November 1/18

Stocks:

The S&P 500 rallied over 1% for the 3rd straight day for the first time in six weeks after Trump tweeted that he and Xi of China had a good conversation on trade.

However, in after market trading Apple shares were down up to 7% after it warned that it could miss its December revenue target due to weakness in the emerging markets.

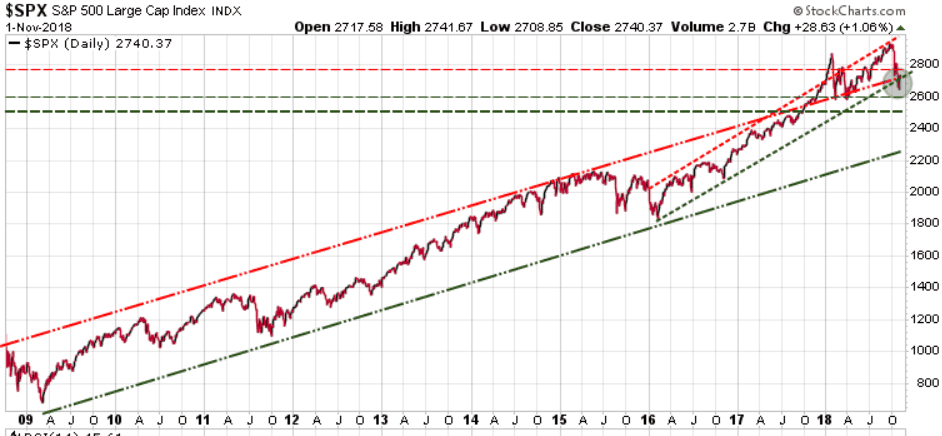

The S&P is now back above its 9+ year uptrend channel (green shaded area). What we are looking for is that 2600 support level to hold. We have resistance at 2770 and if the S&P cannot get up through that resistance level we could see a sharp decline testing 2600. If 2600 is tested and does not hold, then we have 2580, 2535 and 2500. Our previous long-term projection was after 2930 we would see a sharp correction with a potential low of 2470 – that projection is still valid.

There are lots of reasons for the market to drop dramatically and do not underestimate the impact of a Democratic win in the upcoming elections. As investors we do not participate in political discussions other than to say if the markets felt that Trump’s tax and regulation policies were to be rolled back we would see a violent reaction.

Key support levels to watch tomorrow and next week are 2700, 2600, 2580, 2535. Expect a wild ride over the next month.

Long-term trend is bullish

Immediate trend is neutral

Our current position is neutral

Once again we implore every investor to have a hedging or exit strategy. As an investor you need to be prepared for a serious market correction, or potential crash. If the recent market action has caused you to lose sleep at night then you are not properly protected. Now is the time to protect your investments.

If you have not done so already, for each of your positions determine how low you are willing to let them go before selling. Then use SELL Stops and if they are hit, SELL, do not change your mind and talk yourself out of selling. Or if you do not want to sell for tax or other reasons, use a hedging service like Trend Technical Trader. TTT subscribers who have followed its lead have booked gains of over 40% in a number of trades in just the last 5 or so weeks. If you want to subscribe, we will extend our earlier offer of a $250 discount, meaning you only pay $399.95.

If you had been a TTT subscriber and actioned those trades, they could have covered a decades’ worth of subscriptions. Click here to take advantage of this offer. It’s your money – take control!

Gold:

Gold had a solid day gaining 23.60 and closing just above its previous high. If it can continue higher, 1260 is its next resistance level.

Long-term trend is bearish

Immediate trend is bullish

Our current position is bullish

Stay tuned!