Market update – February 24/20

In last week’s update we drew attention to the fact that for most of last week, we saw the equity markets moving to new highs at the same time as bonds, gold, and the $US were rising. This was telling us that the much larger bond and currency markets were very concerned regarding the coronavirus potential for disruptions to the global supply chain, while the smaller equity markets were not concerned, making new all-time highs.

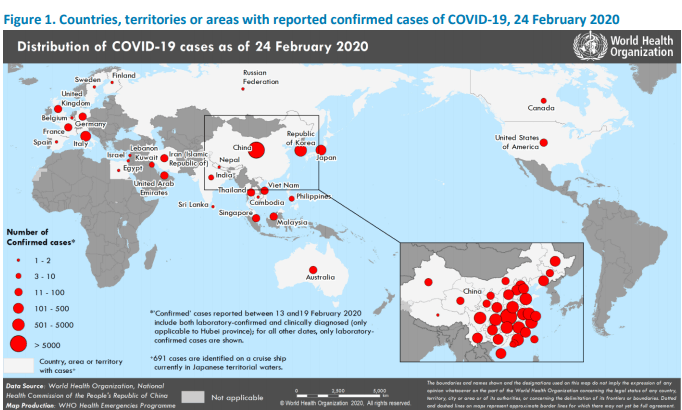

Then on Monday, the equity markets got slammed with a couple of events centered around the coronavirus. First we had some countries outside China experience a significant spike in infections. According the the World Health Organization the virus has reached more than 30 other countries and territories, and is spreading in South Korea, Europe and the Middle East. The W.H.O. site shows the total death toll now at 2618, with 78,238 confirmed cases.

The second shoe to drop came from China’s Premier Xi Jinping, who in a rare televised address admitted that the crisis had reached a “crucial stage” and the economy “cannot stand being on hold for much longer.” Xi said that it is unavoidable that the novel coronavirus epidemic will have a considerable impact on the economy and society.

Here is a look at some key markets.

US S&P 500: The S&P 500 was down 112 points and 3.35%. It is now testing its key near-term support.

Canada TSX: The Canadian market chart was also hit but gold prices allowed it to absorb the blow a little better. Still, it was down 1.57% for the day

Shanghai Market: A most interesting development with this cognitive dissonance over deadly-virus supply-chain disruptions is that China is actually outperforming US, Canada, and Europe since the crisis really began

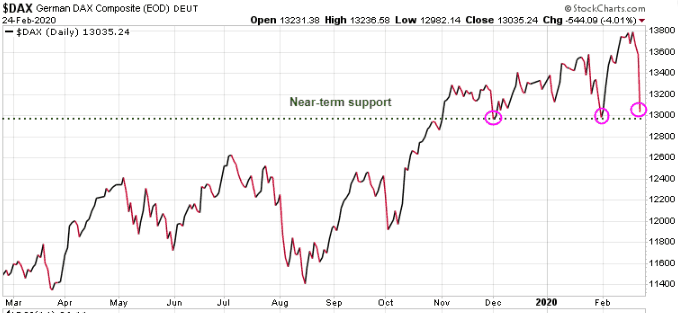

German DAX: The German market took a massive 4.01% hit and is coming close to testing key near-term support.

US Bonds: As we noted earlier the bond market has been warning of trouble ahead. Investors who do not follow the bond market are really missing a key indicator of where global capital is headed. Every week the Trend Letter highlights what is happening in all markets, including the global bond market. In fact, we recommended a bond ETF on January 3rd and that trade is up 19% today

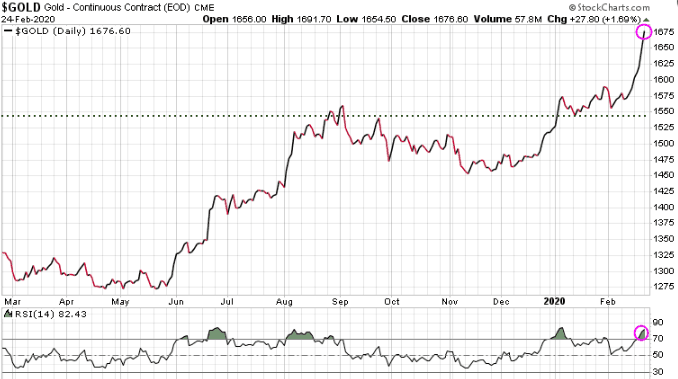

Gold: Last week we highlighted how gold had risen along with bonds, $US and equities, which is unusual. With today’s major sell-off in equities, gold had a solid day, up 27.80 or 1.69%. Note that gold is overbought here so a pull back would be expected.

Note: This sell-off in equities and rallies in bonds, and gold are getting stretched, so we could see a rebound for equities tomorrow, and decline in gold, depending on the news of the day.

If you have a lot of exposure in the equities but do not want to sell the stocks currently, or if you simply want to profit from a potential serious stock market decline, then seriously consider subscribing to our Trend Technical Trader (TTT) service.

Trend Technical Trader (TTT) service. TTT is primarily a hedging service designed to profit during market declines. If interested, you can subscribe for only $399.95, a $250 discount off the regular price.

Click here to subscribe at this special rate.

Stay tuned!