Below is a summary of the many excellent calls made by the Trend Technical Trader team over the years. Investing in some of these calls would have paid for a subscription for a lifetime. Subscribe now and pay $349.95, a saving of $300.

TTT beginning 2018

Jan.01/18

The turning of a calendar year often marks a turn in stocks or commodities, and on the last trading day of the year we have a renewed bullish signal in our Gold Trend Indicator, so…

We’ll enter a gold trade on Tuesday. The current set-up in gold looks to be the same as a year ago, however the ultimate upside should be far higher this time. – Gold was up ~19% by October’19

Dec.01/19 – BEFORE ANY COVID NEWS

Stocks are blowing off into what we believe will prove to be a major market top that is already, or will very soon be, upon us.

Simply, the market has been held aloft in anticipation of news of trade deals that would make no material difference to the market anyway. Once this “hopeium” is gone, stocks will plunge.

Our system back tests 11 out of 11 for predicting major reversals in the last year of a decade going back to 1909, and we’re now of course in the last year of a decade.

At the WOFC in 2020, before COVID was really known, our models were bearish for the markets.

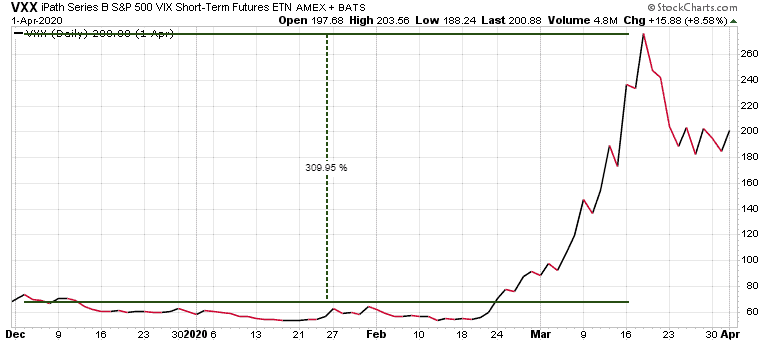

Our buy stop on VXX was triggered today. – VXX was up ~310% by March 18/20

Dec.31/19

No change in our sentiment or outlook. A material reversal in stocks seems imminent, likely to be the most severe in years.

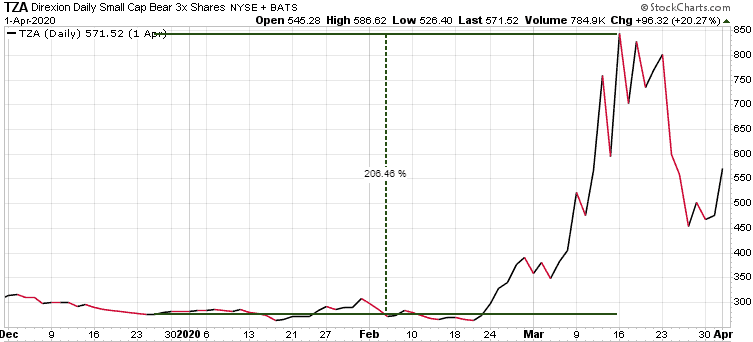

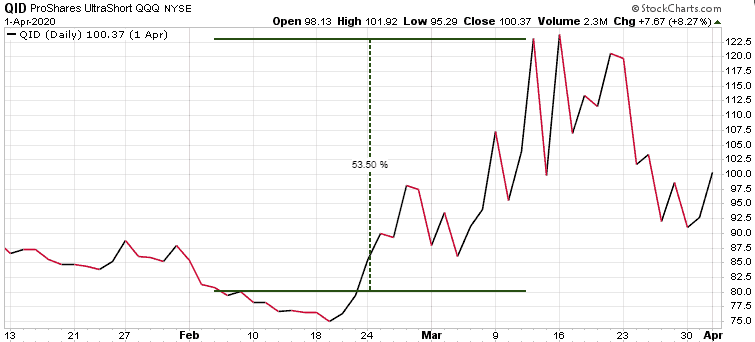

Soon after, our BUY Stops were triggered for TZA and QID. – TZA was up ~206% by March 13/20

Jan.31/2020… well BEFORE any Covid news, fears or selling

We have a bearish confirmation in the Monthly Indicator.

We have a turn to bearish on the Weekly Indicator.

The dominant trend has turned long-term bearish.

Markets are grossly overbought and a material reversal in stocks has likely begun, which should be the most severe in years and quite possibly much worse.

At the 2020 WOFC we were telling attendees that our models were calling for a bearish market. Within 6 weeks, QID was up ~53%.

March 25/20

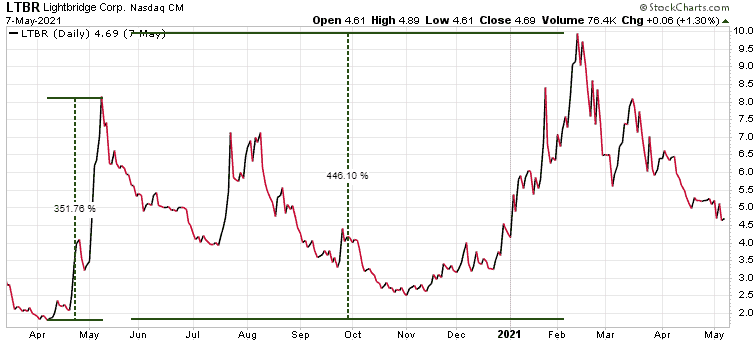

LTBR hit a low of $1.92 today, triggering a new entry. – 2 weeks later LTBR was up ~350%!. Less than a year later it was up ~446%!

