Fed cuts rates, yet the US dollar soars – why?

We continue our series of publishing timely questions with our answers so that we can share with all readers. Today’s question is on the US dollar.

Q. I simply do not understand why the US dollar is rising against all other currencies even after the Fed cut rates. Can you explain?

A. The simple answer is the US dollar is the ‘least ugly’ currency. One of the main reasons that we cover bonds, currencies, equities, commodities, and precious metals in the Trend Letter is because they are all connected. To be a successful investor you need to understand that global capital flows out of perceived ‘unsafe’ areas and into perceived ‘safe’ areas. Every week the Trend Letter publishes the yield on 10-year government bonds throughout the globe. We do it to help subscribers understand how bond yields can influence currencies.

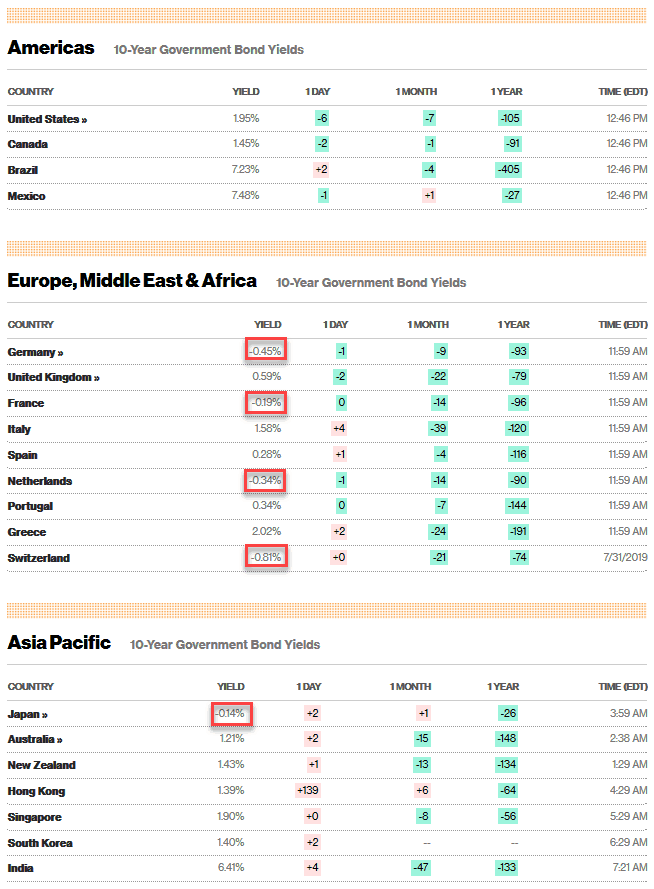

Below is one of the charts we show each week. On the chart we have highlighted in red government bonds that have a negative yield. Think about that for a minute, an investor who buys one of these 10-year bonds is guaranteed to lose money every year, for ten years, until that bond matures.

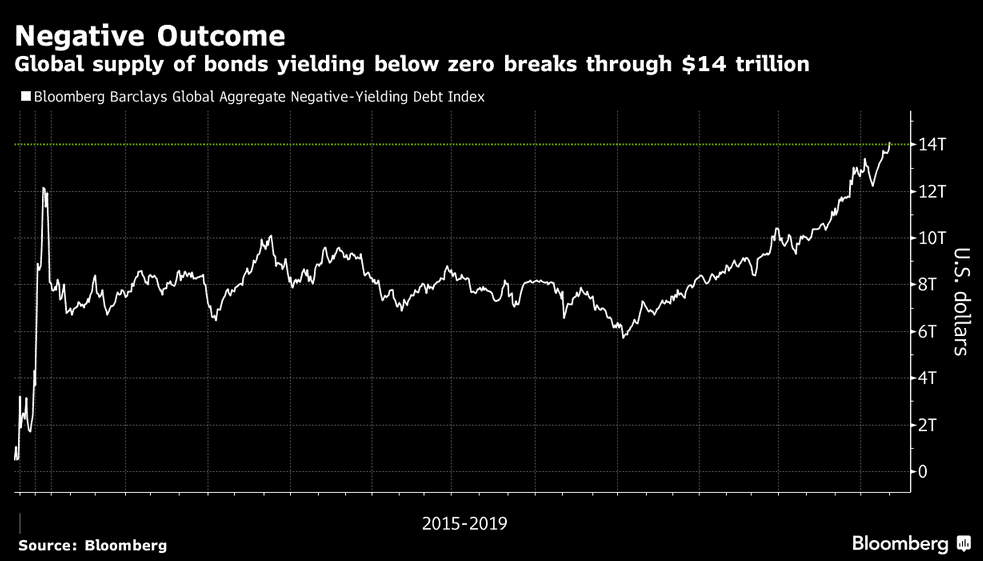

According to Bloomberg there is now over $14 trillion invested in negative yielding bonds.

This is remarkable to us, as why would anyone invest in something for 10 years knowing that they are guaranteed to lose money? If you look back at the first chart we can see that the 10-year bonds in Japan (-.14%), France (-.19%), Netherlands (-.34%), Germany (-.45%), and Switzerland (-.81%) are all yielding negative returns. Then look at the US 10-year, it is paying +1.95%.

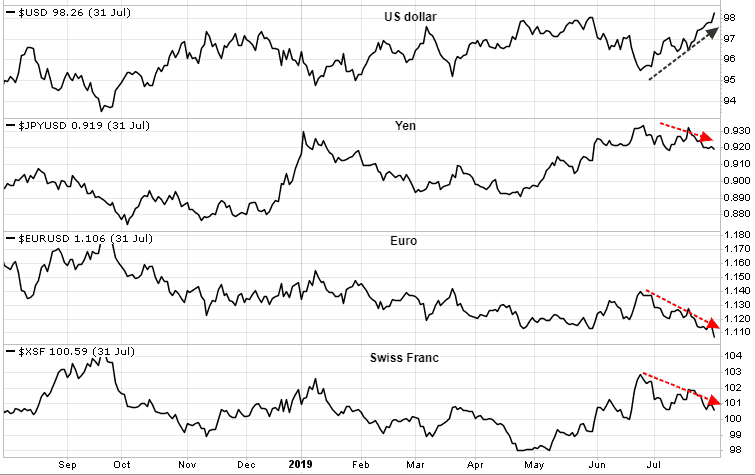

If you were an investor in Switzerland would you rather buy a Swiss government 10-year bond and be guaranteed to lose .81% every year, or buy a US 10-year government bond and gain 1.95% every year? Global investors are taking their capital out of Switzerland, Germany, France, Japan and the Netherlands, and they are buying US bonds. In order to do that they must convert their local currency into US dollars. Below is a chart showing the currencies of these countries, and as we can plainly see the US dollar is the only currency that is in an uptrend.

It is not just bonds that global capital is flowing into. Foreign investors continue to move capital into the US equity markets which are outperforming global markets. Again, this means they must buy US dollars, which drives up the value of the dollar. As the debt crisis that we keep warning about gets nearer we will see this trend intensify. When the European and Japanese bond markets implode, global investors will panic and rush to get their money out of those regions, looking for a ‘safer’ place to park their capital. The US dollar, and to some degree the Canadian dollar, will rise with this increase in demand.

Stay tuned!