October 15/18

We follow the trends and capital flows. Remember, this is a global market, it is all connected.

Stocks

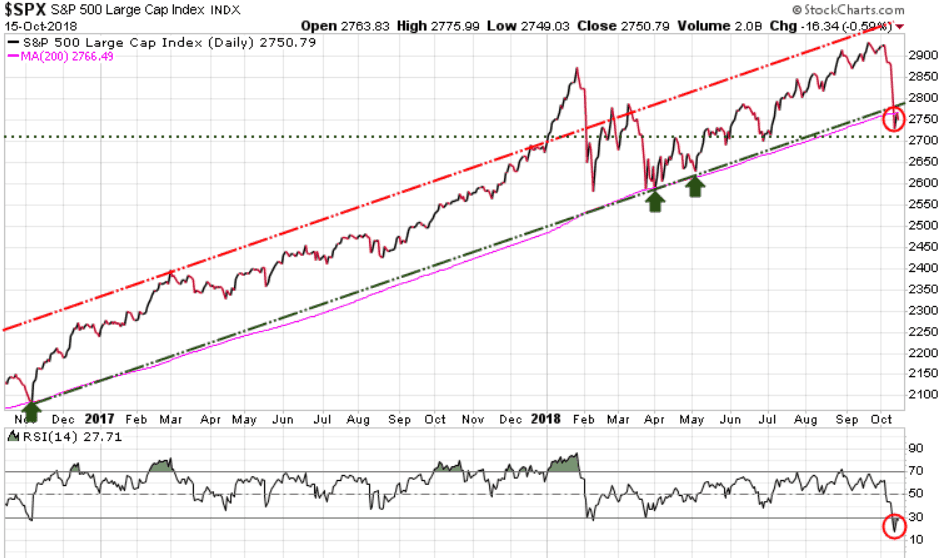

The S&P 500 had just surpassed Friday’s high with about an hour to go in today’s trading, then gave it all up and closed down 16.34 points or .59% on the day.

Looking at the lower chart we see that the Relative Strength Index (RSI) at 27.71 is still below 30, indicating that the S&P 500 is still oversold here. Continue to watch the 200-day MA (link line), as it has in the past acted as a very solid support level for the S&P 500. If the S&P cannot climb back and close solidly above this support, it means we are not out of the woods and that more moves to the downside are certainly possible.

Long-term trend remains bullish

Immediate trend is bearish

Our current position is NEUTRAL

Gold

Gold had another up day, closing today up 8.30 or .68%. Gold has broken out of its near-term downtrend channel and now needs to close above 1246, then push through and close above 1260, 1307, and 1377 to have a chance of having a solid bull run.

Long-term trend is bearish

Immediate trend is bullish

Our current position is a BUY

Stay tuned!