CHARGING FORWARD – Solid State Battery Technology

Long-lasting, quick-charging batteries are essential to the expansion of the electric vehicle market, but today’s lithium-ion batteries fall short of what’s needed — they’re too heavy, too expensive and take too long to charge. Solid state batteries are a promising technology aiming to solve these issues, but the technology itself has a few problems that must be resolved before they can be manufactured at an industrial scale.

A unique battery technology has originated from several critical discoveries made by a research group at Harvard’s John A. Paulson School of Engineering and Applied Sciences. This team has developed a new field of mechanical constriction design of battery materials and devices.

The Harvard engineers are so confident in their design that they spun off a start-up company to commercialize the technology. The start-up is called Adden Energy and it uses an exclusive technology license from Harvard’s Office of Technology Development to develop solid-state battery systems for use in future electric vehicles. Based on lithium-metal technology, the battery can achieve charge rates as fast as three minutes with over 10,000 cycles in a lifetime. The coin-cell prototypes developed by Adden for lab testing don’t look like much now, but Adden wants to scale the battery up to a palm-sized pouch cell and further to a full-scale EV battery.

With the capacity of 10,000 charging cycles over its lifetime, and a charge rate of only three minutes, the battery has the potential to totally disrupt the EV battery sector. For comparison, standard EV batteries today only last up to about 3,000 cycles, which for consumers who drive daily is only enough cycles to last three to five years, which is not much of a lifespan.

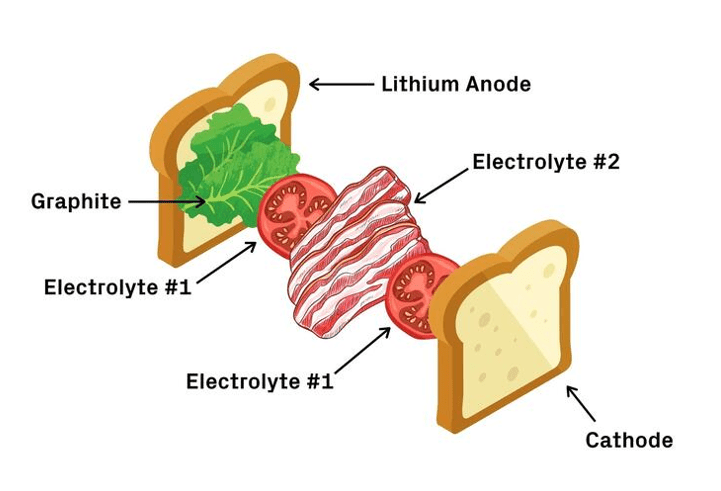

In addition, this new technology boasts high energy density and a level of material stability that overcomes the safety challenges posed by some other lithium batteries today. The battery uses a new technology that prevents dendrite formation in the lithium-metal anodes. The innovative solid-state electrolyte is essential to this technology, allowing it to achieve an ultrahigh current density with no lithium dendrite penetration. The electrolyte features a “multilayer design, which has the structure of a less-stable electrolyte sandwiched between more-stable solid electrolytes.” The dendrite growth happens inside the less stable electrolyte layer, but any cracks formed are quickly filled by “dynamically generated decompositions that are also well constrained.”

“A lithium-metal battery is considered the holy grail for battery chemistry because of its high capacity and energy density, but the stability of these batteries has always been poor. Our research shows that the solid-state battery could be fundamentally different from the commercial liquid electrolyte lithium-ion battery. By studying their fundamental thermodynamics, we can unlock superior performance and harness their abundant opportunities.” Xin Li, Associate Professor of Materials Science at the Harvard John A. Paulson School of Engineering and Applied Science (SEAS).

One of the key game changing components of this technology is that the batteries are the most expensive component of EV vehicles. With the current battery technology, EV drivers today only get 2,000 – 3,000 cycles and can expect to pay somewhere between $10,000 and $20,000 to replace their battery every 3 – 5 years or so. If Adden can scale up this technology and prove out its ability to last three to five times longer, it will be a major cost savings for these EVs.

The other major inconvenience of today’s EVs is that they take so long to charge. Current batteries take about 30-45 minutes just to get to 80% charge. For those who do not have a 240-volt charger at home or in their complex, that is a major time consumer. If this new technology, with a 3-minute charge can be commercialized, it will be a game-changer.

To date, Adden Energy has proven that this technology works for small solid state batteries roughly the size of a fist. The next step is to scale it up and demonstrate that the same approach works for larger EV-size batteries. That’s the next big milestone.

