Market Update – July 8/20

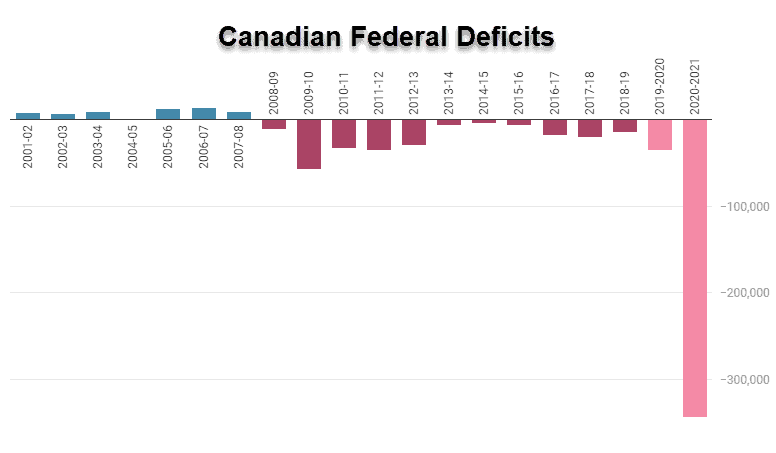

The Canadian government just released its updated deficit projections and they were mind boggling. The government now projects the federal deficit for this fiscal year to be $345 billion. That is approximately 18 times larger than the 2019 deficit. PM Justin Trudeau then made this statement.

“As a Federal Gov’t we decided to take on that debt, so Canadians wouldn’t have to”

Really? Is it possible that the PM of the country doesn’t understand that when the country takes on debt, it is the Canadian citizens who will have to pay off that debt? There are a little over 37 million people in Canada. A $345 deficit is the equivalent to every man, woman and child taking on $9,300 of debt.

Stocks:

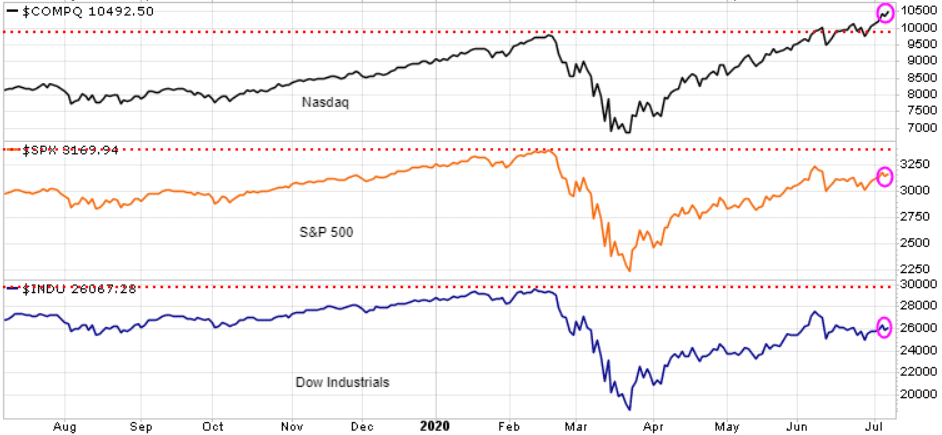

The Nasdaq continued to lead markets higher, setting another new all-time high today. As investors we need to watch this as the Nasdaq leads markets higher while the Dow is lagging suggesting it will lead the next downturn.

Gold & Silver:

Gold was another big story today as it continues to run higher. We are seeing gold and equities moving together, which is a scenario we forecast when we see the coming liquidity crash where confidence in government comes into question. We do believe that this current move in gold is a bit early, but we never argue with the markets. Note at the bottom of chart how based on the Relative Strength Index (RSI) gold is getting close to being overbought, so at least a temp high could be in place soon.

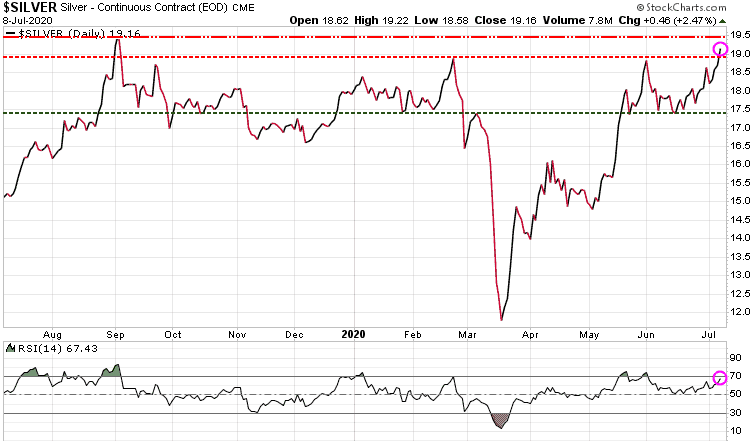

Silver has been lagging behind gold and just now broke through the February high, while gold broke through that level back in April. Note that silver is also getting close to being overbought based on RSI.

While gold is within 6% of its all-time high, silver would need to rise over 130% to reach its 2011 high.

Both the Trend Letter (TL) and Trend Technical Trader (TTT) have plays on to gain from this current rally in precious metals with TTT experiencing some significant gains such as 85%, and 100% to highlight a couple recently.

If you are not a subscriber but would like to be, we are opening up a previous special price window valid till Friday. CLICK HERE for special offers.

Stay tuned!