How high can US government allow interest rates to rise?

It doesn’t matter which party is in power in the US, as both Republicans and Democrats overspend their budgets. The pace of overspending has ramped up with Bush and Obama. In fact, Obama racked up more debt than all other presidents combined. With Trump’s promises of massive spending, this trend is not likely to end anytime soon.

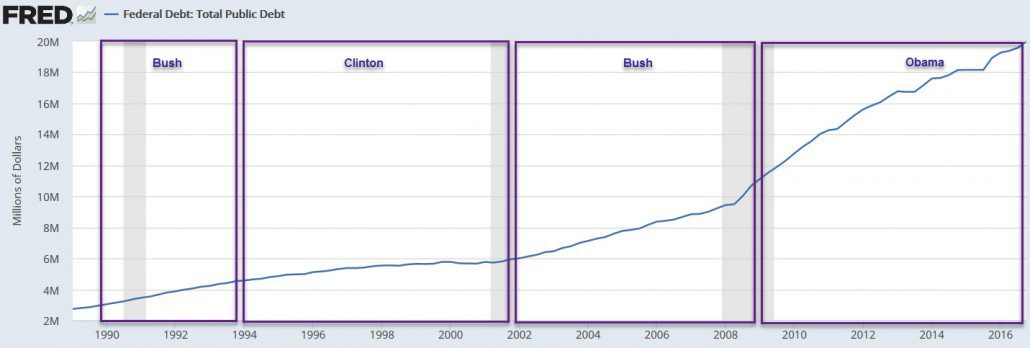

Here is a chart showing how the ‘official” US federal debt has grown dramatically over the past 16 years. The total ‘official’ US debt today is $19.98 trillion! To put that number into perspective, it equates to $61,000 per citizen, or $165,000 per taxpayer.

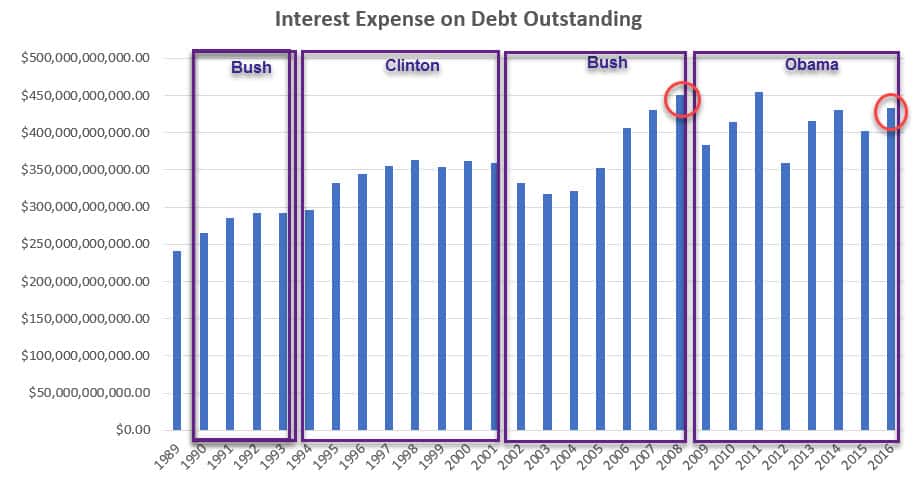

With the debt doubling over the past 8 years, one would expect that percentage of the Federal budget to service the debt would have risen dramatically over that same period of time. But as we can see on the following chart, the interest expense paid in 2016 was actually less than what was paid in 2008…how can this be?

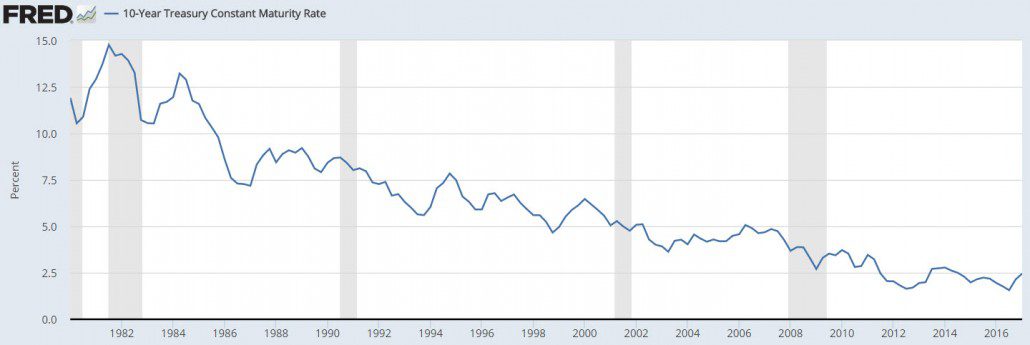

The answer is interest rates. In the early 1980’s after interest rates hit almost 20%, we started a 35 year bond market rally, and since yields decline when bonds rise, we had a 35 year decline in yields.

So the reason that the amount of interest expense in the US has not increased dramatically, even as the debt has, is solely based on the fact that interest rates have declined from almost 20% down to almost 0%.

But as we can see at the far right on the previous chart, yields (interest rates) have started to rise. What does this mean for the for the interest expense for the US Federal government to service its debt?

Given the sheer size of the US debt, if the interest rate were to rise by even 1%, the annual federal deficit rises by $198 billion. A 2% increase in interest rates would increase the federal deficit by $396 billion. If rates were to ‘normalize’ to 6%, the annual federal deficit rises by $990 billion, just to service its debt.

So the question going forward is how high can the US government allow rates to go, knowing that each percentage point rise will cost them an additional $198 billion in interest expense?

Stay tuned!