Gold update

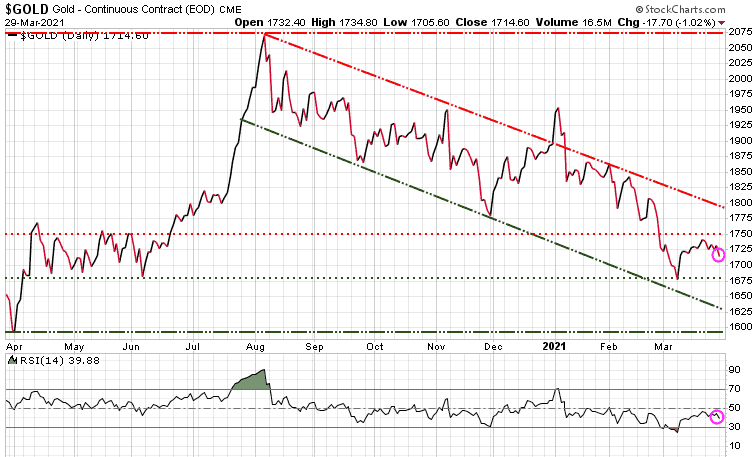

Gold gave up another 17.60 on Monday, as it struggles to gain any traction here. Gold has been in a downtrend channel since August and we need to see it break out of the tight trading range it has been in this month. Based on the Relative Strength Index (RSI) gold is not oversold at this point (RSI is highlighted at the bottom of the chart).

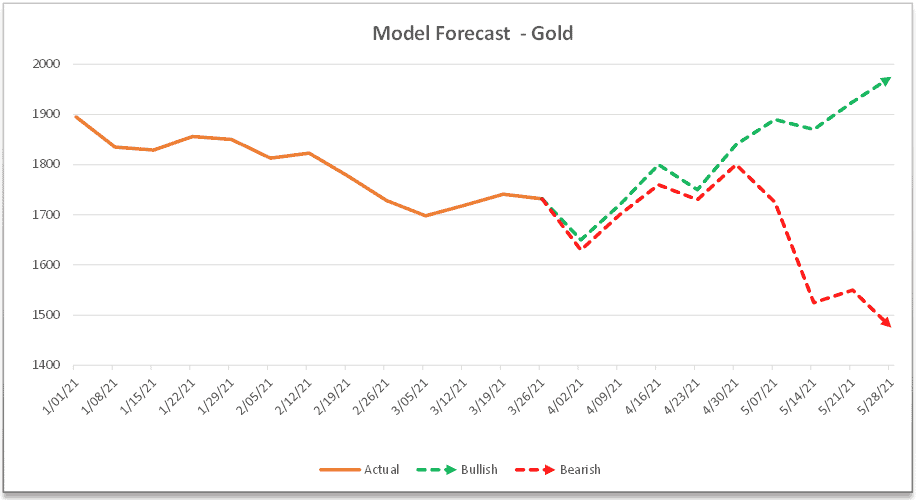

Subscribers to the Trend Letter are presented with our various Forecast Models, which are dynamic and are updated at the end of each week. Our Forecast Models calculate both bull and bear scenarios. Below is the updated Model Forecast for gold which was sent to subscribers Sunday.

• In both scenarios there is an immediate decline to the 1640 range, then a rally to 1800 by the end of April.

• The bullish scenario sees a decline to 1640, then a rally up to 1940 by June

• The bearish scenario would see a decline to 1640, then a rally to 1800, which would be the high, and then see a prolonged decline into early 2022

If you are not a subscriber to the Trend Letter, we are offering some great discounts to all of our services. Check the offers below:

Trend Letter:

Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the markets are going, and it has explained in clear, concise language the reasons why. Using unique and comprehensive tools, Trend Letter gives investors a true edge in understanding current market conditions and shows investors how to generate and retain wealth in today’s climate of extreme market volatility.

A weekly publication covering global bonds, currencies, equities, commodities, & precious metals. Over the 20 years Trend Letter has been published, it has achieved an incredible average return of 65% on its closed trades.

Timer Digest says: “Trend Letter has been a Timer Digest top performer in our Bond and Gold categories, along with competitive performance for the intermediate-term Stock category.”

Technical Trader:

Trend Technical Trader (TTT) is a premier trading service, designed to profit in both up and down markets. Included is our proprietary Gold Technical Indicator (GTI).

TTT had another excellent year in 2020 averaging +27.3% per closed trade with an average holding time of 9.5 weeks, or +149% annualized overall.

Over the past 5 years TTT’s closed trades have averaged +40% annualized.

Trend Disruptors:

Disruptive technology trends will propel our future and the reality is that no industry will go untouched by this digital transformation. At the root of this transformation is the blurring of boundaries between the physical and virtual worlds. As digital business integrates these worlds through emerging and strategic technologies, entirely new business models are created.

Trend Disruptors is a service for investors seeking to invest in advanced, often unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Quantum Computing & many more.

Trend Disruptors has realized average annualized gains of 178% over its 3 years years of service.

Money Talks - Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | $399.95 | $200 | |

| Technical Trader | $649.95 | $399.95 | $250 | |

| Trend Disruptors | $599.95 | $399.95 | $200 | |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1249.90 | $699.95 | $549.95 | |

| Trend Letter + Trend Disruptors | $1199.90 | $699.95 | $499.95 | |

| Technical Trader + Trend Disruptors | $1249.90 | $699.95 | $549.95 | |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1849.85 | $799.95 | $949.90 |