Market update July 19/21

Rising concerns about inflation and the resurgence of COVID-19 infections hammered Wall Street on Monday, with major benchmarks suffering their worst declines since May, even as quarterly earnings continue to reflect a strengthening economic rebound.

Fears about broadly rising coronavirus cases drove the Nasdaq and S&P 500 to their biggest drop in nearly two months, and sent benchmark yields to their largest decline in over 3 months as investors sought shelter from the uncertainty. The Dow’s 725 point drop (-2.09%) was its worst since October 2020.

Adding to the market woes was the story in Reuters that Johnson & Johnson may be filing for bankruptcy due to the ongoing crisis of their baby powder containing asbestos.

The S&P 500 dropped 68.67 points or 1.59%. We want to see if the 50-DMA holds (red wavy line ) at 4240. After that, the next support level is 4163 (green horizontal line).

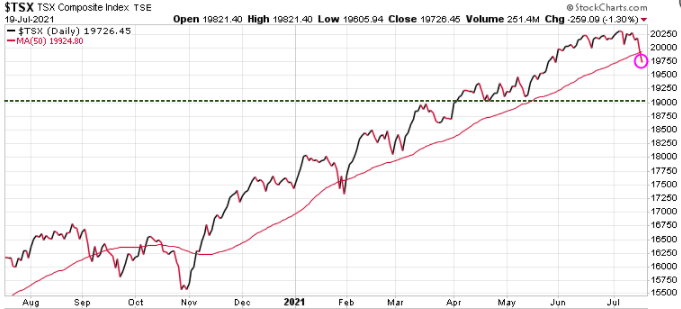

The Toronto stock exchange was down 259.09 points or 1.30%. Note that the Canadian index has now fallen through its 50-DMA. Next support level is 19,200.

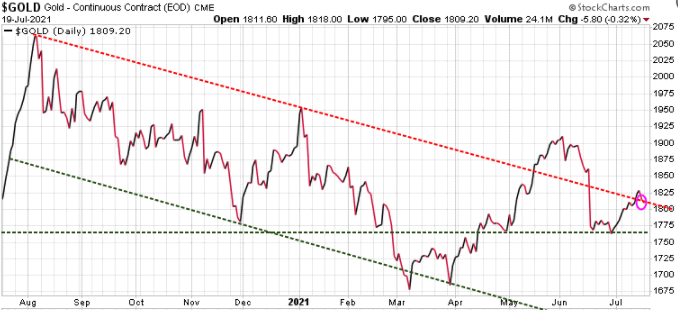

Gold was down 5.80 today and has dropped back into its downtrend channel. Next support level is 1760.

Bonds continued to rise, meaning yields decline. Here is the updated chart that we have been showing our paid subscribers. Most investors pay no attention to bonds and that is a mistake. We can see that yields are in a downtrend channel, with a series of lower highs and lower lows (red arrows).

With currencies, the $US and Japanese Yen tend to act as ‘safe haven’ currencies, and that is what we have been seeing as equity markets sell-off.

The $US has been on a nice run since the end of May and weakness in the equities usually means capital flows into the $US.

The Yen had been on a long downtrend since the start of the year, but has broken out in the last couple of weeks.

The Canadian dollar was the strongest major currency in the world for most of the last year. As we saw it starting to peak in May, we repeatedly recommended that Canadian subscribers convert some $CAD to $USD. Hopefully, they did.

Note: both our Trend Technical Trader and Trend Letter services have been warning of a coming correction in the equity markets, and have provided subscribers with hedging strategies that will protect them in a downtrend. Protecting your assets in a violent downtrend allows prudent investors to be in a solid cash position that will give them the buying power to acquire targeted stocks at greatly reduced prices. .

If you are not a subscriber but would like to be, see below for some great Special Offers on all our services.

Trend Letter:

Since start-up in 2002 Trend Letter has provided investors with a great track record, giving exceptionally accurate information about where the markets are going, and it has explained in clear, concise language the reasons why. Using unique and comprehensive tools, Trend Letter gives investors a true edge in understanding current market conditions and shows investors how to generate and retain wealth in today’s climate of extreme market volatility.

A weekly publication covering global bonds, currencies, equities, commodities, & precious metals. Over the 20 years Trend Letter has been published, it has achieved an incredible average return of 65% on its closed trades.

Timer Digest says: “Trend Letter has been a Timer Digest top performer in our Bond and Gold categories, along with competitive performance for the intermediate-term Stock category.”

Technical Trader:

Trend Technical Trader (TTT) is a premier trading & hedging service, designed to profit in both up and down markets. Included is our proprietary Gold Technical Indicator (GTI).

TTT had another excellent year in 2020 averaging +27.3% per closed trade with an average holding time of 9.5 weeks, or +149% annualized overall.

Over the past 5 years TTT’s closed trades have averaged +40% annualized.

Trend Disruptors:

Disruptive technology trends will propel our future and the reality is that no industry will go untouched by this digital transformation. At the root of this transformation is the blurring of boundaries between the physical and virtual worlds. As digital business integrates these worlds through emerging and strategic technologies, entirely new business models are created.

Trend Disruptors is a service for investors seeking to invest in advanced, often unproven technology stocks on the cheap, with the objective to sell them when masses finally catch on. Covering Artificial Intelligence (AI), Virtual Reality (VR), Augmented Reality (AR), 5G, Quantum Computing & many more.

Trend Disruptors has realized average annualized gains of 178% over its 3 years of service.

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | 299.95 | $300 | Trend Letter $299.95 |

| Technical Trader | $649.95 | $324.95 | $325 | Trend Technical Trader $324.95 |

| Trend Disruptors | $599.95 | $299.95 | $300 | Trend Disruptors $299.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $524.95 | $724.95 | Trend Letter + Technical Trader $524.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $503.95 | $695.95 | Trend Letter + Technical Trader $503.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $524.955 | $724.95 | Trend Disruptors + Technical Trader $524.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $610.45 | $1,239.40 | Trend Suite TL =TTT + TD $610.45 |