Oil update: Patience required

Oil rallied 3.3% today, marking the strongest single-day rally since late last year. Reasons given for the rally were that Saudi Arabia announced that they would cut August exports to 6.6 million barrels a day—a million barrels less than a year earlier.

Also, Nigeria, which isn’t part of the production-cut agreement led by OPEC, promised to limit its daily production to 1.8 million barrels.

As with every bit of good news, speculators jumped in with both feet, continuing to buy every dip. While we have forecast a strong bull market for oil starting in 2018, we strongly suspect that this is yet another bear market bounce.

While traders took these developments as “bullish” for oil prices, we must highlight that the Saudis normally lower exports at this time of year because of stronger domestic demand for oil. Also, Nigeria’s current level of production is just over 1.6 million mb/d, meaning that Nigeria’s production will rise another 200,000 b/d before it would reach its 1.8 mb/d cap.

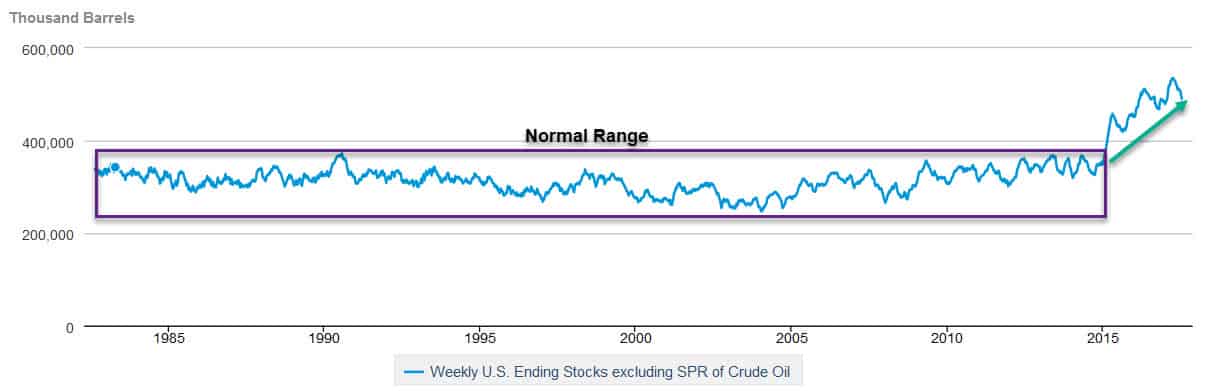

It is true that US oil stocks are declining, but this is the summer “driving season” when oil stocks always decline as refinery utilization rises to meet the demand from the summer drivers.But even though we are seeing stocks decline, the current level is still over 110 – 150 million barrels higher than the previous normal range.

Once this summer “driving season” ends in 6 weeks, we will see demand wane, and then we expect to see oil prices see their final decline in this painful phase of the oil price cycle.

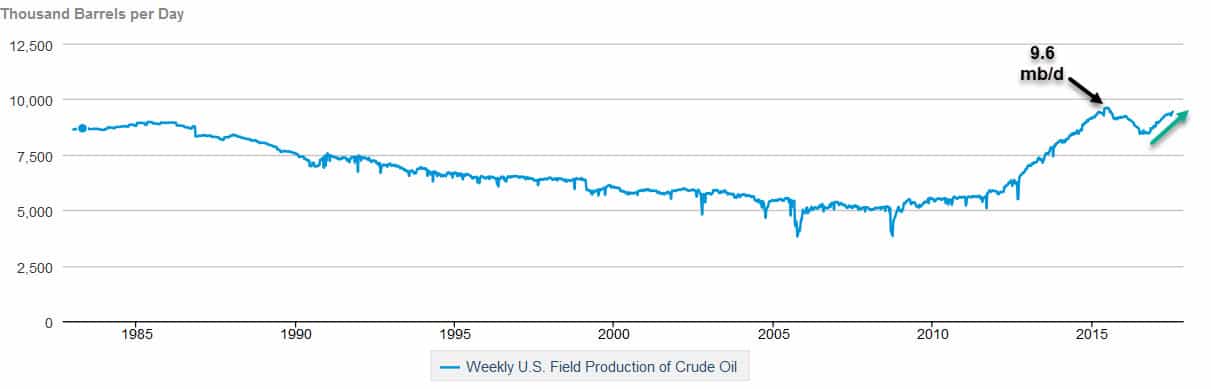

Another factor that the speculators are either ignorant of, or they are simply ignoring, is that US production continues to rise. The The US Energy Information Agency (EIA) has forecast that US production will reach 10 million barrels per day in 2018, the highest level ever!

We believe that those who show patience and hold plenty of cash will be in a terrific position to jump in when we hit the table pounding buying opportunity, likely late 2017, early 2018.

Note: Subscribers to The Trend Letter will receive Flash Alerts when our model signals those great buying opportunities.

We do see a new bull market for oil, and for most of the commodity sector. The energy sector performs very well during commodity booms, and we expect great gains, once we work through the last phase of this liquidation.

We will discuss some of the reasons for our longer-term bullish view next week.

For now be patient and wait for our table pounding BUY Signal! We expect to see the oil price to drop below 40.00, into the low to mid 30.00 range before we get our buying opportunity.

Note: If you are not a current subscriber and want to get on the list to receive all of our weekly reports + our Flash Alerts, we our offering you a very Special Offer to receive The Trend Letter for only $369.95, a $230 discount off our regular rate. Click here to take advantage of this Special Offer.

Stay tuned!