As an investment newsletter, dedicated to great investment ideas such as trend disruptors, we scour the market to identify companies poised to become technology disruptors. In a recent update, we introduced to our subscribers three new entities that align with our criteria. Today, we shine a light on one of those companies: GSI Technologies

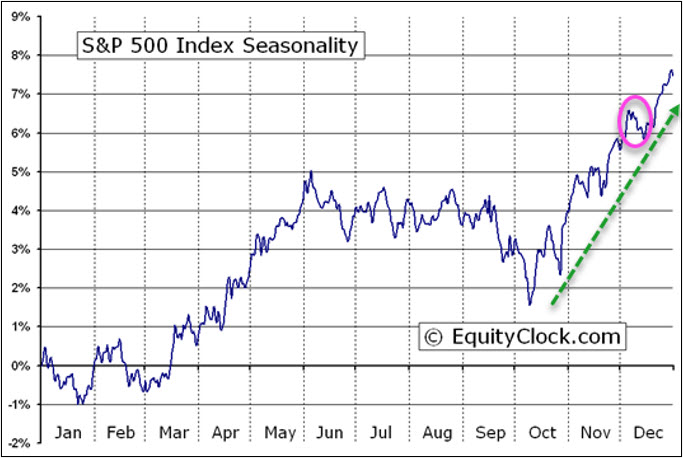

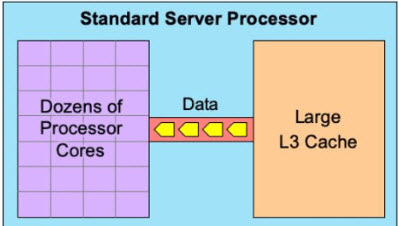

Using AI technology requires vast amounts of data to be processed quickly and efficiently in order to be useful in applications that depend on it. In the AI world there are huge amounts of data in play, but processing that much data in the standard cache-to-processor chips can be too slow. The illustration below shows how standard server processor cores struggle with large datasets, due to the narrow connection with the large on-chip memory.

GSI Technologies, a recent pick for TREND DISRUPTORS subscribers has developed a first-generation chip (GEMINI-l) to speed things up, and are developing the next version (GEMINI-ll), aiming to bring this solution to market in the second half of 2024.

GSIT is a leading provider of semiconductor memory solutions for in-place associative computing applications. The company deals directly with high-growth markets like AI and high-performance computing, which includes both natural language processing and computer vision.

To be clear, this is not traditional processing. GSIT’s Gemini technology uses associative processing unit (APU) products focused on applications using similarity search, which are used in visual search queries for things like e-commerce, computer vision, drug discovery, and cybersecurity. Of course, advanced AI chip solutions can serve many markets, like networking, telecommunications, and the military.

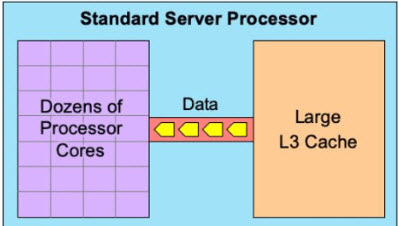

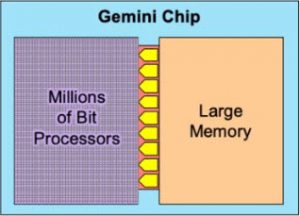

GSIT has just announced they have completed the tape-out for Gemini-II and will evaluate the first silicon chip by the end of 2023. Gemini features millions of cores that can all access memory at once, allowing a much greater flow of data, generating much faster results.

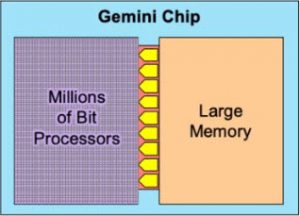

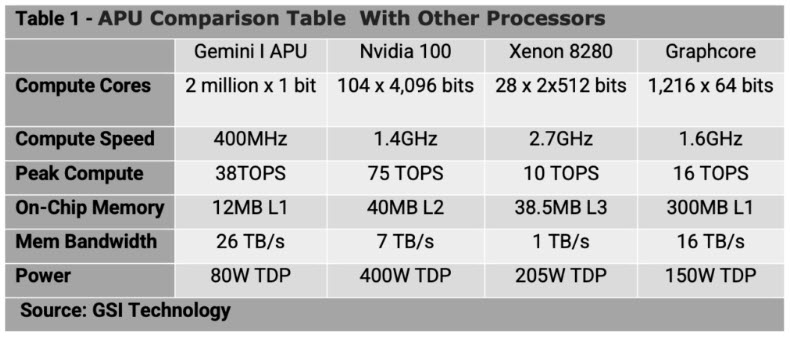

Gemini-I APU’s architecture features parallel data processing with two million-bit processors per chip. The massive in-memory processing reduces computation time from minutes to milliseconds, while significantly reducing power consumption, all in a scalable format. A comparison of leading AI chips, shows that the Gemini chip excels when compared to products from Intel, Nvidia, and Graphcore.

