Market Charts – April 5/22

US stocks faltered on Tuesday, dragged down by losses in tech, as investors weighed remarks by Federal Reserve Governor Lael Brainard that indicated policymakers were ready to act more aggressively to rein in inflation. Investors also monitored reports indicating the US and European Union are expected to unveil more sanctions against Russia on Wednesday.

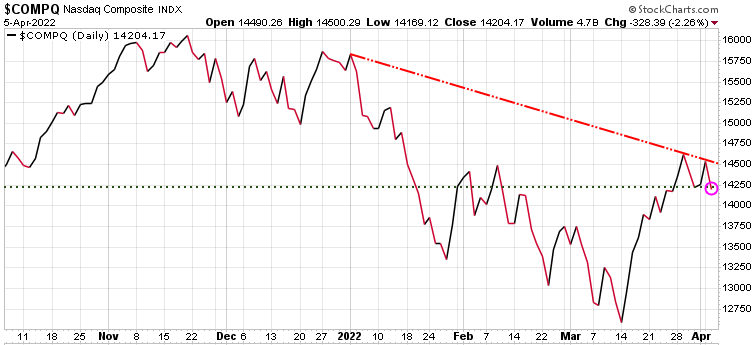

The S&P 500 tumbled 1.3%, and the Dow Jones Industrial Average shed 280 points after climbing for two straight trading sessions. The Nasdaq Composite plunged 2.3% to log its biggest drop in three weeks and erase gains from a tech rally that helped the index pop on Monday. Meanwhile, the 10-year U.S. Treasury yield jumped to 2.56%, its highest level since May 2019.

Brainard, who is awaiting a confirmation vote to serve in the central bank’s number two role, said at a conference on Tuesday that the Fed can raise interest rates more aggressively to dampen the high rate of inflation felt by Americans, also noting that officials will likely start shrinking asset holdings in a about a month (a move that could have the effect of further raising long-term interest rates).

FOMC board members speak all the time, but Brainard is the pending vice-chair, so her comments should be given more weight than other Fed members. We had been warning our Trend Letter subscribers know that the Fed was between a rock and a hard place. If they raise rates and reduce their balance sheet to fight inflation, they will crush the stock markets and risk putting the economy into a deep recession. If they don’t fight inflation, it will continue to soar. And because it is an election year in the US, and given lower income voters are hit hardest by rising inflation, there will be political pressure to fight inflation, even if it means crushing the economy and stock markets.

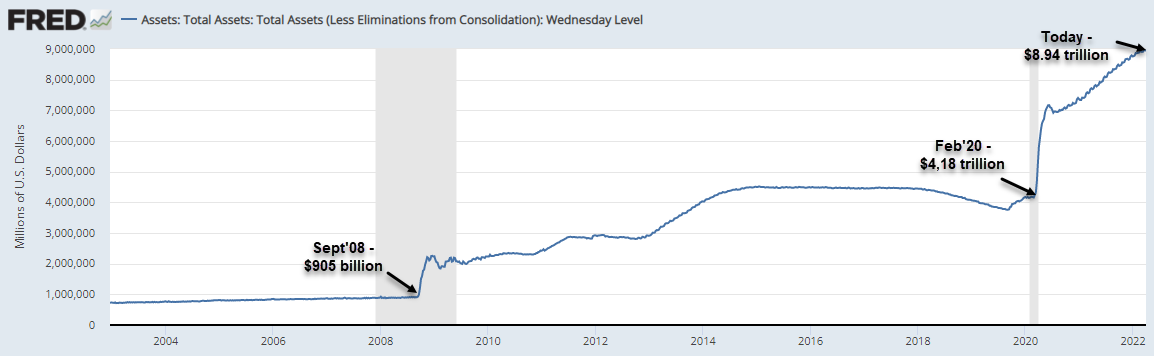

With Brainard indicating that QT (reducing balance sheet) will be accelerated, this is a big negative for financial assets, meaning stocks and credit will be under pressure. As we can see on this chart, the Fed has aggressively been adding bonds and mortgage-backed securities, running their total assets up from $905 billion in Sept’08 to $8.94 trillion today.

The threat of a more aggressive QT, combined with rising rates, is a negative combination for stocks, especially tech stocks that are not yet generating cash flow and must borrow money to keep the lights on. The Nasdaq dropped 2.26% after Brainard’s comments. Rising rates, QT, and any escalation in the Russia-Ukraine conflict are not a good combination for stocks.

Gold has been stuck in a fairly tight range over the past month, which is discouraging. If it cannot gain traction with soaring inflation and a war, you have to question what will drive it higher?

If you do not have a hedging strategy, seriously consider subscribing to Trend Technical Trader (TTT) which offers numerous hedging options. Note also, TTT includes the Gold Technical Indicator (GTI).

To ensure all readers have access to this hedge service, we temporarily reduced the price by $300. Click button below to subscribe. It’s your money – take control!

Stay tuned!