Market Notes – October 18/21

The S&P 500 and Nasdaq ended higher on Monday, rising for a fourth straight day to add to gains after the S&P 500’s best week since July. Investors weighed concerns over elevated inflation against hopes that more companies will follow the lead of the big banks last week and post strong quarterly earnings results.

The moves in US stocks came amid a drop in overseas equities after China reported its slowest GDP growth rate since last year for the third quarter, as energy shortages and property-sector turmoil dragged down economic activity in the world’s second-largest economy.

This week, investors are looking ahead to a packed slate of corporate earnings results, which will help offer more insights into how companies across various industries have navigated inflationary trends, widespread labor scarcities and lingering virus-related disruptions.

The S&P 500 was up 15.09 points or .34%. Looking at the bottom of the chart we can see the 5-day RSI is now overbought, so we could have a short term pullback at any time, but understand the uptrend is still intact. Key support sits at the July low at 4250 (green dotted horizontal line).

Note: One thing that could trigger a pull back in December would be if Biden’s tax hikes go through. If higher tax rates go through, investors holding long-term gains will likely liquidate those positions by year-end, booking the profits at the lower tax rates this year.

This is a Key Chart! Breadth is looking good here. Since mid September the NYSE advance/decline line has rising, now leading the major indexes higher. If this trend continues, then the seasonal lows should be in place.

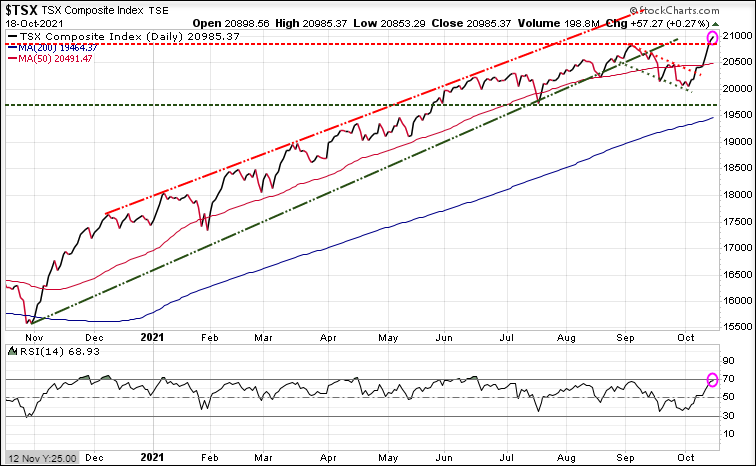

Canada’s main stock market moved further into record territory Monday despite a relatively quiet day marked by a pullback in the key energy sector. The TSX has been the hottest market in North America and continues to make new all-time highs, which it did again today.

Oil was slightly lower on the day, but has been on a tear since mid August. Based on RSI (lower part of chart) oil is now technically overbought.

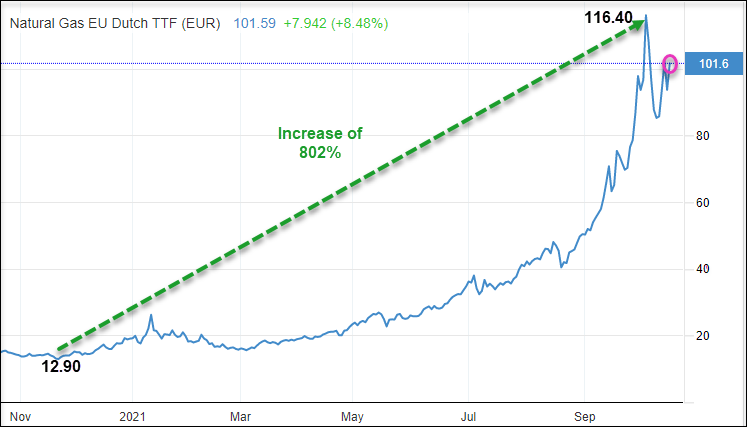

Natural gas prices have been volatile, rising 170% from December to early October, then selling off the last few days.

While North Americans complain about high natural gas prices, those in Europe have seen an 800% increase in the price of natural gas since November. Putin had commented that Russia would increase supply, but today Russian producer Gazprom has decided not to increase supply to Europe, pushing the price up again.

Gold was down 2.60 and continues to struggle to gain any momentum. Our models are targeting a turn for gold in November and our subscribers will be alerted when we have a new BUY Signal. If you wish to subscribe, go to bottom of this page for some excellent discounts.

Bitcoin has been soaring in anticipation of the first Bitcoin futures Exchange Traded Fund (ETF) that starts trading tomorrow.

Stay tuned!

Not a subscriber but want to be? Review the special discounts we are offering today.

Special Offers

| Service | Regular Price | Special Price | Saving | Subscribe |

|---|---|---|---|---|

| Trend Letter | $599.95 | 299.95 | $300 | Trend Letter $299.95 |

| Technical Trader | $649.95 | $324.95 | $325 | Trend Technical Trader $324.95 |

| Trend Disruptors | $599.95 | $299.95 | $300 | Trend Disruptors $299.95 |

| Better Deals | ||||

| Trend Letter + Technical Trader | $1,249.90 | $524.95 | $724.95 | Trend Letter + Technical Trader $524.95 |

| Trend Letter + Trend Disruptors | $1,199.90 | $503.95 | $695.95 | Trend Letter + Technical Trader $503.95 |

| Technical Trader + Trend Disruptors | $1,249.90 | $524.955 | $724.95 | Trend Disruptors + Technical Trader $524.95 |

| Best Deal | ||||

| Trend Suite: Trend Letter + Technical Trader + Trend Disruptors | $1,849.85 | $610.45 | $1,239.40 | Trend Suite TL =TTT + TD $610.45 |