Market Update

US Fed sees 0% rates through 2022

The US Federal Reserve pledged to maintain at least the current pace of asset purchases and projected interest rates will remain near zero through 2022, as Chairman Jerome Powell committed the central bank to using all its tools to help the economy recover from the coronavirus.

“We’re not even thinking about thinking about raising rates,” he told a video press conference Wednesday. “We are strongly committed to using our tools to do whatever we can for as long as it takes.”

Interesting to compare the S&P 500 recovery now versus that during the Great Depression. It is all about the Fed.

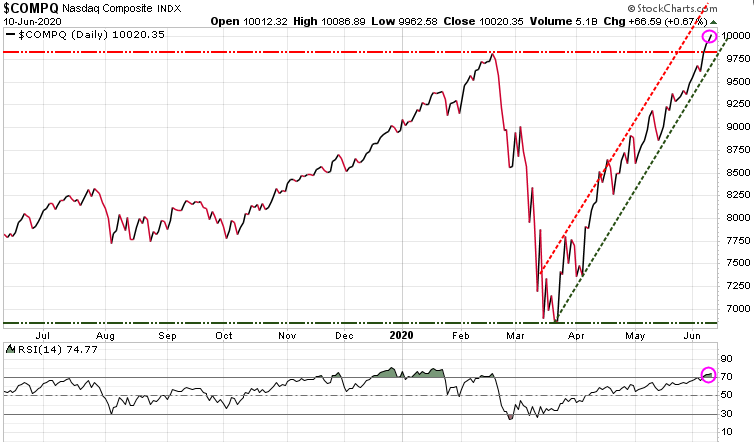

The NASDAQ Index is the clear winner here as tech stocks continue to lead the way. The NASDAQ closed today above 10,000 for the first time ever. The question now is, does the NASDAQ continue to lead equities higher? Note at the bottom chart, Relative Strength Index (RSI) is now technically in overbought territory.

The Dow Industrials did not follow the NASDAQ’s lead today and as we highlighted to subscribers on Sunday, the Dow is lagging, posing the question: is the NASDAQ going to lead equities higher, or will the Dow lead the markets lower and potentially re-test the March lows? By closing below 27,000, we must now watch to see if the Key Support at 25,230 holds.

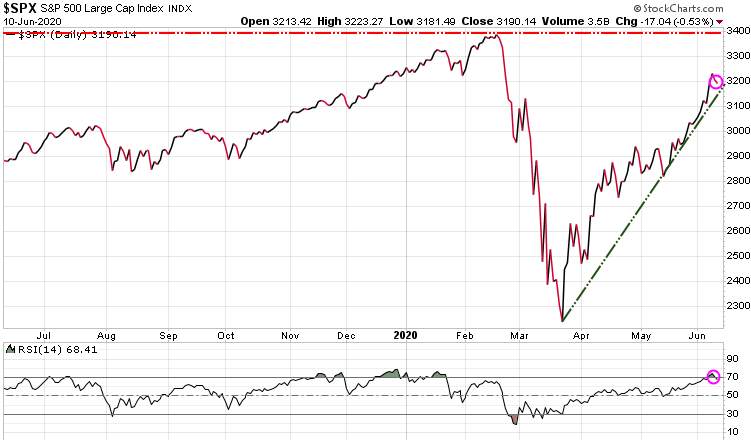

The S&P 500 also struggled today, giving up 17 points.

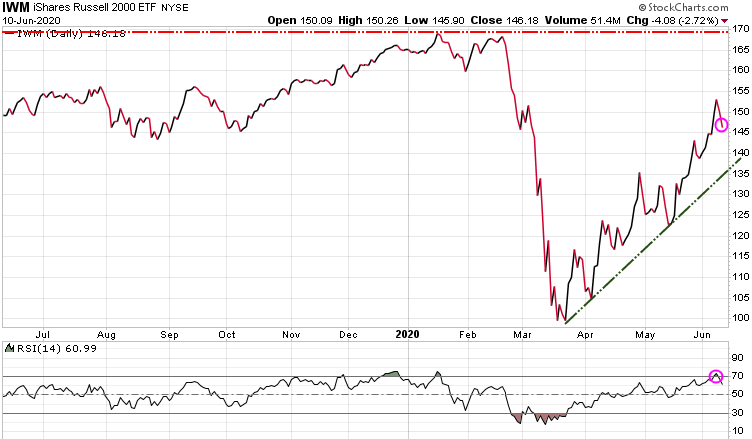

The Small Caps represented by the Russell 2000 Index was the big loser for US equities today, down 2.72%.

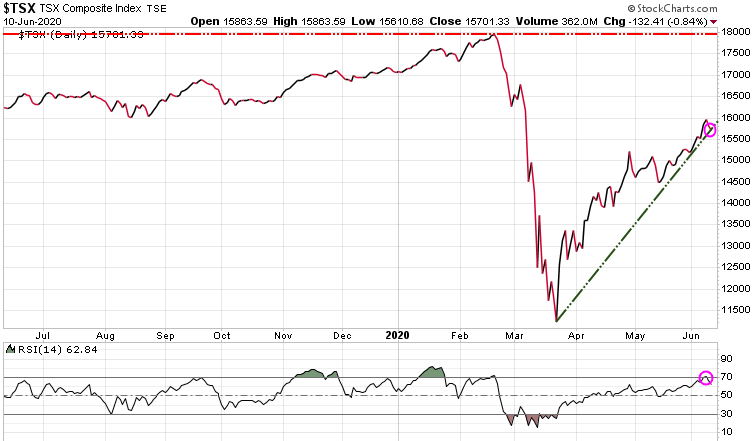

The Canadian market was also down today.

With the Fed vowing to keep rates low, the yield on the 10-year bond dropped 10 points to .75%

With the Fed promising low rates, the US dollar continued lower. Canadian and European investors might want to look to convert some local currency to $US during this weakness.

Gold has been trading in a tight range lately.

Stay tuned!