Record market sell-off

As we have been anticipating, global markets started to correct last week, and that downturn gained strong momentum in today’s historic sell-off. Fortunately for subscribers to The Trend Letter and Trend Technical Trader (TTT), both services had strategies in place to deal with this correction. In fact, while the Dow saw its biggest single-day decline in history, two of TTT picks had gains of 33%, & 11.37% today!

Below we take a look at how markets performed around the globe today.

First off we check out the VIX Volatility Index and see that after over 15 months of “complacency” (indicated with a reading below 20), the VIX rocketed higher to 38, as investors quickly switched from “complacent” to “fearful” (indicated with a reading over 30).

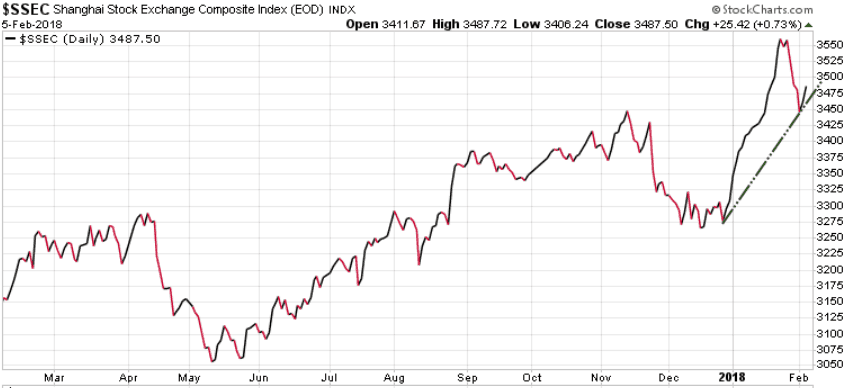

The Asian markets were the first to open and we saw them all decline, picking up where North American markets left off on Friday. The Japanese Nikkei closed down 2.55% for the day, and 6.4% from its recent high.

Shanghai managed to eek out a .73% gain on strong service numbers.

Europe was next up, and we saw the German DAX index drop .76% for the day and 5.6% since its recent high.

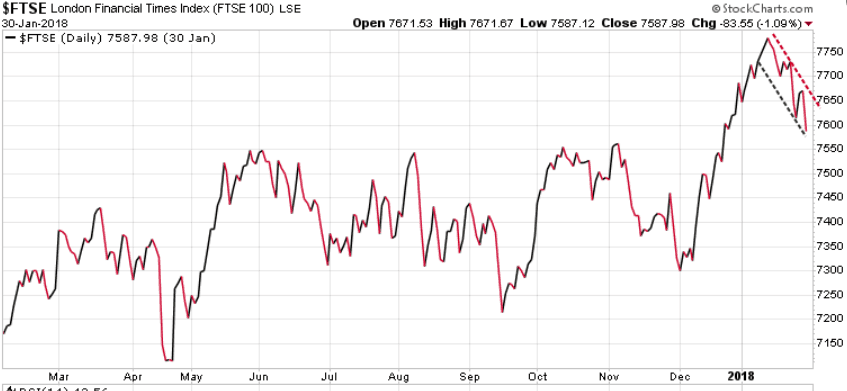

The London FTSE dropped 1.09% for the day.

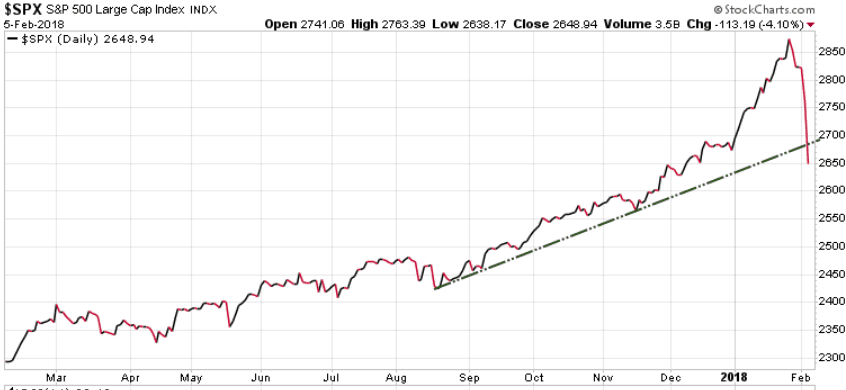

Jumping back to North America, the Dow Industrials plummeted a stunning 1,175 points, or 4.60%, erasing all of 2018 gains. This was the largest single-day decline in the Dow’s history.

