October 23/18

Stocks:

Another wild day in the markets with the S&P 500 trading in a range between the high at 2753.59 to a low of 2691.43, before rallying back some to close at 2740.69, down 15.19 or .55% for the day.

The latest news driving the market down was..

- a Chinese official told a group of U.S. business leaders that China is not afraid of a trade war.

- the EU has rejected Italy’s budget, demanding changes to both deficit spending and growth estimates. This is the first time the EU has rejected a countries budget. Rhetoric from both sides suggest that Italy’s relationship with the EU is not getting better.

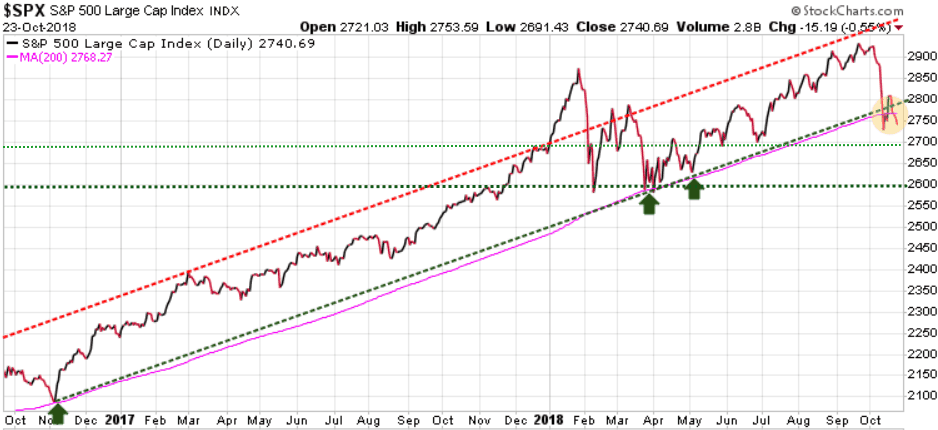

The immediate concern here is that the S&P closed 27.58 points below its 200-day MA (pink line), so we need to keep an eye on this as in each recent test (green arrows) the 200-day MA support level has held.

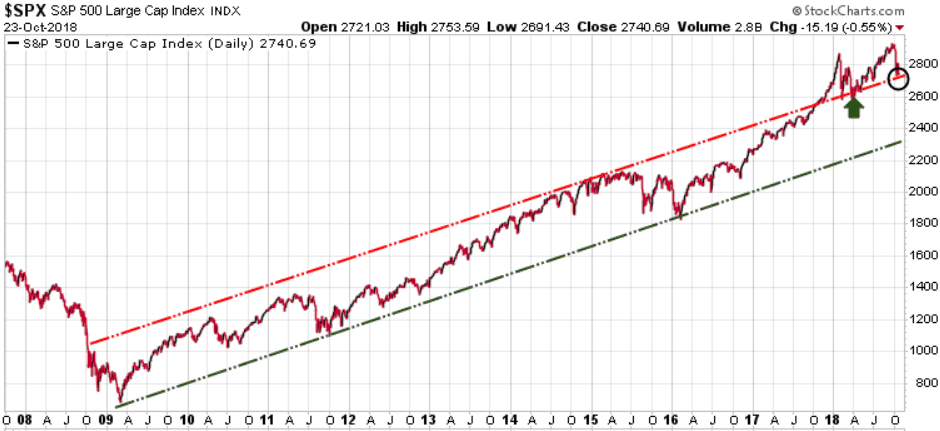

Looking at the bigger picture we see that the S&P is still trading above its 9+ year uptrend channel, although it did dip below the upper level during the day today. In the near-term we need to see the S&P continue to close above the upper level of that channel at 2715. Keep an eye on this level.

Long-term trend is bullish

Immediate trend is neutral

Our current position is neutral

Note: Whether you believe that this market is going to run much higher, or believe that we are now heading for a big crash, you need to have an exit or hedging strategy. This bull market will end, whether it starts today, next month, next year, or 2-years from now. Every investor needs to have a strategy to protect your wealth against a serious downside move that is accompanied by recessions.

While we are currently neutral with offsetting long and short positions, our Trend Technical Trader (TTT) hedging service has a number of more aggressive short trades and those trades have gains of 10.9% (entered Sept.5/18), 37% (entered Sept 12/18), 33.8% (entered Oct 4/18), and 30.4% (entered Oct 4/18). All of these trades are simple click of the mouse actions, the same as trading any stock online. If you would like to subscribe to TTT, we are extending our Special Offer at $399.95, a $250 discount. Click Here to subscribe at this rate.

Gold:

Gold popped up to 1245 at the intra-day high today as the equities were hit, but then cooled off and closed the session at 1236.80, up 12.20 for the day.

Immediate trend is bullish

Long-term trend is bearish

Our current position is a buy

Stay tuned!