Market Charts – April 8/22

Bond yields keep rising (bonds dropping), as the yield on the 10-year Treasury spiked to 2.72% today. The 10-year yield is now up 130% since November.

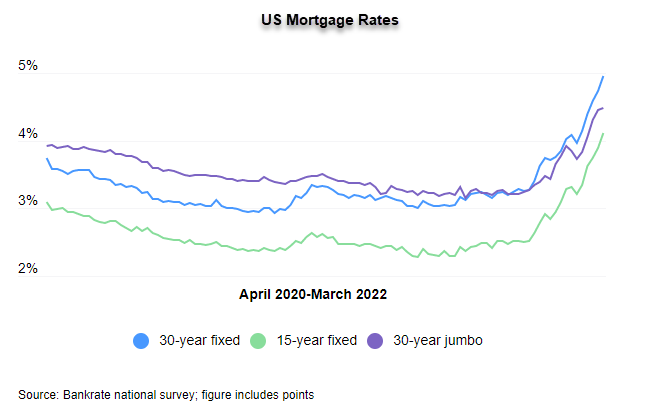

When bond yields rise, so do mortgage rates. The US 30-year mortgage is now just under 5%, the highest rate since later 2018.

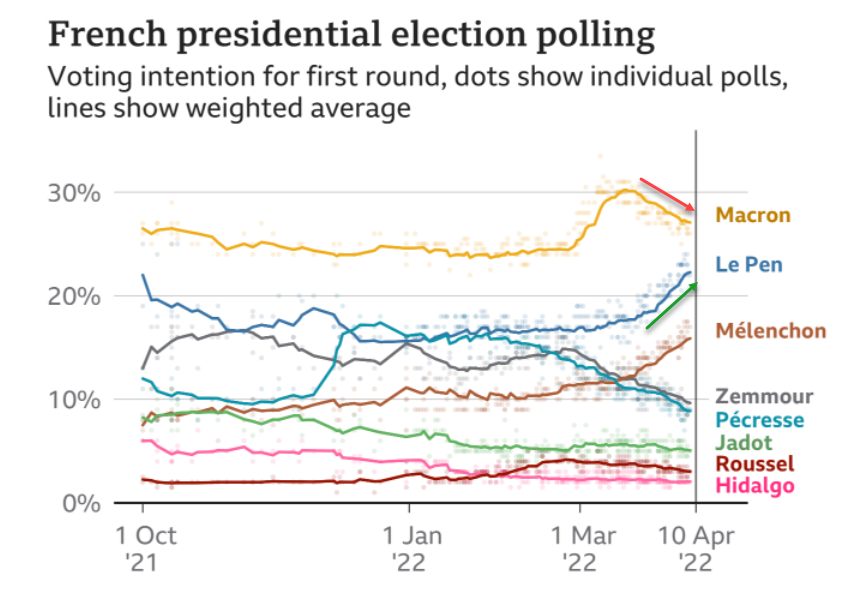

One of the ‘events’ that is occurring is the French election, with the first round this weekend. As investors, we want to keep an eye on this election because Marine Le Pen’s popularity has been steadily rising. The reason investors should be aware of this is that Le Pen is a far-right politician and one of the issues she favours is to leave the Eurozone, like the UK did.

According to BBC, a month ago Marine Le Pen was trailing President Macron by 10 points and fighting for a place in the second round against him. Now she’s seen as the clear favourite to challenge him for the presidency after Sunday’s first round. If she does make it through to the April 24 run-off, opinion polls suggest for the first time that a Le Pen victory is within the margin of error. As we can see, Le Pen has been rising, while Macron has been slipping.

What we find interesting for investors is, the markets don’t seem to have priced in the possibility that Le Pen could win. To us, even if she just makes it to the run off, the angst of France leaving the EU would be profound. Last year, Trend Letter recommended subscribers be short the Euro (via an ETF) and that trade has done well, up ~24% to date. But we suspect that should Le Pen make it to the run off, the Euro could be under even more pressure over the next couple of weeks; and should she actually win, well watch out!

