Key targets for the S&P 500

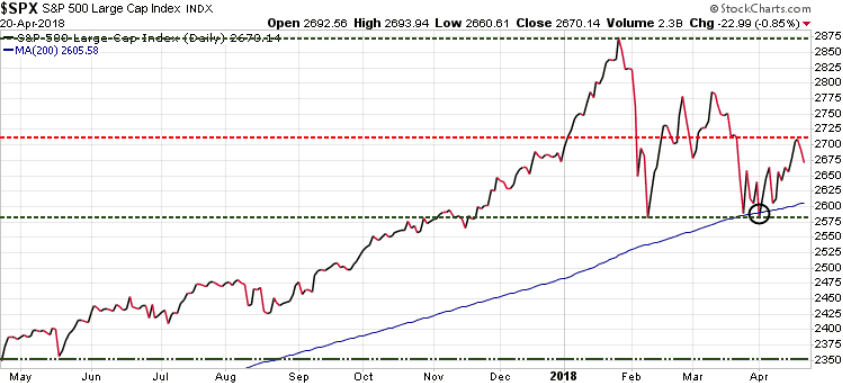

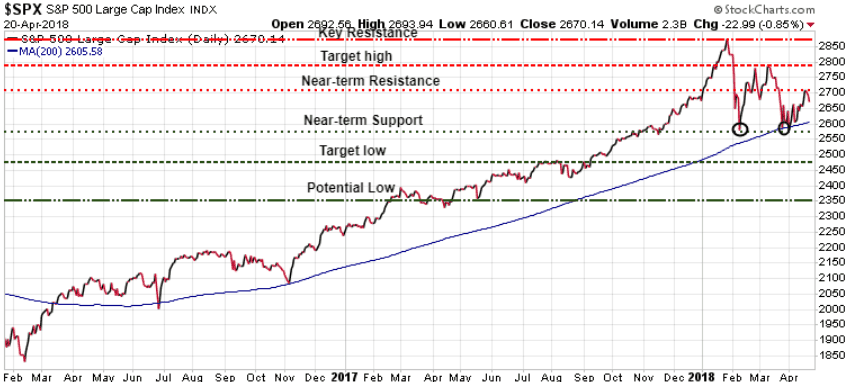

As we close the week, we continue to see the S&P 500 consolidate, trading in a range between Near-term Support at 2581 and Near-term Resistance at 2707. That 2700 level is a resistance target we noted for the past month and it held right on schedule. The 2581 level has been our targeted support since March 27th.

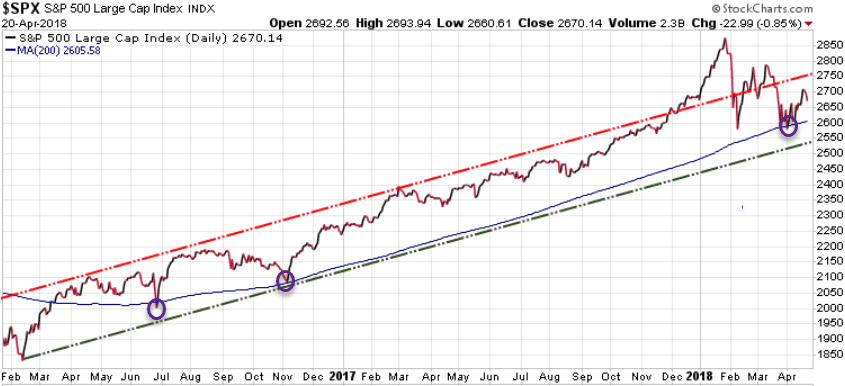

Looking at the 2-year chart we can see how the 200-DMA (blue line) has acted as very strong support for the S&P 500. While we are actually still bullish for the market, at least for another 1-2 years, our indicators continue to warn that this consolidation phase that we have been in since January 26th, is not yet complete. Our models warn that the market is ripe for a significant decline from the recent high at 2707, with a re-test of its 200-DMA likely, and a challenge of the lower band of the uptrend channel very possible.

Short-term, we want to keep a close eye on that 200-DMA because it is an important technical indicator. In bull markets, stocks tend to spend most of their time above the 200-DMA, while during bear markets, they spend most of their time below this line. Stocks seldom stray too far from this line in either direction, and when they do, the further they stray, the faster they tend to revert back to it. Having spent most of the last 2-years above the 200-DMA, the S&P is now consolidating closer to that level.

We would expect to see the S&P drop below the 200-DMA in the next 2-3 weeks, recharge, and find a bottom before making a run at new highs.

Here are the Key levels to watch for the next 2-3 weeks:

Bearish scenario:

2587 – the 200-DMA

2535 – bottom of the 2-year uptrend channel

2470 – target low

2350 – potential low

Bullish scenario:

2707 – near-term resistance

2780 – target high

2873 – key resistance

Note that should we see a surprise breakout through 2780, it would need to be acknowledged as an early resumption of the uptrend, and would suggest a break above the January 26th high of 2873 is likely, with an upside target of 2900-2920.

If we are correct and we see the bearish scenario play out over the next few weeks, and we hit our target low of 2470, then in early May we will likely be sending out some new BUY signals to subscribers. If you are not currently a subscriber but want to receive all of our weekly reports, including all of our buy & sell recommendations, you can subscribe now and get The Trend Letter for only $369.95, a $230 discount off the regular price. Click Here to subscribe.

Stay tuned!