S&P 500 and Gold

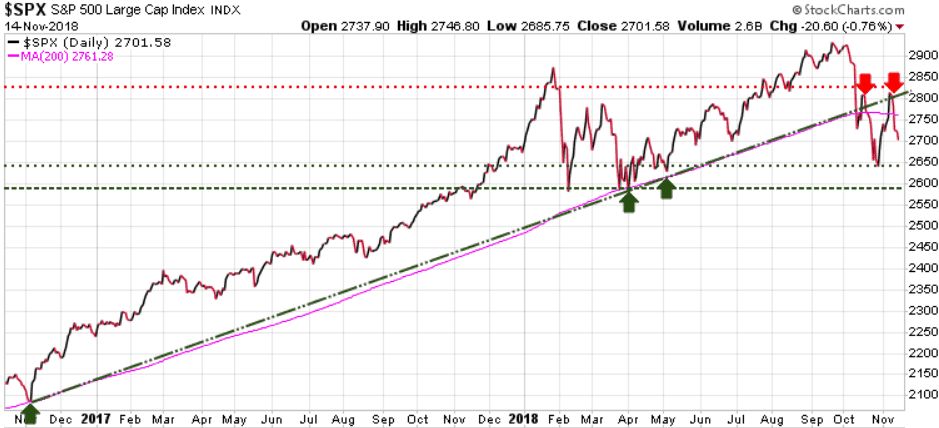

S&P 500:

Another wild day in the equity markets with the S&P hitting a high of 2746.80, then hitting a low of 2685.75, before closing at 2701.58. As we warned in Sunday’s issue of the Trend Letter, instead of a year-end rally we could see a cycle inversion if the S&P cannot push through the 2830 resistance level. In Sunday’s Trend Letter we showed a chart of a bearish scenario with a test of 2600 in December, and a potential low of 2475 before year-end.

The S&P has fallen below both its uptrend line (green diagonal) and its 200-day MA (pink line),

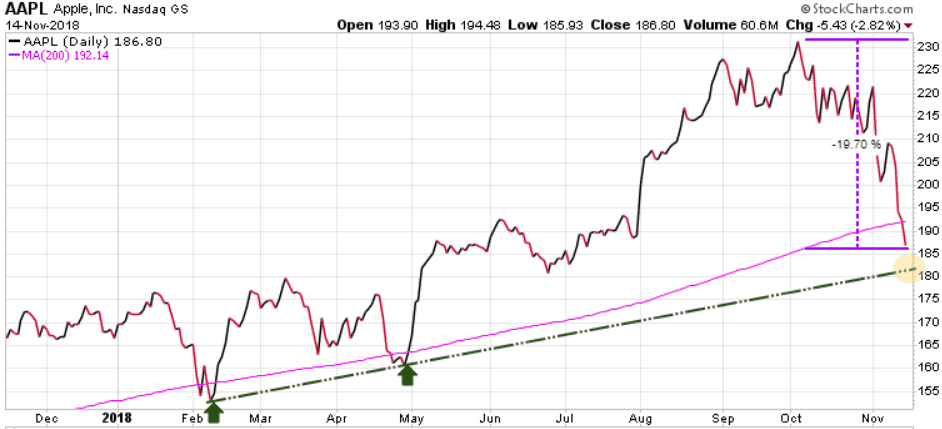

One of the negative drivers was that Apple has now dropped below its 200-day MA and is down almost 20% since its high in October. Tech stocks which have been the darlings of the bull market are being sold-off and are leading the way down. Apple has Key Support at 182, its uptrend line (yellow shaded area).

S&P 500 trends:

Long-term trend is bullish

Immediate trend is bearish

Our current position is neutral

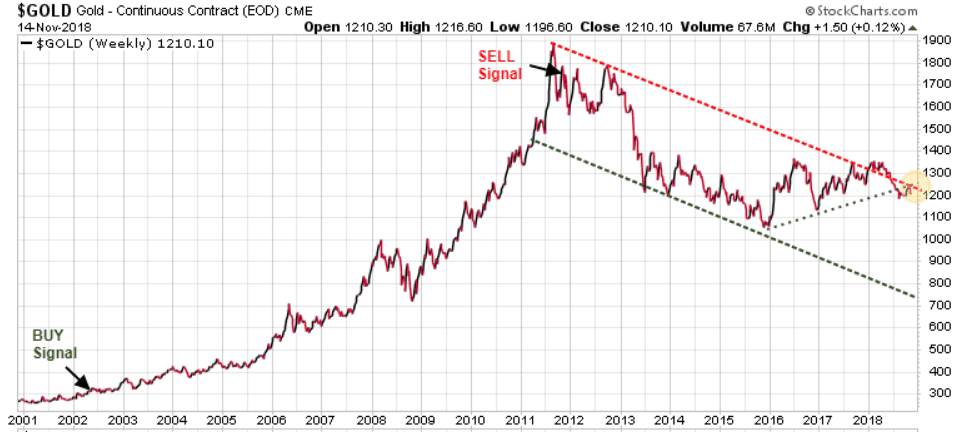

Gold:

Gold was finally able to have an up-day closing up 8.70 after declining all through November.

In our very first issue of the Trend Letter in 2002 we recommended buying gold when it was trading at 290. We rode that bull market all the way up to August 2011 when it hit our SELL Stop at just under 1800, a 500% gain. Since then gold has been in a 7+year downtrend channel.

So what happened? After the peak in 2011, after years of decline, investors got tired of waiting for gold to rebound, to the point where today gold is hated by the investment community. Over the past month based on the Commitment of Trader (COT) data, gold is oversold to an extreme. It means that future traders are massively pessimistic on gold and even more so on silver. As contrarians will love these scenarios because at the extremes futures traders often get it wrong. When these speculative traders all bet in one direction, the opposite usually occurs. This opens a scenario where we could see a very good run for gold, silver, and other precious metals.

But understand, while we are looking for gold to have a good run up here, we do not see this as the ultimate low for gold. So if adding gold or gold stocks at these levels be sure to determine your SELL Stops to protect yourself in case this expected rally does not materialize, or does not last long. Gold must push through 1370 before we even consider a long-term rally.

Long-term trend is bearish

Immediate trend is neutral

Our current position is buy

Stay tuned!