Market update – September 21/20

The markets opened down on fears of COVID-19 spreading again, the gridlock in Washington, and of course fears that the results of the US election won’t be known for weeks, or even months after the election. In addition, word was out that a number of major financial institutions, including JPMorgan Chase, HSBC, and Deutsche Bank, were allegedly involved in a multi-trillion dollar money laundering scheme between 1999-2017. Over 2,100 counts of “suspicious activity” were reported to the Department of Treasury’s Financial Crimes Enforcement Network and a further investigation will be underway.

As the day progressed stocks pared losses as a rebound in some tech giants tempered concern over cloudy prospects for economic stimulus and a report about suspicious transactions at global banks. Bonds and the US dollar rose, while gold fell with the equities on a strong US dollar.

S&P 500 – down 38.41 or 1.16%

The S&P broke through its 50-DMA (red line) on Friday and continued its decline today. In yesterday’s issue of the Trend Letter we highlighted how a break below 3285 ‘would warn of a potential deeper correction‘. We need to watch 3260, then 3205 as key support levels. If the 3205 support does not hold, a serious correction could be in the cards. Ultimately, the 200-DMA (blue line) has been a solid support level for the S&P 500 (green arrows. So will need to keep our eye on that level (3104).

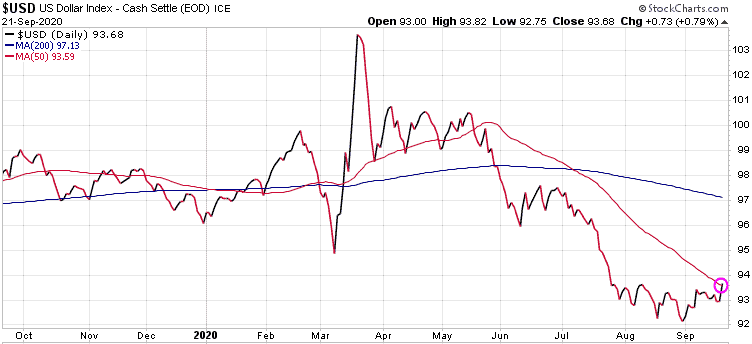

US Dollar – up .73 or .79%

Despite all the doom and gloom projections for the $US, when investors get nervous and want some safety for their capital, the $US is still the ‘safe-haven’ currency.

Canadian Dollar – dropped .006 or .75%

With $US strength most currencies retreated, including the $CAD. The $CAD has dropped below its 50-DMA (red line)

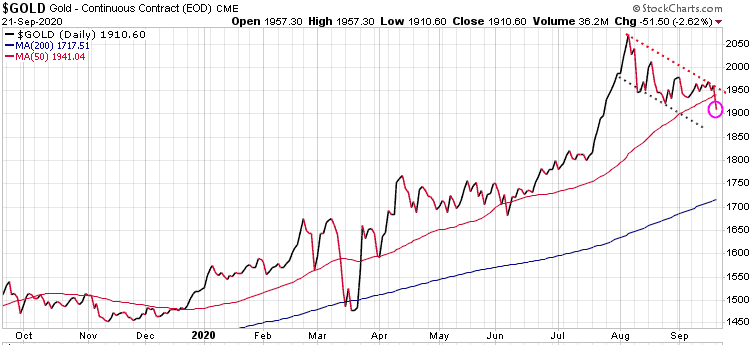

Gold – down 51.50 or 2.62%

With the equity market sell-off, capital flowed into the $US and US bonds. With the $US strength, gold and silver were knocked lower. Gold has now dropped below its 50-DMA (red line), and a break of the August intra-day low of 1865 would open the door for a test of 1800.

Subscribers to the Trend Letter & Trend Technical Trader have been given recent ‘insurance ‘ plays to protect their portfolios in case we do see a steeper correction here. Both of our models are warning of a market decline into October.

Trend Letter:

Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the markets are going, and it has explained in clear, concise language the reasons why. Using unique and comprehensive tools, Trend Letter gives investors a true edge in understanding current market conditions, and shows investors how to generate and retain wealth in today’s climate of extreme market volatility.

A weekly publication covering global bonds, currencies, equities, commodities, & precious metals.

Timer Digest says: “Trend Letter has been a Timer Digest top performer in our Bond and Gold categories, along with competitive performance for the intermediate-term Stock category.”

Technical Trader:

Originally developed to be a premier hedging service designed to profit in declining markets, Trend Technical Trader (TTT) was evolved into an excellent all round trading service that prospers in both up and down markets. After delivering excellent gains during the March melt-down, TTT steered subscribers into gold trades and a number of long equity positions for phenomenal gains in very short holding periods.

TTT is an online service, updated every Monday, Wednesday and Friday, after the market close.

Trend Disruptors:

Disruptive technology trends will propel our future and the reality is that no industry will go untouched by this digital transformation. At the root of this transformation is the blurring of boundaries between the physical and virtual worlds. As digital business integrates these worlds through emerging and strategic technologies, entirely new business models are created.

Trend Disruptors is a service for investors seeking to invest in advanced, often unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Quantum Computing & many more.

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | 299.95 | $300 | Trend Letter $299.95 |

| Technical Trader | $649.95 | $324.95 | $325 | Trend Technical Trader $324.95 |

| Trend Disruptors | $599.95 | $299.95 | $300 | Trend Disruptors $299.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $524.95 | $724.95 | Trend Letter + Technical Trader $524.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $503.95 | $695.95 | Trend Letter + Technical Trader $503.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $524.955 | $724.95 | Trend Disruptors + Technical Trader $524.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $610.45 | $1,239.40 | Trend Suite TL =TTT + TD $610.45 |