Gemini-I excels at large (billion item) database search applications, like facial recognition, drug discovery, Elasticsearch, and object detection. Gemini-II will bring significant performance enhancements over Gemini-I with more than ten times the processing performance with eight times the memory density compared to Gemini-I. Gemini-II’s combination of high processing power, large built-in memory, tremendous bandwidth, reduced power consumption, and latency, provides a best-in-class solution for AI applications.

Gemini-II contains 1 million Bit Processors in six megabytes of associative compute memory tightly connected to 96 megabytes of distributed SRAM with a huge 46 terabyte per second bandwidth. The Gemini APU implements bit-granular processing, which allows users fully flexible cycle by cycle data format operation, an inherent advantage versus other parallel processors. Gemini-II is a complete package that includes a DDR4 controller and external interfaces for PCIe Gen4 by 16, and PCIe Gen4 by 4. This integrated solution offers substantial processing capabilities, being suitable for both low power data center expansion and enabling data center functions at the edge. This empowers local execution of computationally intensive tasks, increasing the capabilities of edge applications like advanced driver assistance systems for automobiles, and HPC in delivery drones, autonomous robots, unmanned aerial vehicles, and satellites.

“This major achievement showcases our continued commitment to pushing the boundaries of AI chip technology,” said Lee-Lean Shu, CEO and Chairman of GSI Technology. “We’re in talks with a leading Cloud Service Provider to further explore the APU architecture benefits highlighted by Gemini-II. Large language models, such as ChatGPT, Microsoft BING, and Google’s Bard, are pushing natural language processing boundaries. We’ve just begun to tap into their transformative potential across many industries and applications. Abundant opportunities await Gemini-II and future APU implementations in the AI market.”

Founded in 1995, GSI Technology, Inc. is a leading provider of semiconductor memory solutions. The Company recently launched radiation-hardened memory products for extreme environments in space and the Gemini® Associative Processing Unit (APU), a memory-centric design that delivers significant performance advantages for diverse AI applications. The Gemini APU architecture removes the I/O bottleneck between the processors and memory arrays by performing massive parallel searches directly in the memory array where data is stored. The novel architecture delivers performance-over-power ratio improvements compared to CPU, GPU, and DRAM for applications like image detection, speech recognition, e-commerce recommendation systems, and more. Gemini may be the ideal solution for edge applications with a scalable format, small footprint, and low power consumption where rapid, accurate responses are critical.

GSIT has announced its receipt of a Phase I SBIR contract in the 23.5 cohort by AFWERX, which is a United States Air Force program with the goal of fostering a culture of innovation within the service. Encompassing a number of programs supported with relatively small amounts of funding, the initiative is intended to circumvent bureaucracy and engage new entrepreneurs in Air Force programs. Under this contract, GSIT will perform a feasibility study to adapt, modify, and enhance its commercially proven Gemini® APU to propel Air and Space Force computing at the edge. They are embarking on a mission to explore high-performance edge processing. At the heart of this collaboration is the Gemini® APU, a dual-purpose compute-in-memory chip crafted to unleash the potential of various AI applications, including inference and high-performance computing workloads. While the APU is well suited for data center applications, its exceptional power efficiency will allow GSI to pursue this remarkable capability to the edge as well.

Given all of the above, it is no surprise that TREND DISRUPTORS has an eye focused on this company, as GSIT has the potential to be a major Trend Disruptor in the hugely Disruptive AI market. The goal of TREND DISRUPTORS is to discover and monitor technical developments that have the potential to DISRUPT market sectors. We look for the best ideas, and we generate actionable investment recommendations for subscribers. As a general rule, these recommendations are speculative, and we advise caution, discretion, and thorough research. We strive to identify investment opportunities that can lead to success for the well-informed investor.

Stay tuned!!