It is exciting to see a brand-new entrant in the battery tech space making great progress but so far, all these in-roads have been made in the lab. Now the challenge is to commercialize at scale. The technology that can do that will prove to be the winner in this space.

The goal of TREND DISRUPTORS is to discover and monitor technical developments that have the potential to DISRUPT a market sector. We look for the best ideas and generate actionable investment recommendations for subscribers. As a general rule, these recommendations are speculative, and we advise caution, discretion, and thorough research. We strive to identify investment opportunities that can lead to success for the well-informed investor.

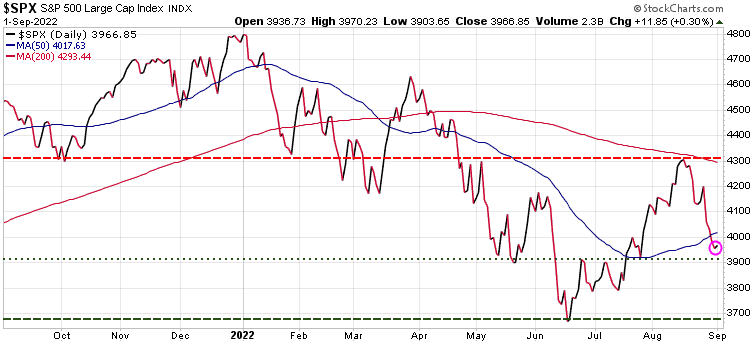

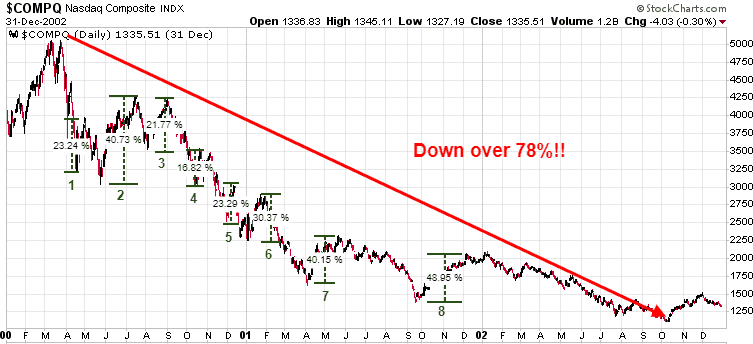

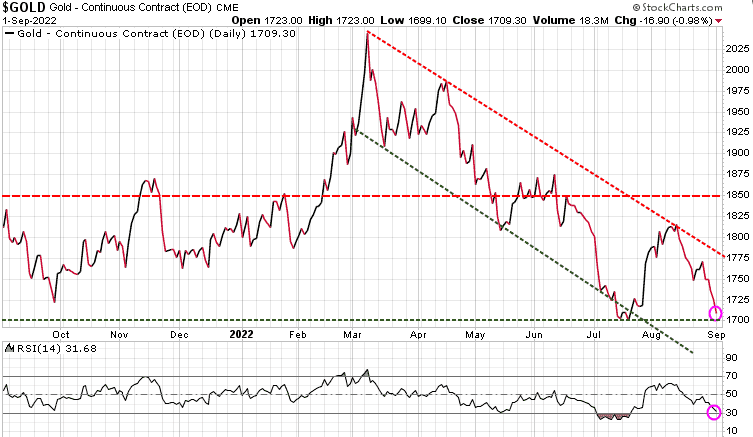

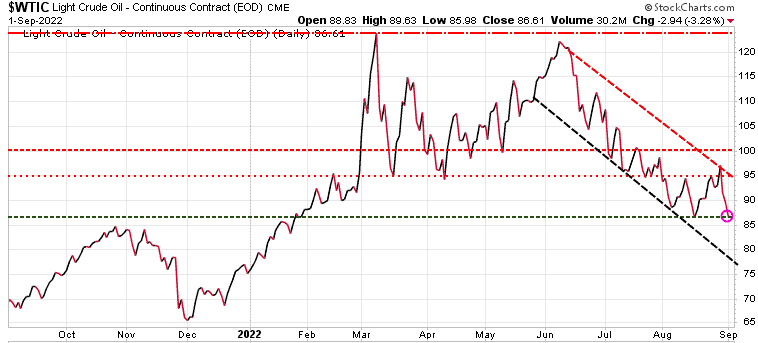

In the current bear market environment, we have not been making any new recommendations. But we are still doing plenty of research and have built a very impressive list of 25 disruptive companies that we feel will be leaders in many disruptive sectors. We continue to send updates on these companies to our subscribers and will be issuing BUY Alerts when our models trigger it is time to buy.

If you want to learn more and get on our subscriber list, click here

Stay tuned!