Really, the S&P 500 below 2500 this week?

Stocks:

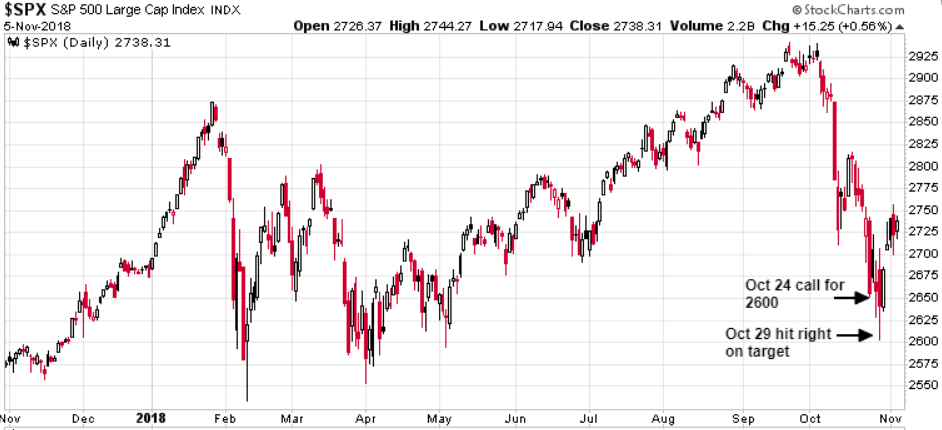

In our October 24th Market Update we stated:

S&P has been trading above its 9+ year uptrend channel, although it has now fallen below the upper level of that channel. All this action is bearish, suggesting that the S&P will very possibility test the 2600 level. Given that markets decline much faster than they rise, we could see this support level hit this week

Five days later the S&P hit an intra-day low at 2603, just 3 points from our target.

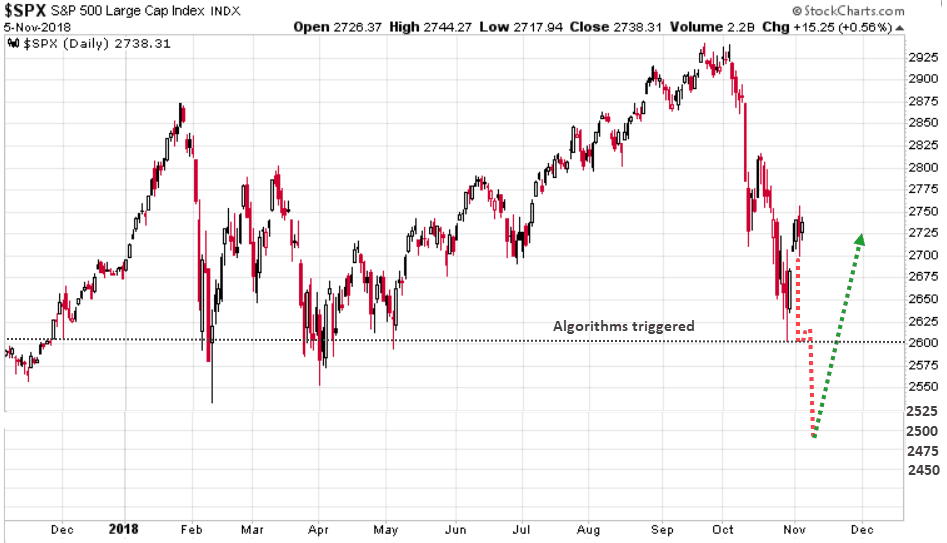

Tomorrow is the US mid-term election and over the next few days we could see some wild action in the markets. Below is one of the scenarios our models are projecting, so be prepared. If the market gets nervous and re-tests the 2600 level, a breach of this level could trigger black box algorithms initiating a series of SELL Stops that could quickly push the S&P down below key support levels at 2535 and 2500. This scenario would then validate our model’s Feb’18 call for an ultimate low of 2470. If this scenario plays out, the market would be then be extremely oversold opening the door for a significant rally right back through 2600, potentially closing the week close to 2725.

An immediate push through 2800 would diminish the odds of a bearish decline to 2500 target and would signify a likely early resumption of the uptrend.

Let’s watch and see how the mid-term elections play out.

————————————————————————————

In the recent market correction Trend Technical Trader (TTT) recommended 4 plays to profit during a market decline. At their peak these plays gained 24%, 46%, 49% & 54% in less than 2 months. If you would like to subscribe to TTT and have a plan to not just protect yourself during the next market correction or crash, but to actually profit from it, CLICK HERE and receive $250 off the regular price and pay only $399.95

————————————————————————————

Stay tuned!