MoneyTalks radio interview with Trend Letter founder Martin Straith

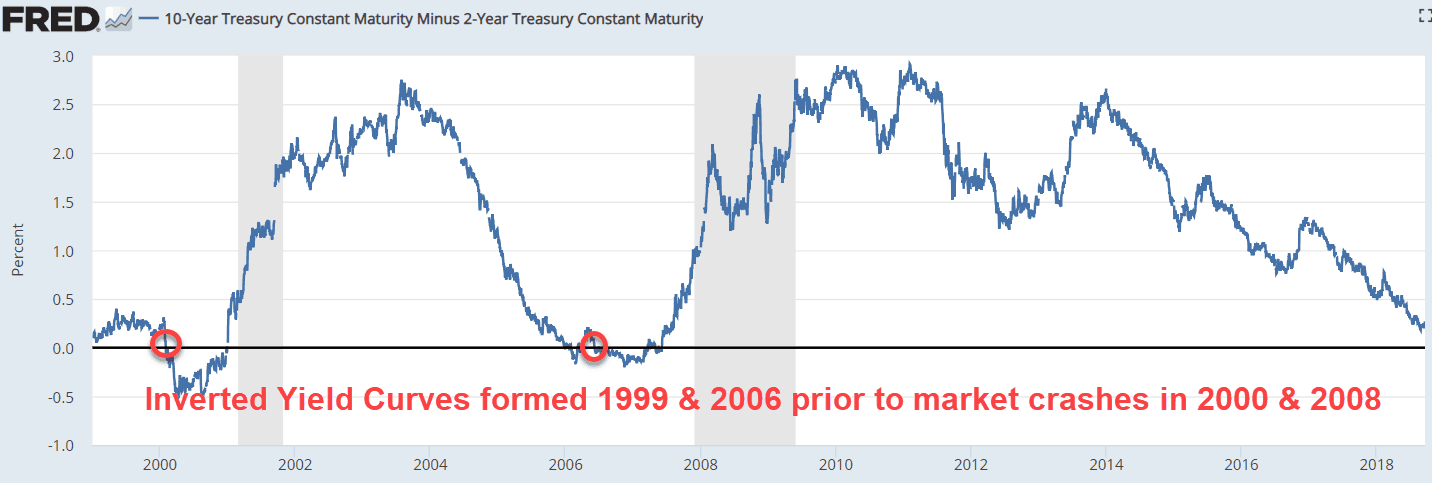

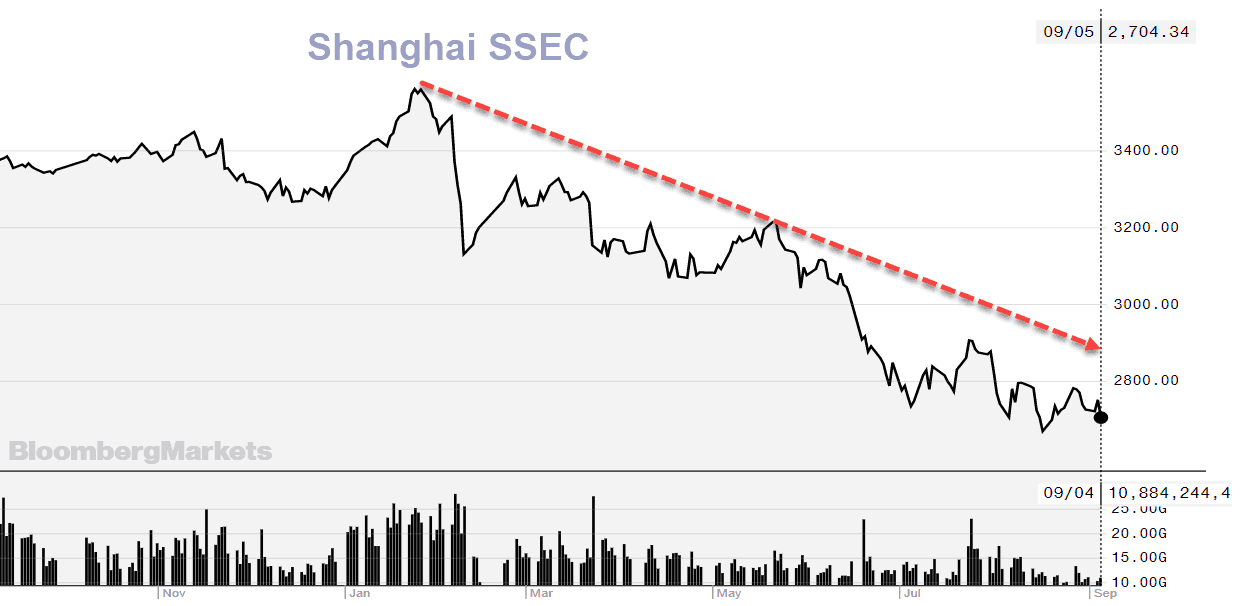

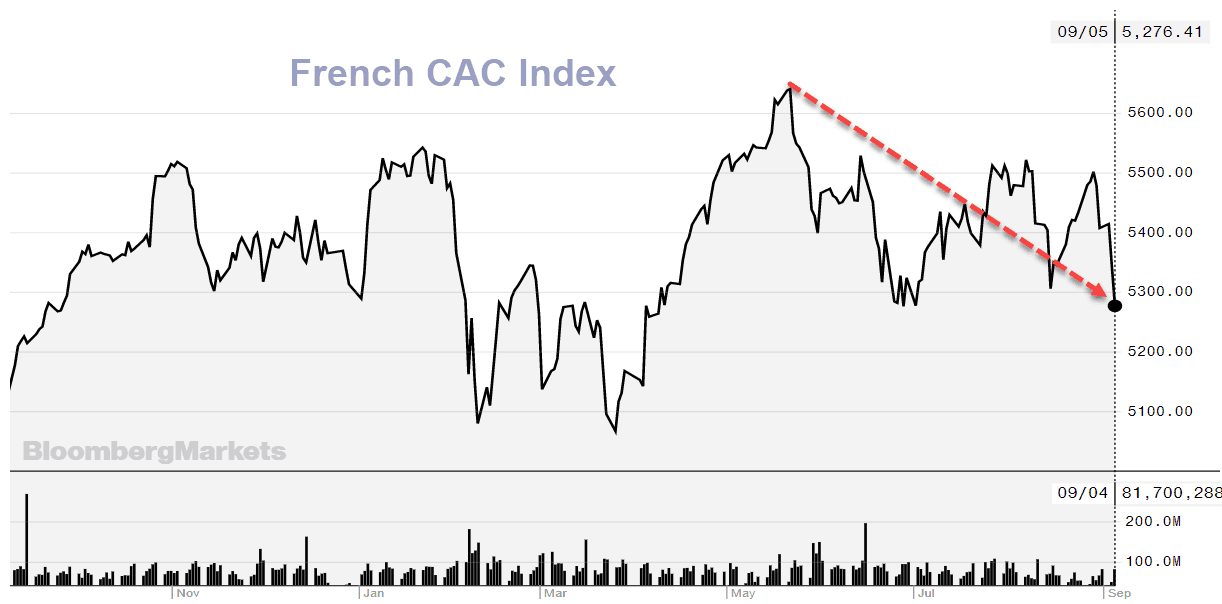

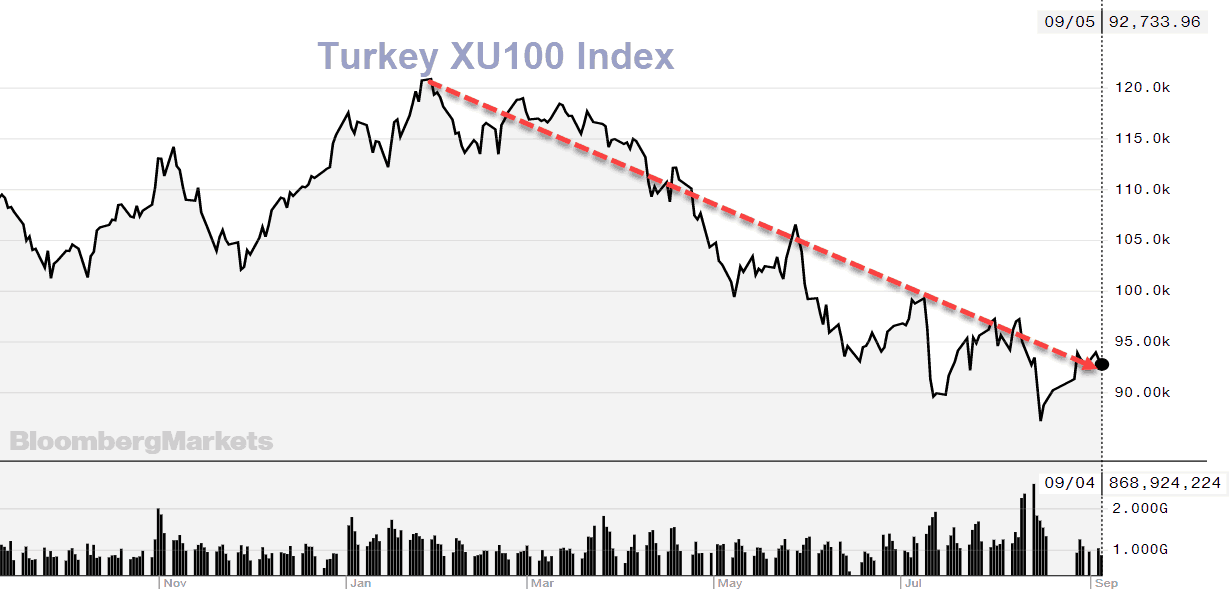

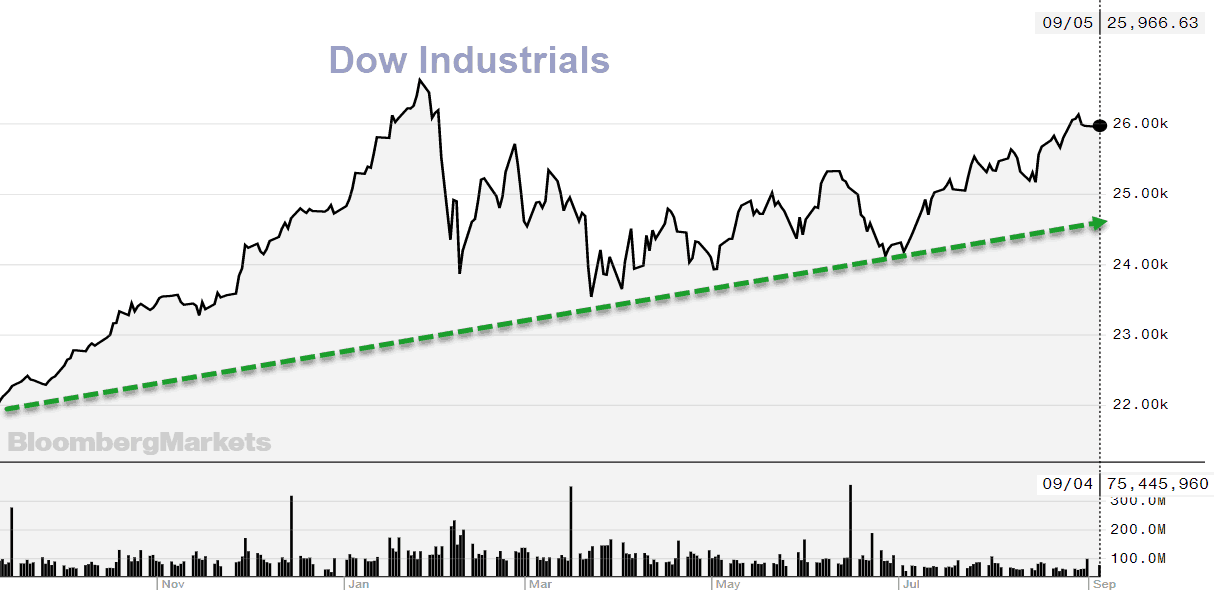

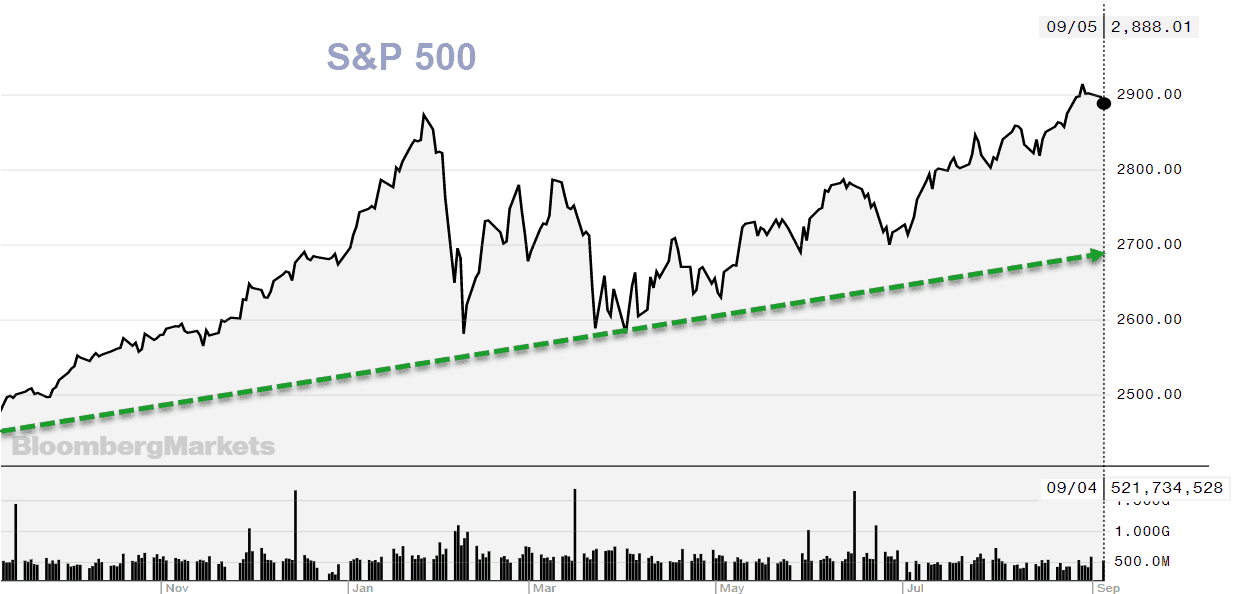

