Stock Market ‘Red Flag’ close to being triggered

This bull market in stocks is still very much alive, and we are even anticipating a powerful run or ‘melt-up’ before it is all over. But after this big ‘melt up’ we expect that we will have a ‘melt down’.

Whether our prediction of a melt-up is true or not, the next question is when does this nearly 10-year bull market end? One of the key indicators that we trust to tell us when this powerful stock market bull run will end is if we see an ‘inverted yield curve.’

Typically, long-term interest rates are higher than short-term rates, which makes sense the longer someone owes you money, the greater risk that you won’t be paid back in full increases the further out in time you agree to lend. Meaning that all things being equal, your risk is much lower when lending for 3-months versus 10 years.

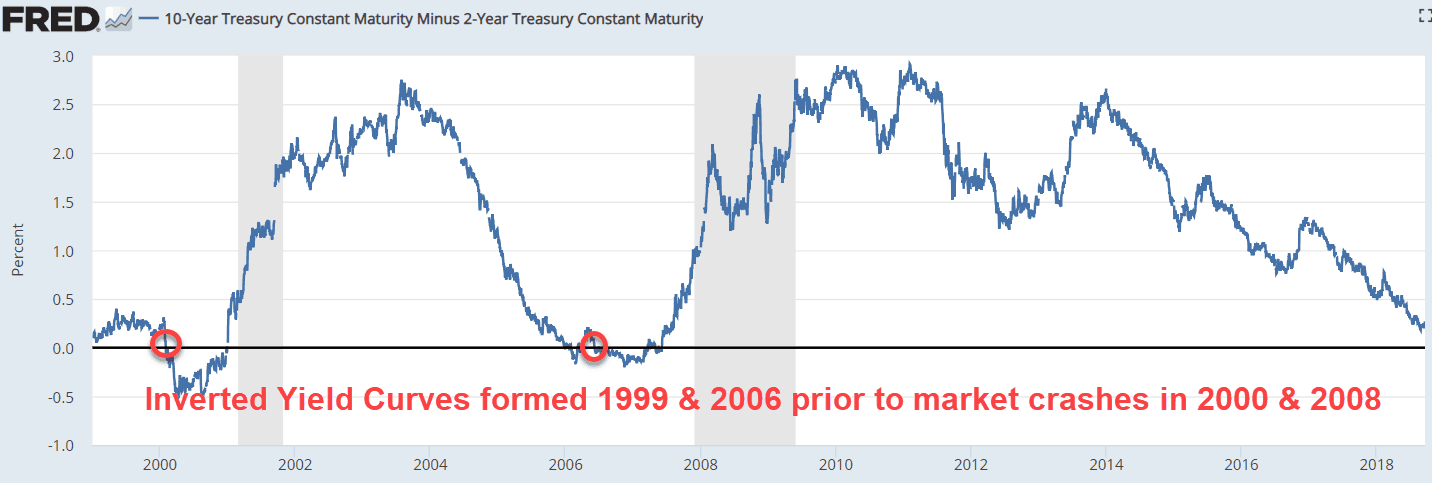

But on occasion when the Federal Reserve wants to slow the economy down, they push short-term rates higher than long-term rates. When that happens, we have what’s called an inverted yield curve. History shows that every stock market top over the past 40 years has been preceded by an inverted yield curve, so when it happens, we must pay attention.

An inverted yield curve is a leading indicator, meaning that the stock market top does not happen right after the yield curve inverts. Typically, the market crash starts 12-18 months after the yield curve becomes inverted. The two most recent time we saw an inverted yield curve in was in 1999 before the DOT COM crash in 2000 top and 2006 before the global financial crisis in 2008.

Today, the spread between US 2-year & 10-year yields is just .27% and is threatening to invert very soon.

If we see the yield curve invert in the next few months, we could then expect to see a serious market crash or correction 12-18 months later.

Given that the yield curve has not yet inverted we could have at least another year before the ultimate end of this bull market. If the yield curve inverts in the next few months, we should see the end of the bull market sometime in 2020/2021. When the melt-down starts, it could be the nastiest of our lifetime, worse that 2008.

All investors need to start planning so they have an exit strategy for when the market has a significant decline…we can discuss how to do that later. The coming bear market crash may not be imminent, but it is coming.

Do you have a strategy to protect your wealth when the melt-down comes? Seriously consider subscribing to Trend Technical Trader, which is a hedge service designed to not just protect you in a melt-down, but to allow you to profit from a melt-down.

Stay tuned!