Market Charts – February 28/22

Yesterday, the US and its allies ramped up their sanctions against Russia when they announced that certain Russian banks would be shut off from SWIFT. That’s a global messaging system used by banks worldwide to conduct their business and issue payments. It’s a key system when it comes to a country’s ability to participate in international trade. SWIFT is an acronym for the Society for Worldwide Interbank Financial Communications.

The Bank of Russia halted trading in Moscow on Monday, one of several measures unleashed in a bid to shield the nation’s economy from sweeping sanctions.

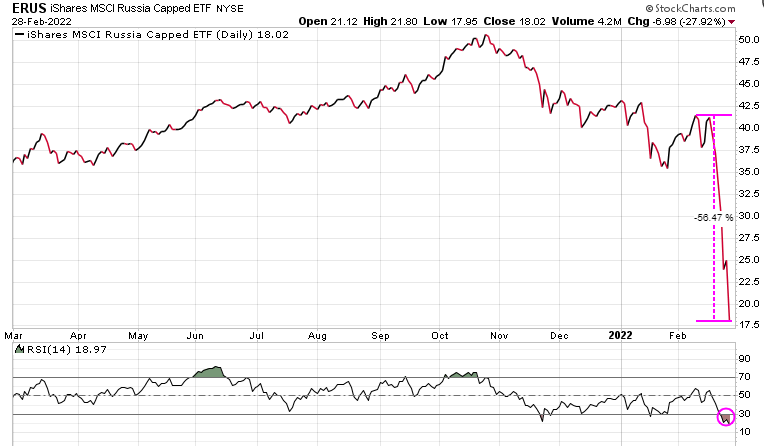

The Russian ETF is down a staggering 28% today, and 56% in the last week.

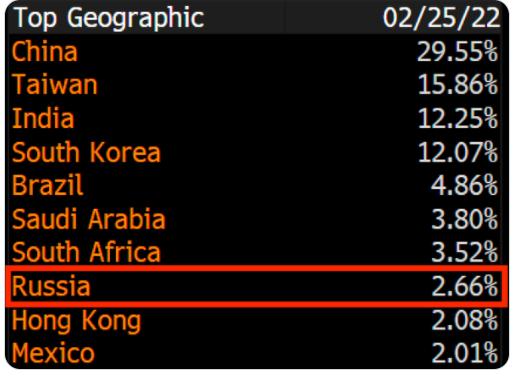

According to Reuters, equity index provider Morgan Stanley Capital International (MSCI) on Monday said Russia’s stock market is ‘uninvestable’ after stringent new Western sanctions and central bank restrictions on trading, making removal of Russian listings from indexes a ‘natural next step.’ With more than $924 billion in emerging markets ETFs, and with a Russian weighting of 2.66%, this move means that over $24 billion will flow out of Russian equities.

Oil was up another 4.13 or 4.51% as new sanctions put squeeze on many commodities.

Stay tuned!