Market Notes – Tuesday’s Charts

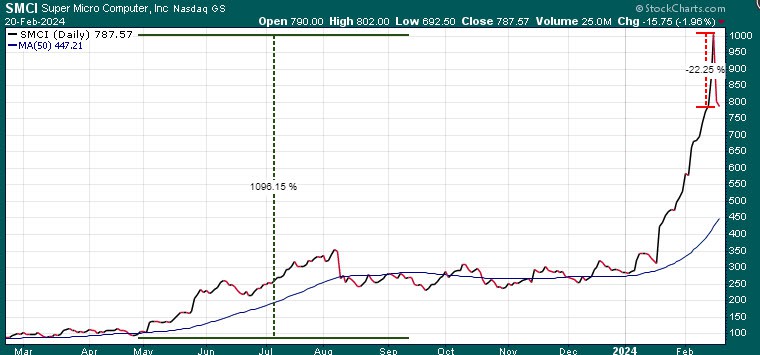

On Thursday last week, BofA analysts initiated a buy signal for Super Computer. Then on Friday, the current favorite meme stock, experienced its own parabolic ascent, soaring to a record-breaking pinnacle of $1,077. At that point it was up over 1,000% for the year.

Then it dropped 20% Friday afternoon and another 2% today.

Nvidia, the parabolic champion, is in the spotlight. Following tomorrow’s closing bell, the company will announce its earnings, attracting significant attention akin to a mini bubble. Market expectations hint at a substantial outperformance.

Analysts are setting ambitious targets, with some projecting a rise to $1,040 from its current price of $750. While Nvidia might exceed expectations in its earnings call tomorrow, the market exuberance is palpable. Remarkably, Nvidia’s valuation now surpasses that of the entire S&P Energy Sector.

After reaching a close of $737 last week, Nvidia has experienced a 7% decline, breaking through its recent steep uptrend line and nearing its first support level at $685. If $684 is breached, there’s a gap down to $620, followed by the 50-day moving average at $574.

On a bullish note, should Nvidia surpass $750, it could potentially surge towards $800.00.

What implications does this have for the broader market? As we’ve pointed out to Trend Letter subscribers, numerous indicators are signaling that these markets are excessively overbought.

Today, we observed that the majority of the Mag 7 stocks ended the day in the red, this is a pattern that has been developing over the last few trading days.

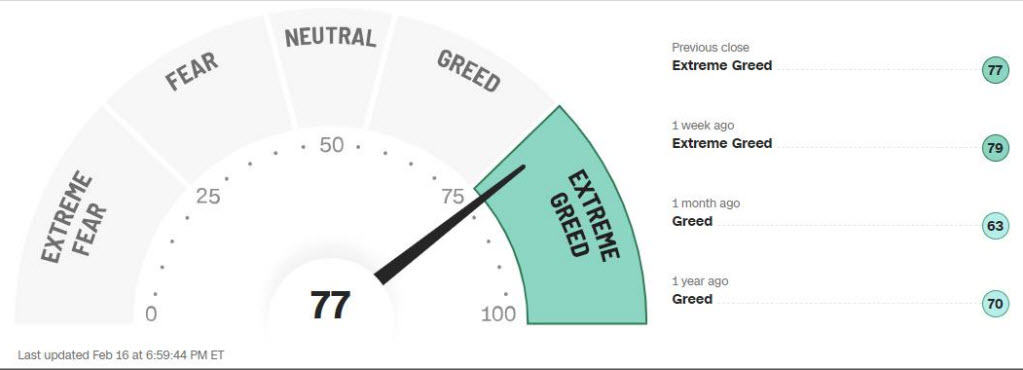

Market sentiment often oscillates like a pendulum, swinging from one extreme to another. Currently, market sentiment has reached levels of Extreme Greed.

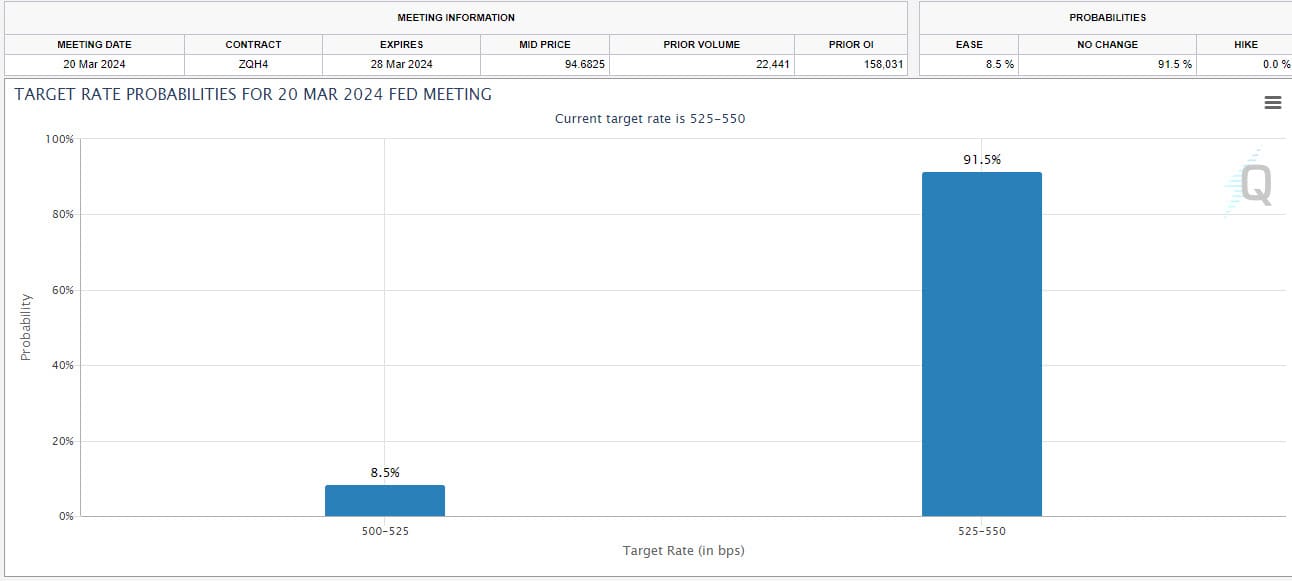

Earlier, markets surged with the anticipation of the Fed reducing rates by six or more times in 2024, driven by that hopeful outlook. However, just a month ago, there was a 71% probability that the Fed would cut rates in March, which has now dwindled to just 8.5%.

The probability of a rate cut in May has now diminished to just 14%.

We also make note that Jeff Bezos recently offloaded $6 billion worth of stock, coinciding with Amazon reaching a new peak.

While these events don’t necessarily indicate that markets cannot ascend further, it’s worth noting that overly exuberant markets typically require a healthy correction, and this one appears overdue. Exercising caution would be prudent.

Regarding the S&P 500, we anticipate a potential test of the 50-day moving average around the 4800 range, followed by a possible descent to the 100-day moving average at 4584.

Stay tuned!