Market update – a good hedging strategy makes all the difference

For most investors last week was a disaster! Global stock markets got absolutely hammered last week, with the S&P 500 down almost 13% since its recent record high.

But subscribers to the Trend Letter & Trend Technical Trader greatly reduced any losses and in fact could have made significant gains by simply following the recommended defensive strategies.

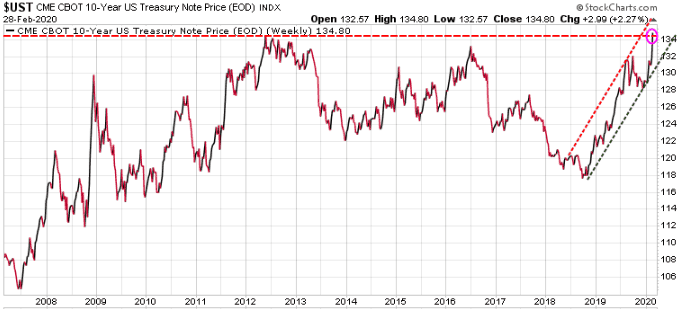

Most investors ignore the bond and currency markets, which is a huge mistake. The bond and currency markets dwarf the global stock markets and for those who know what to look for, these markets tell us where the global capital is flowing. Clearly last week, global capital sold off global equity markets and flooded into the bond market, especially the US bond market. Here is a chart of the US 10-year bond.

On January 3/20, the Trend Letter recommended that as insurance for what it forecast as a potential major correction, subscribers buy a leveraged Exchange Traded Fund (ETF) that would profit 2% for every 1% rise in bond prices. The logic for this investment was that while some capital might go to gold and some other safe-haven trades, the US bonds would be the first place large institutional investors would go, and that is exactly what happened. On the close Friday, that trade is up over 27% in 2 months.

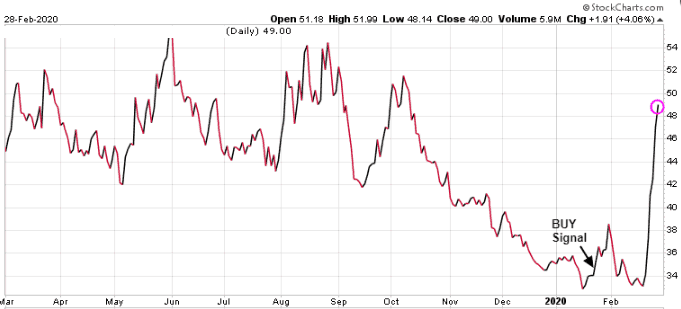

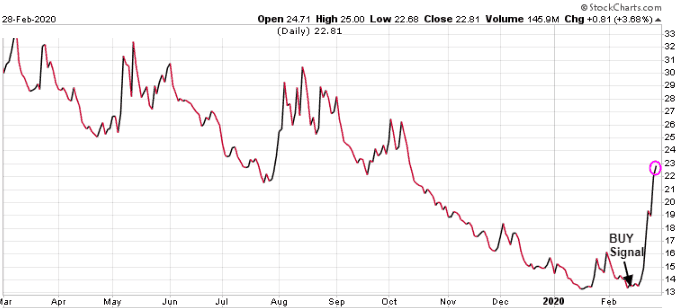

While the Trend Letter’s bond trade was an excellent strategy for subscribers, Trend Technical Trader (TTT) did even better. TTT is a hedging service designed to make money in down markets. The deeper the correction or bear market, the bigger the returns TTT is likely to make. Here is a sample of what TTT subscribers would have made

On January 23/20, TTT recommended subscribers buy a leveraged Short Small Cap ETF. Understand these ETFs are as simple to trade as any stock, as simple as a click of the mouse. You do not need to actually short anything, you simply use this ETF. In a little over 1 month, that trade is up 40.97%.

On the next day TTT triggered another trade, this one trading the volatility in the markets, again using an ETF. That trade is up 65.89% in just over 1 month.

On then, just 8 days ago, on February 20/20, TTT triggered another trade, this one a leveraged play to short the Dow Jones Industrial Average. Again, this was an ETF, simple for any investor to enter. In just 8 days that trade is up 45.12%.

Gold and gold stocks on the other hand, had a severe sell-off, as investors took profits and in many cases had margin calls forcing them to dump their winners to cover their losses in equities.

The equity crash is now oversold, so depending on the conoravirus news this weekend, we could see the markets bounce next week, especially if the Fed promises a big rate cut. But typically, even if this is not the start of a deep bear market, we are likely to re-test these lows, if not set new ones before the correction is over. That means having a good hedging strategy is paramount to preserving your capital.

We are opening our recent offer that we gave attendees of the World Outlook Conference earlier this month. Click the button below for those special offers.