Market Charts – March 14/22

(From Yahoo finance)…Stocks erased earlier gains to close mostly lower, with investors looking ahead to the Federal Reserve’s next monetary policy decision later this week amid an ongoing war in Ukraine and soaring inflation.

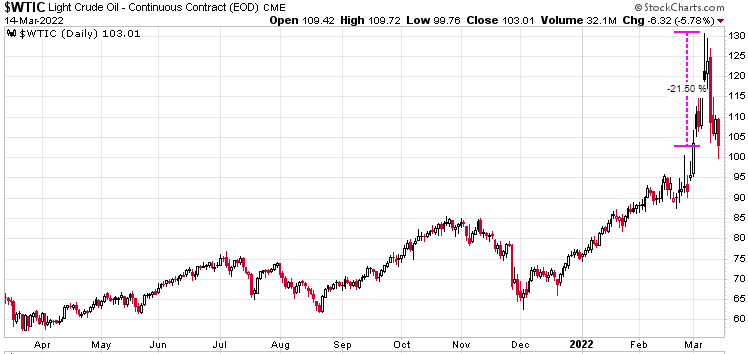

The Dow Jones Industrial Average erased earlier gains of as many as 451 points to end little changed by market close. The Nasdaq dropped 2%, and S&P 500 also turned negative as technology stocks came under renewed pressure. US crude oil prices dipped below $103 per barrel to a two-week low, while the average price for gas at the pump held near a record above $4.30 per gallon across the US.

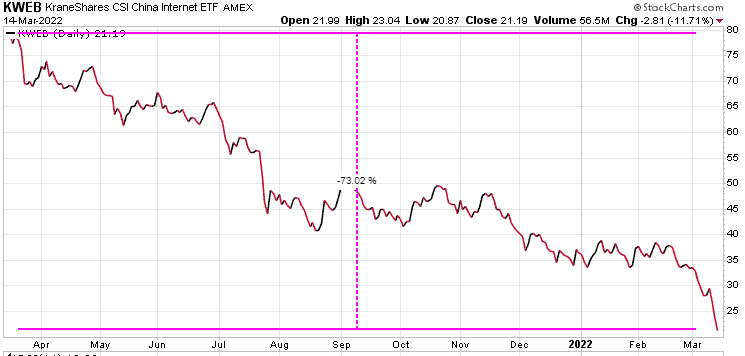

Meanwhile, Chinese stocks remained volatile as concerns over regulatory pressures and Beijing’s relationship with Russia rose further. According to reports over the weekend citing U.S. officials, Russia had asked for military support from China for the war in Ukraine. American depository receipts of major Chinese companies including Alibaba ), Nio and Baidu slid in intraday trading, building on steep year-to-date losses.

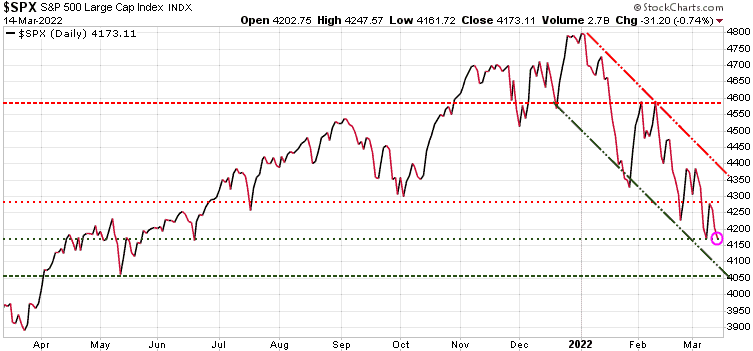

The S&P 500 was down again today, now testing the previous low. While technically we could see a reaction rally soon, such a move would likely be short-lived. The index is seeing a series of lower highs and lower lows and until it can break out of that trend, the path to least resistance is down.

