Market Update – May 19/21

Stocks

US stocks closed mixed and Treasury yields rose as minutes showed Federal Reserve officials were cautiously optimistic about the US recovery at their April meeting, with some signaling they’d be open ‘at some point’ to discussing scaling back the central bank’s massive bond purchases.

The S&P 500 fell for a third day, and 10-year Treasury yields jumped to session highs following the release. Energy and raw-material stocks fell the most as commodities prices tumbled amid mounting concern about inflation and potential curbs on monetary stimulus. The Nasdaq 100 notched a small advance, boosted by late-day gains in tech stocks including Facebook and Alphabet.

Strong inflation readings and signs of a worker shortage in recent weeks have fueled fears and roiled stock markets despite reassurances from Fed officials that the rise in prices would be temporary.

Note on the chart below that the previous low for the S&P 500 on May 12th held. This suggests that we should see a rally from here, provided there is not some new negative news. We are looking for a potential high of 4265 in the next two weeks.

Crypto

Digital currencies fell sharply after China’s banking association issued a warning over the risks associated with digital currencies. A statement posted on the industry association’s website said all members should ‘resolutely refrain from conducting or participating in any business activities related to virtual currencies.’

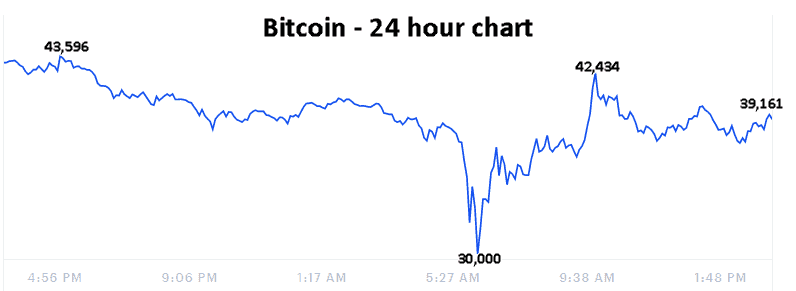

Below is Bitcoins’ 24-hour chart and we can see what a wild ride it was. At just before 5:00pm last night Bitcoin was trading at $43,596, then 12 hours later it was down to $30,00, before rallying back to $42,434, 4 hours later. Bitcoin finished the 24-hour day at $39,161.

Gold

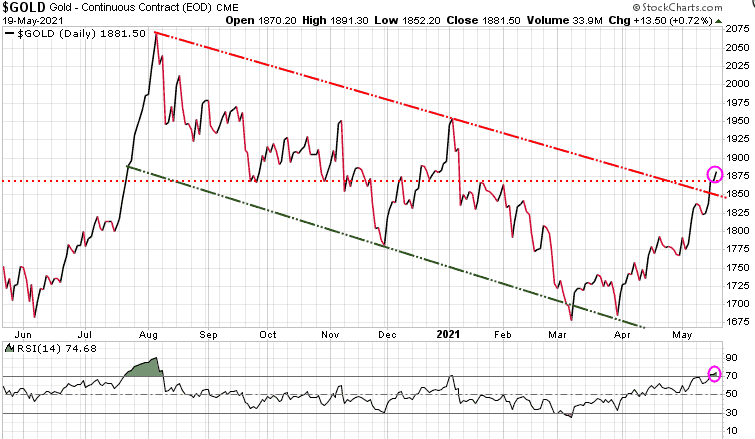

Gold had a solid day, up $13.50. Gold has now broken out of both its downtrend channel, and its near-term resistance (horizontal red dotted line). At the bottom of the chart, we can see that gold is now technically overbought, suggesting a near-term top is to be expected.

Stay tuned!