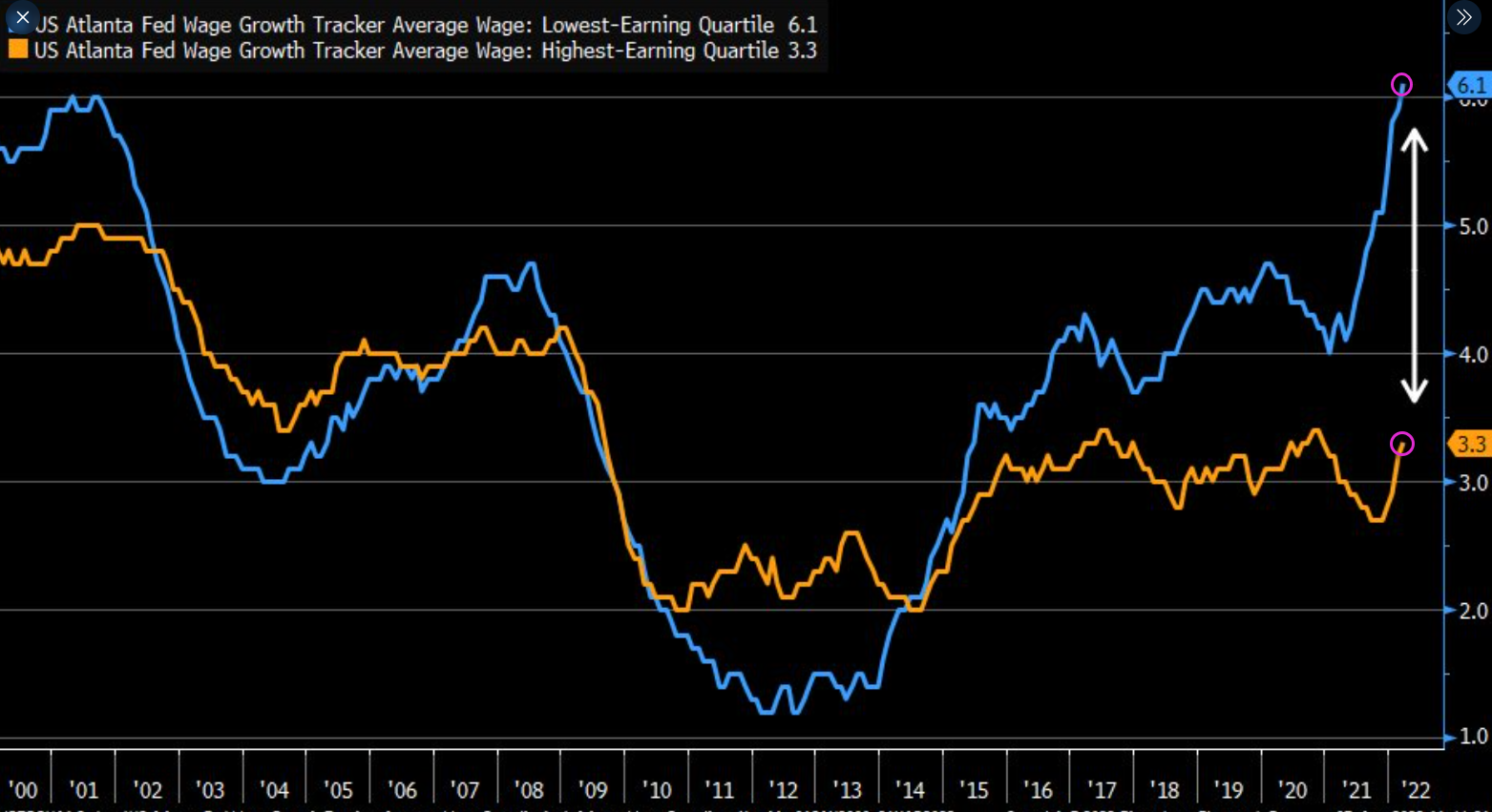

Interesting chart showing how the lowest-earning workers (blue) have had the strongest wage gains on record. Wage growth also up for highest-paid workers (orange), but not nearly as strong.