Market Notes – June 2/22

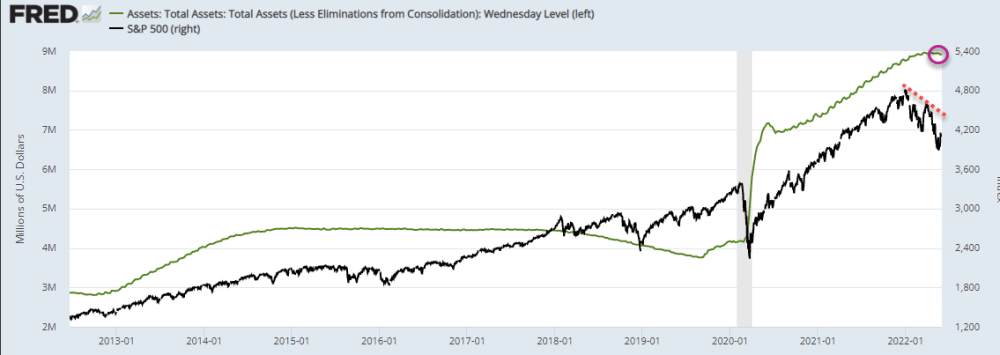

A major reason the equity markets had such a great run over the past decade has been thanks to the loose monetary policy of the Federal Reserve. And from August 2019, the Fed has increased its balance sheet 137%, from $3.76 trillion, to $8.92 trillion. That is more than all of the prior QE periods combined.

Now the Fed is starting to shrink its balance sheet , starting a new era of Quantitative Tightening (QT). The last time we saw QT was in 2018 where the Fed shrunk its balance sheet by almost $700 billion in 15 months. The result of that QT was the equity markets declined, then the Fed quickly backed off, reversing its stance, lowering interest rates and starting a new QE program that massively added to the balance sheet.

While QE has dramatically juiced the stock markets over the past decade, QT will have the opposite effect. While many are saying that the bottom is in for the equity markets, as long as the Fed sticks to their QT plan, we suggest there is more pain to come.

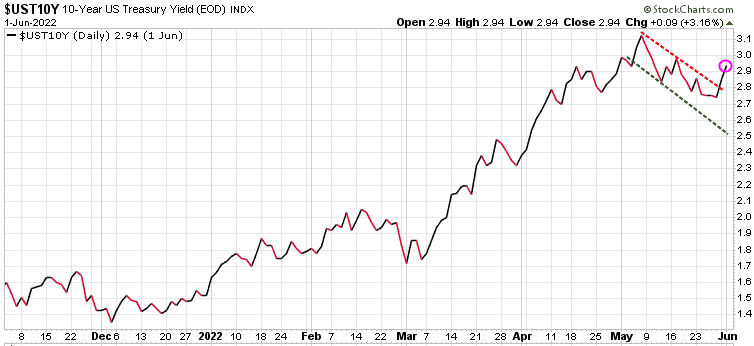

The US 10-Year yield had been making lower highs for nearly a month, but recently has started moving higher again. For those who don’t watch bonds and yields closely, bonds and yields move opposite each other. We want to keep an eye on this as if the yields start to decline again it means that bonds are rising, and bonds are typically safe-haven plays, suggesting the bond market is bearish on the equity markets.

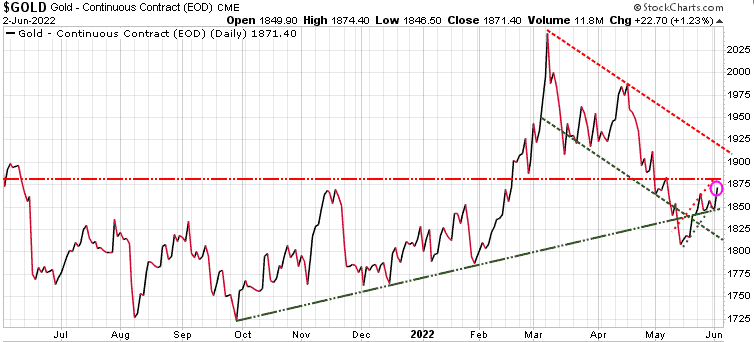

After sinking below $1,800 in May, gold has spent the last few weeks rising to ~$1,870. And a breakout north of $1,880 would likely compound into additional gains. While we could get a nice run here, we expect the next big rally for gold will likely start in the fall.

Stay tuned!