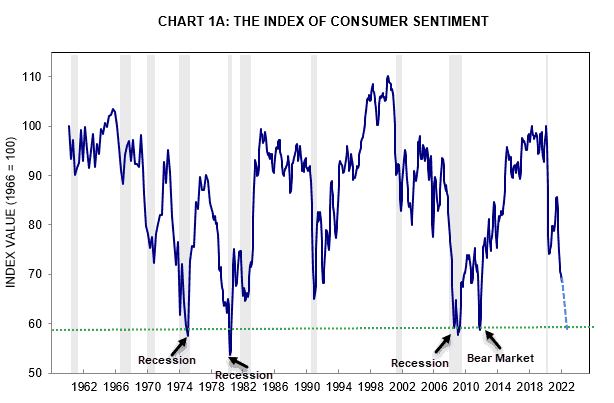

The university of Michigan posted its preliminary results of its March’22 Consumer Sentiment Survey and that figure was 59.70. Every time the survey has been this low, other than in 2011, the US economy fell into a recession (grey shaded areas indicate a recession).

Chinese tech stocks continue to slide and are now down over 73% in the past year.

As we have been highlighting to our premium subscribers, oil was extremely oversold and in the last few days has giving up over 21% of its gains.

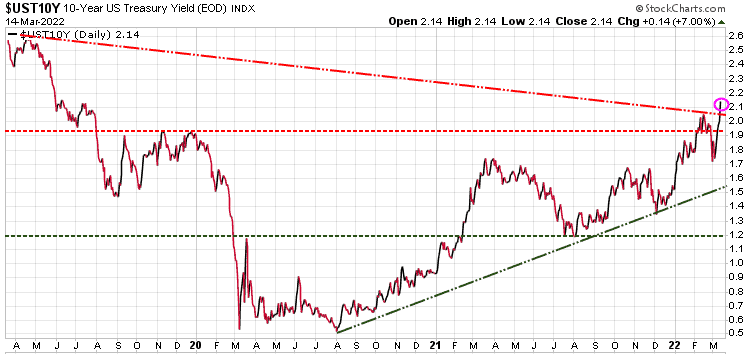

The US 10-year up 7% today, to 2.15%, the highest level since July’19. The 10-year tends to drive mortgage rates, meaning we will be seeing mortgages rising soon.

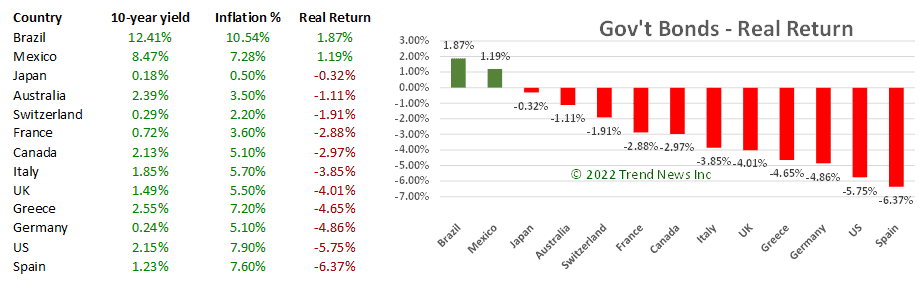

Thinking of investing in government bonds? While bond yields have been rising lately, the Real Return (nominal yield minus inflation) is negative for most countries. Here is a chart we update each week for premium subscribers and it shows that only Brazil and Mexico bonds deliver a positive return, all the others on the chart yield negative returns. Canadian bond holders are losing 2.97% per year, US bond holders are losing 5.75% and Spanish bond owners are losing 6.37% per year. If you invest in these bonds, you are guaranteed to lose purchasing power each year.

If you do not have a hedging strategy, seriously consider subscribing to Trend Technical Trader (TTT) which offers numerous hedging options. Note also, TTT includes the Gold Technical Indicator (GTI).

To ensure all readers have access to this hedge service, we temporarily reduced the price by $300. Click button below to subscribe. It’s your money – take control!

Stay tuned!