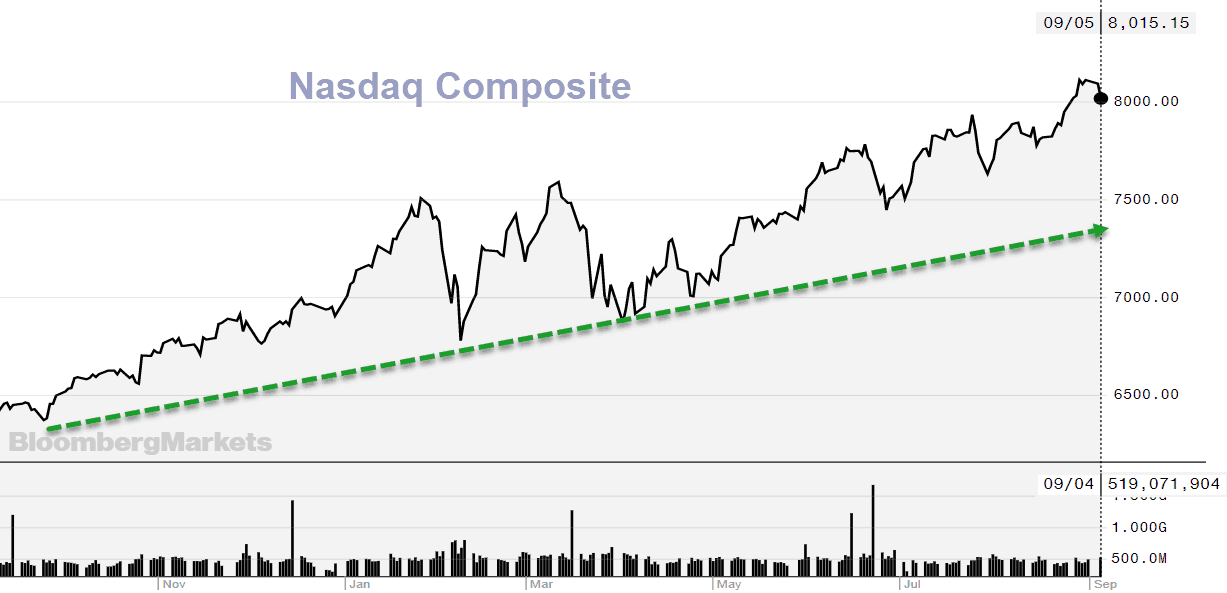

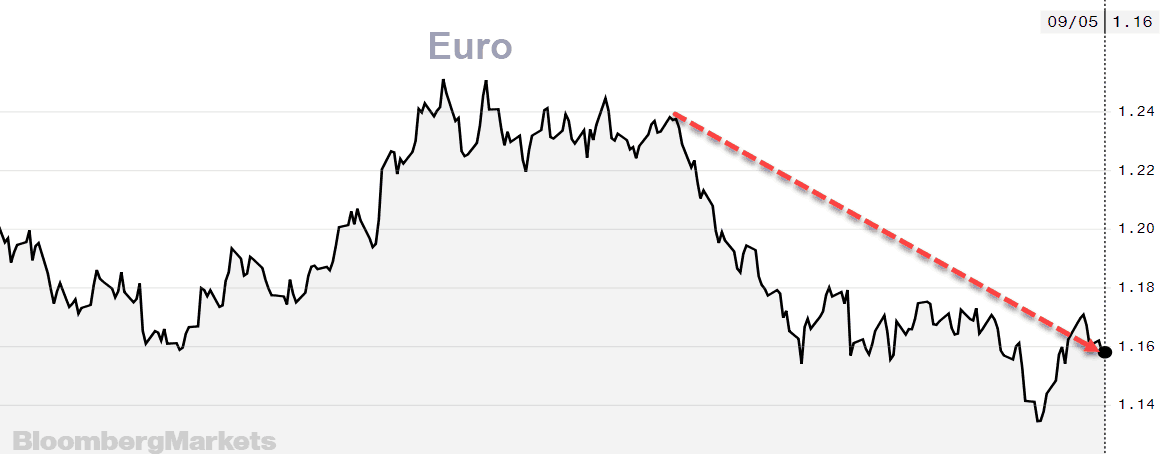

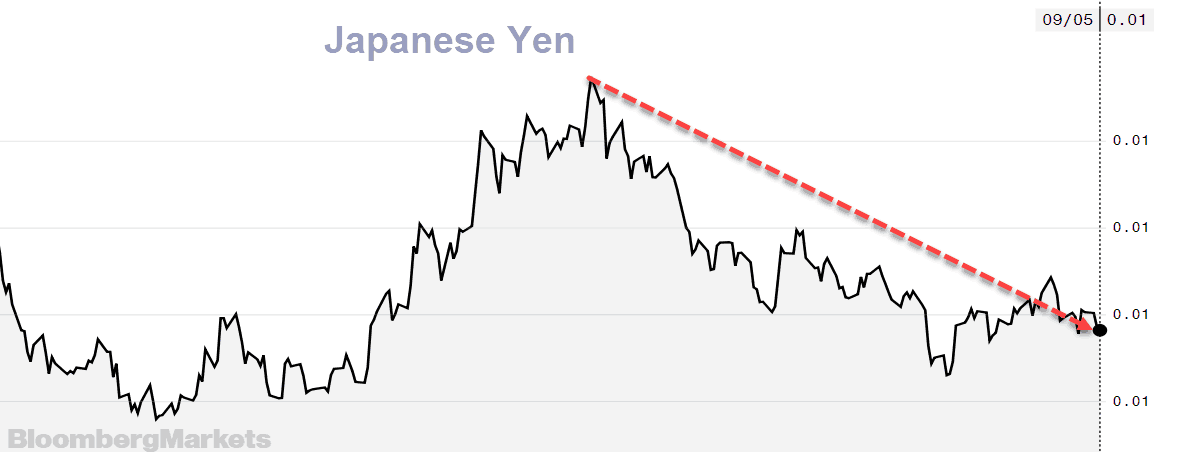

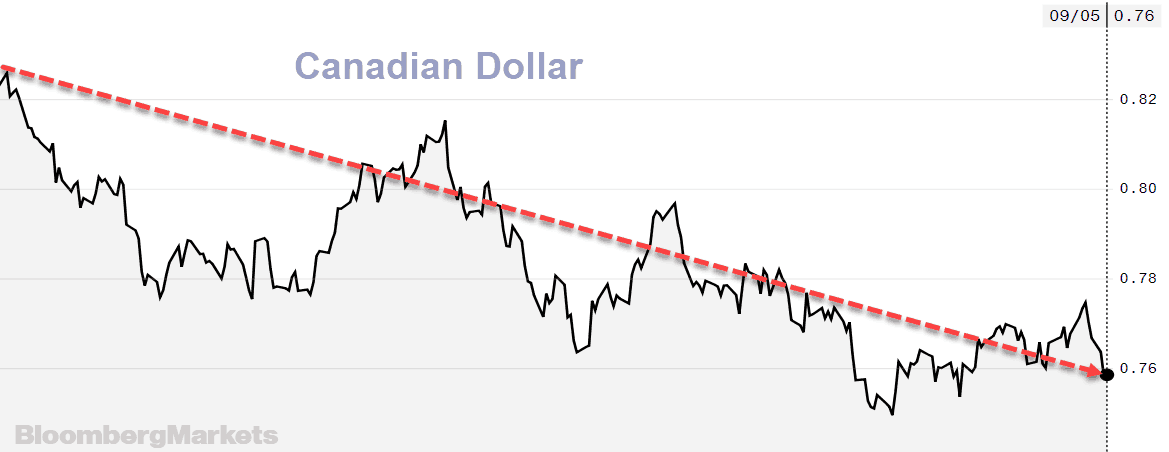

“No matter what your opinion of Donald Trump the person, that administration’s policy of reduced business taxes and regulations are very good