If the Fed cuts rates will that be the time to buy?

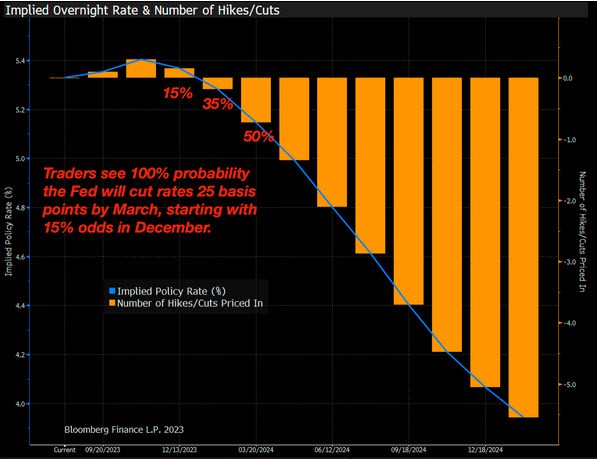

Following benign inflation data last week, Fed Fund futures highlight that traders fully expect a quarter point rate cut by Q1 of 2024.

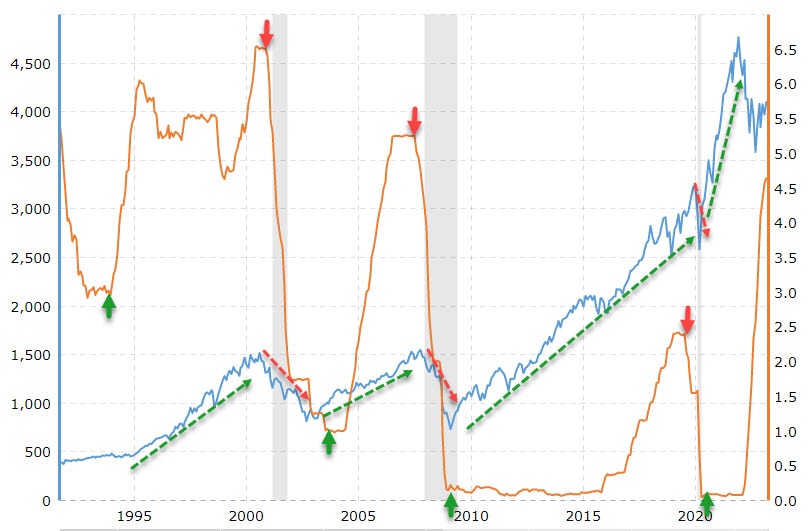

So, the pivotal question is: would the markets truly rebound if the Fed initiates rate cuts in Q1 2024? Though widely held, history contradicts this belief. Typically, markets experience a brief uptick when the Fed pauses after raising rates. However, the chart’s red arrows distinctly indicate that major losses tend to occur when the Fed starts cutting rates.

Certainly, rate cuts are often prompted by economic troubles and impending recessions, prompting investors to sell stocks due to their vulnerability in such conditions. The chart consistently shows market declines during rate-cutting periods, with stock upticks only occurring after the Fed ceases cutting rates (indicated by green arrows).

Keep this in mind if the Fed embarks on rate cuts in early 2024 and the media advocates for stock purchases. The chart highlights a potential risky scenario, akin to a trap.

Stay tuned!