On LL we’ll maintain a bid of $3.21 for an additional position. By December of that year, LL was up ~660%

March 30/20

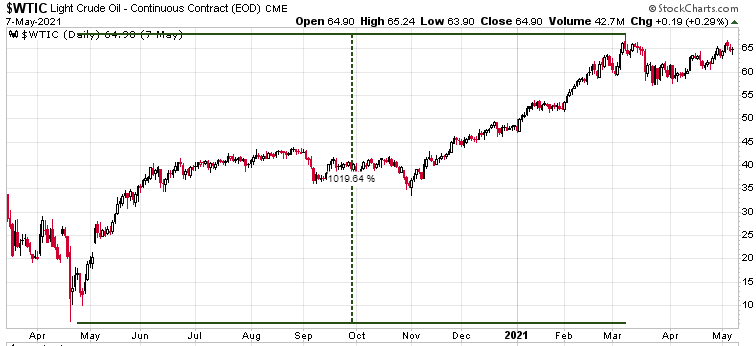

The overwhelming bearish sentiment and predictions on oil at present has us ready and eager to buy. We made absolute killings in oil-related stocks the last time prices crashed and the world turned ultra-bearish. We expect this time won’t be different, and once again we’ll be focusing on a variety of companies and related funds, some paying considerable dividend yields. – Oil actually dropped below zero briefly and then jumped over 1,000% in a year.

Apr.15/20

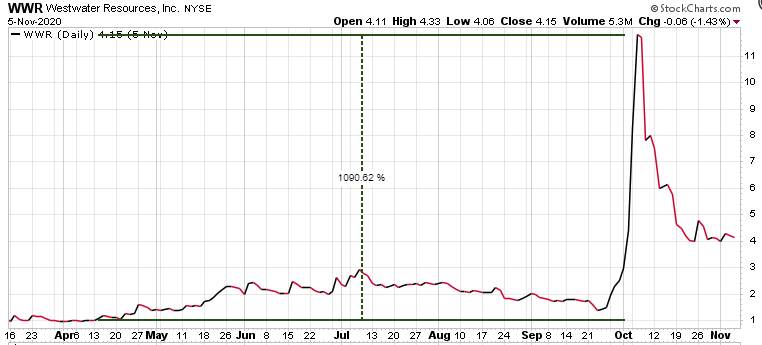

WWR buy stop was hit today at $1.15 No stop for the time being. WWR was up a staggering 1,090% in 6 months!!

Dec.30/20

This year in TTT we’ve enjoyed probably the industry’s best record by far in 2020 in stocks, precious metals AND uranium.

In precious metals alone:

7 winners out of 10 or 70% overall, not counting not counting the massive gains offered by our penny stock suggestions of last December.

+33.4% average with an average holding time of 20.5 weeks, or 85% annualized in precious metals.

In uranium:

5 of 6 winners, or 83% overall.

+130% average with an average holding time of 13.5 weeks, or 501% annualized.

TTT in 2021

October 2021

In addition to a widening spread in bond vs. junk bond yields, serious weakness remains in evidence everywhere that matters, while some key technical indicators are stretched far beyond previous records. In July retail “investment” activity exceeded the previous record by 50% and a Dow Theory Non-Confirmation currently attends markets.

Technical damage is widespread.

Equities momentum has been declining for months and margin has dipped, exactly as it did only prior to the collapses of 1987, 2000, and 2008. We doubt it’ll be different this time.

No government or central bank can stop what’s coming.

Dec. 2021

It seems virtually everyone is very excited about, and invested on leverage in tech and crypto – with the conviction it’s a “no brainer” that tech stocks and crypto will benefit no matter what happens in the near future; pandemic or not, wars or not, market correction or crash or not.

We doubt it’ll be that simple, so:

We’re restoring a position in SQQQ

SQQQ provides 3x inverse exposure to a modified market-cap-weighted index of 100 of the largest non-financial firms listed on the NASDAQ.

Small-caps typically lead advances, and the Russell 2000 Index remains well below its 2021 high, and the NASADQ also hasn’t confirmed the new highs in the S&P 500 and DJIA.

While these non-confirmations exist we maintain a bearish bias. – SQQQ was up 125% in 6 months, 118% in 10 months, or 97% by year-end during the worst year for the markets since the Great Financial Crisis.

FCX was opened today. – FCX was up ~38% about 3 months.

Prudence and patience will pay, as a lasting and rapid drawdown should soon be underway. The clear end of this raging mania will probably coincide with the true end of pandemic concerns.

Gold may be setting up for one of the most bullish signals seen in years. If that triggers, expect several new positions relating to precious metals.

TTT late 2022 into 2023

We’re targeting new energy positions for the next major swing upward in the oil and uranium sectors, which could begin very soon. Same with cannabis.

FNGU – MicroSectors 3x FANG entry was triggered last Friday at $43.00

No stop on this position. We’d rather add more on a significant drop, as big profitable tech is offering reasonable valuations for the first time in a decade.

We remain open to all possibilities, even the idea that the bull market (now 14 years running) isn’t over yet, meaning a new all-time high in the DJIA resulting in one of history’s greatest bull manias ending with one of history’s biggest bull traps and technical non-confirmations.

Be sure to maintain sufficient hedges in place to defend your portfolios against a “surprise” rapid, even sudden or overnight draw-down that when – not if – it happens should be no surprise at all.

Subscribe now and pay $349.95, a saving of $300.