Market update – 06/11/2020

In yesterday’s update we discussed how the US Federal Reserve pledged to maintain at least the current pace of asset purchases and projected interest rates will remain near zero through 2022. We also showed how most indexes were overbought based on the RSI. Overnight the market had a chance to digest that commitment from the Fed and decided that if the Fed is not even considering raising rates for another two years, then they must be seeing plenty of trouble in the next year or two.

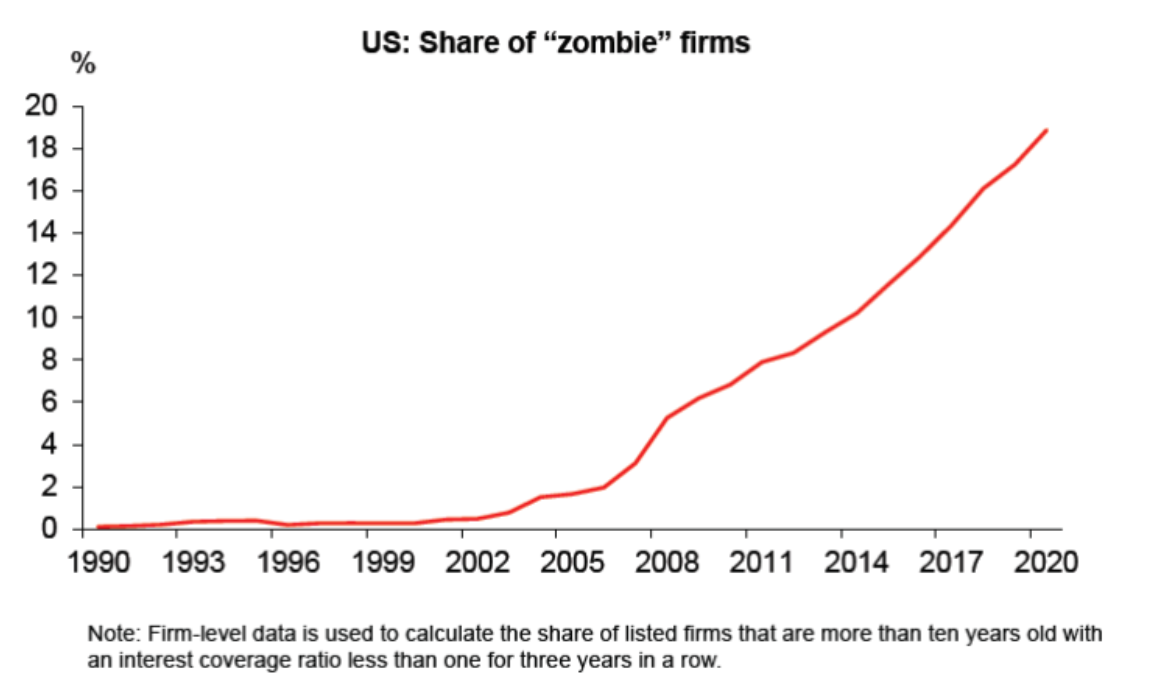

One of the things we have been warning subscribers about is the incredible debt crisis that is looming, not just in governments, but also companies. Low interest rates have created zombie companies. One side effect of central banks keeping rates low for a long time is that it interferes with the normal process of poorly run companies failing and disappearing, it is a natural attrition. With central banks like the Fed actually buying up debt of these companies it is keeping many unproductive companies alive, which ultimately lowers long-run growth rate of the economy.

This chart shows the percent of US firms that have debt servicing costs that are HIGHER than their profits.

The markets sold off today in a dramatic fashion.

The small cap stocks were the big losers today again as identified by the Russell 2000 Index. It dropped a whopping 7.63%, the worst day since March 16.

The Dow Industrials continued to lead the way down for the big three US indexes, down 6.90%. The Dow has now fallen out of its uptrend channel, and by closing below 26,000 warns that the Dow may be leading the markets back into a correction, so caution is required here.

The S&P 500 also falls out of uptrend channel, as it was down 5.89%

The Nasdaq which has been the market leader, also hit, down 5.27%

The Canadian market was down, but at 4.14%, less than the US markets

Yesterday we noted the $US was oversold, at least in the short-term, and it got a bounce today as the safe-haven currency.

Gold caught a bit, as low interest rates makes gold more attractive.

If you do not have a plan to protect yourself in the case of another destructive market decline, then you should seriously consider subscribing to Trend Technical Trader which has a series of defensive plays for you to implement. These plays can not just protect you from losses in a deep decline, but they can help your make significant gains. To subscribe at a very special rate of $399.95, a savings of $250 CLICK HERE

Stay tuned!