for US businesses. Compare that to what we have in Canada and the EU.”

The Trend Letter founder and editor Martin Straith joins Michael to discuss what this divergence in policy means for investors – and more importantly, the specific markets that will benefit.

The interview with Martin starts at 17:30. Click Here to listen in.

In the interview Martin offered MoneyTalks listeners a Special Offer, and will donate $50 each to Kids Help Phone & Special Olympics for every new subscription. Here is the Special Offer:

All 3 services for only $999.95 per year Subscribe

The Trend Letter = $599.95 $399.95 per year Subscribe

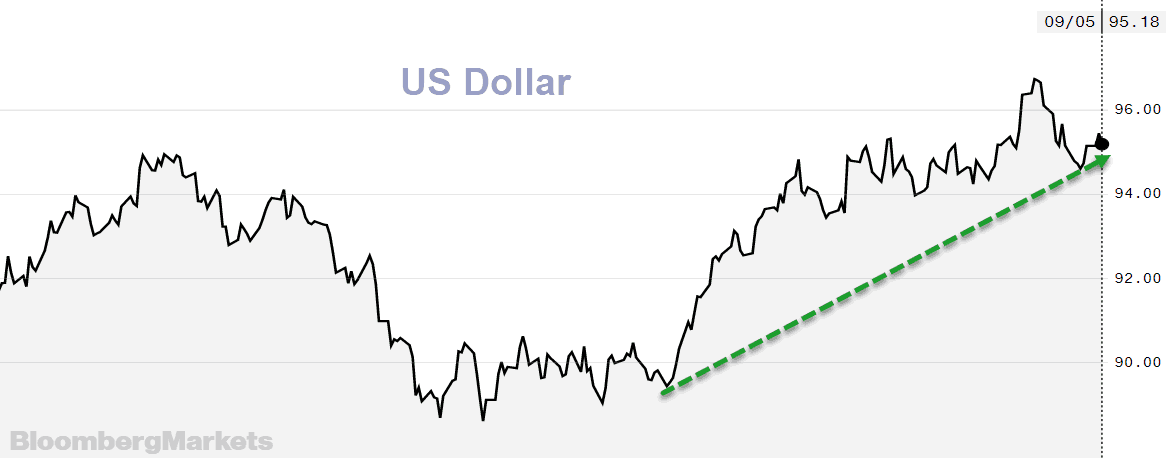

Great track record dating back to 2002, a weekly publication covering global bonds, currencies, equities, commodities, & precious metals

Trend Technical Trader = $649.95 $399.95 per year Subscribe

A premier hedging service designed to profit in a declining market. Includes our proprietary Gold Technical Indicator (GTI)

Trend Disruptors = $699.95 $399.95 per year Subscribe

A service for investors seeking to invest in advanced, unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G & many more

If you have any questions, send us a note at info@thetrendletter.com.

Trend News Team