The S&P 500 fared only slightly better, losing 113 points, or 4.10%.

Canada’s TSX Index dropped 1.74% and is now down 6.6% since its recent high. Note that the TSX is now the 4th worst performing index in the world.

With the Dow down over 1,000 points, Gold was not able to gain any momentum as a ‘safe haven’ play. Gold was down slightly for the day, still trying to re-test recent high.

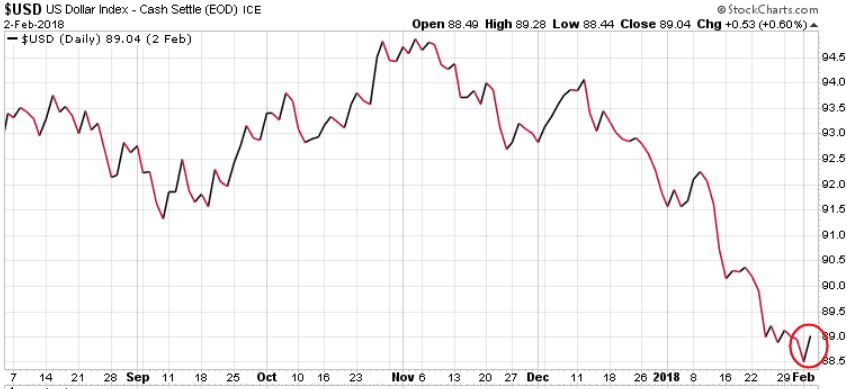

With global markets selling off, the US dollar saw ‘safe haven’ capital flow its way.

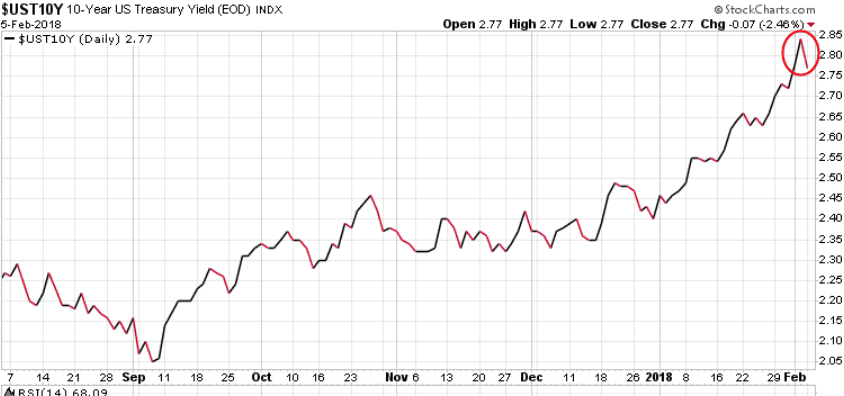

With equity markets selling off, ‘safe haven’ capital flowed into US bonds which were paying up to 2.85% yields. US 10-year yields closed down 8 bps to 2.77%.

These are pretty severe moves, so we could see a bounce tomorrow, but expect much volatility through the rest of the week. Watch for mid March are a Key Turning point.

On January 23rd we posted a blog warning that the markets were getting very oversold. We said…

Now because all of these indicators are warning that this market is overbought, it doesn’t mean it cannot keep rising, it just means you need to be prepared for a pullback, or a more severe correction. You need an exit strategy! What we are saying is that prices are elevated, as are the risks, as the masses are taking on increased risk. This tells us we need to be prepared for a pull back or a more severe correction.

While The Trend Letter does have some “insurance” plays pending, Trend Technical Trader (TTT) is a hedge service, designed specifically to protect, and even significantly grow your wealth on a market decline.

Good deal – We are offering you TTT at $250 off the regular price of $649.95, now just $399.95. Click here to take advantage of this offer.

Great deal – We are offering both The Trend Letter & Trend Technical Trader at $600 off the regular price, now just $649.95. Click here to take advantage of this offer.

We have re-opened those offers.

Stay tuned!