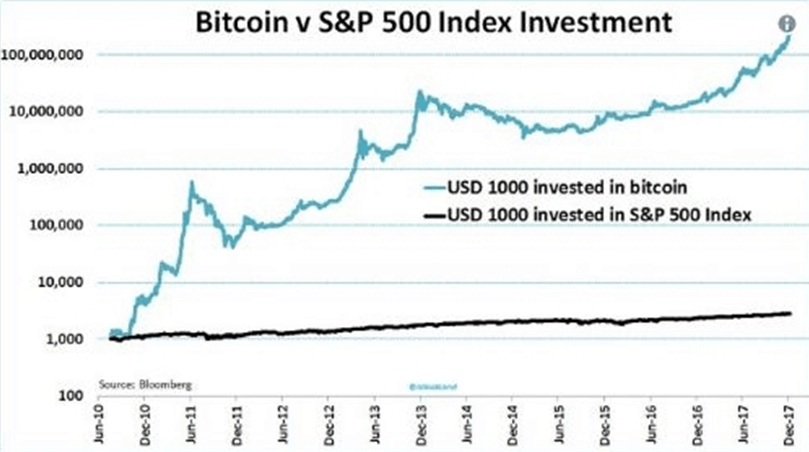

This wild ride will continue, and much like the internet boom, we will see some big winners, and eventually, some big losers. Also, similar to the internet boom, or the uranium boom, it is those who get in early who will prosper, while the mass investors always show up at the end, buying in at the top.

If you would like to step into this wild, but potentially very profitable sector, our Early Bird Special Offer is still available. We offer you Crypto TREND Premium at $175 off the regular rate of $699.95, so you pay only $525.00.

Click here to take advantage of this offer.

Stay Tuned!

Stay Tuned!