Signs of a coming recession?

Are we headed for a recession? There are a couple of indicators that have accurately signaled the last number of recessions.

The bond market is a bit of a mess. Treasury bonds have been getting killed for the third day in a row, taking ten-year yields back above 2%. It is a bit unusual given we are in the middle of a war, but clearly, for now anyways, inflation concerns are driving the bond market. If we’re going to get 10% inflation this year, then it stands to reason that the Fed will hike interest rates a lot—but will they? If they do raise rates, then the economy will get hit hard and that would most likely bring on a recession

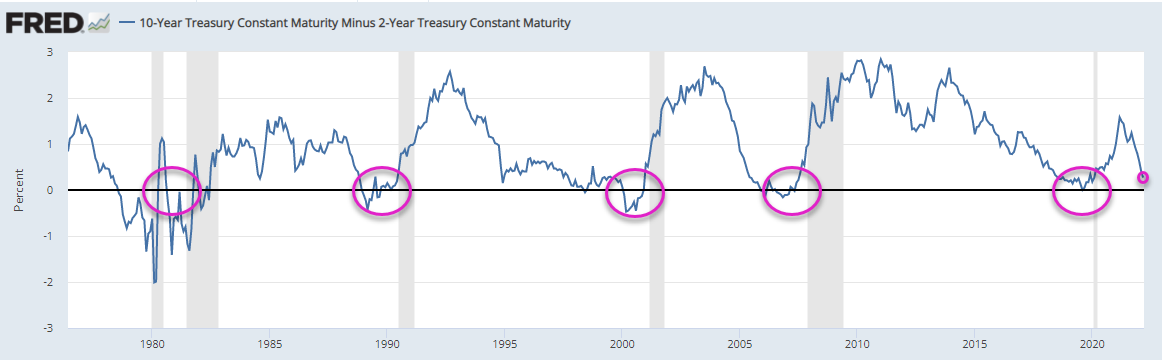

Now most investors pay little attention to the bond market, but the bond market is telling us something. An inverted yield curve has often been a potential recession signal. ‘Inverted’ means that yields on shorter-term bonds exceed those on longer-term bonds. The current 2-Year yield is 1.88%, precariously close to the 10-Year yield of 2.14%, with the ‘spread’ being only .26%, raising fears of an inversion. The reason for the fears is because a Treasury yield inversion has reliably signaled the last six recessions (recessions highlighted by vertical grey shaded areas).

The yield curve inverted in 2019 before the 2020 Covid-induced recession. It also did so in 2007 before the 2008 Global Financial Crisis/Great Recession. And it inverted in early 2000 right before the dot-com/tech stock meltdown.

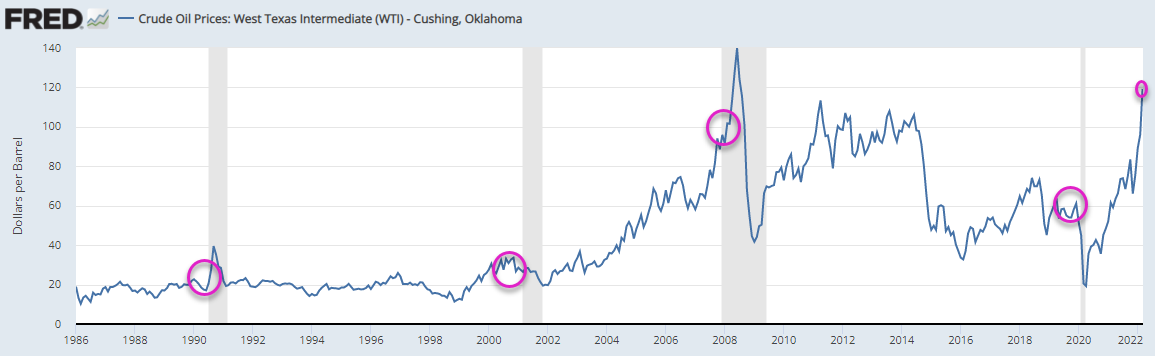

Another reliable recession indicator is crude oil. The breakout of the Ukraine war has seen oil prices spike to their highest level since the 2008 bubble burst, more than doubling the price of one year ago. As the chart illustrates, crude oil price spikes have been a reliable recession signal for decades (recessions highlighted by vertical grey shaded areas).

With the Fed now committed to ending bond purchases while raising interest rates a bear market and recession look potentially unavoidable. The bear market would be the first event to be confirmed but given Fed’s long-overdue policy tightening, we can expect a recession to be confirmed eventually.

Stay tuned!