Market Charts – April 7/22

Stocks ended higher for the first time in three days, shaking off volatility from earlier this week. Still, the S&P 500 was on track to post a weekly loss and end a three-week winning streak, if levels hold through Friday’s close.

Fresh commentary from Federal Reserve officials remained in focus on Thursday, as another set of speakers offered a mixed set of commentary on the policy path forward for the central bank. St. Louis Fed President James Bullard said Thursday that he wanted the Fed to get to between 3% and 3.25% on the Fed funds rate in the second half of this year, implying more aggressive, front-loaded interest rate hikes in the near-term. Bullard was the only dissenter in the Fed’s March meeting, calling for a larger 50 basis point interest rate hike versus the 25 basis point hike that ultimately occurred.

However, other Fed officials offered a more measured approach to raising rates. In remarks Thursday, Atlanta Fed President Raphael Bostic said it would be “appropriate” to move the benchmark interest rate “closer to a neutral position,” suggesting a somewhat less hasty series of interest rate hikes. Meanwhile, Chicago Fed President Charles Evans suggested the Fed would be able to “get to neutral, look around, and find that we’re not necessarily that far from where we need to go.”

Taken together, the confluence of commentary at least temporarily helped stocks pause their latest bout of volatility from earlier this week, and kept Treasury yields steadier after a steep march higher. The benchmark 10-year yield held around 2.6% for its highest level since 2019.

The S&P 500 made a solid turn around after dropping to 4450, as it rallied to finish the session at 4500.21, up 19.06 points. The S&P 500 is still in a pattern of lower highs and lower lows, and that will need to change to get at all bullish..

A month ago crude oil was $130, now it’s $96 – are we seeing a peak in commodity prices? Well, not according to JPMorgan, as they say commodities could surge by as much 40%, far into record territory, if investors boost their allocation to raw materials at a time of rising inflation.

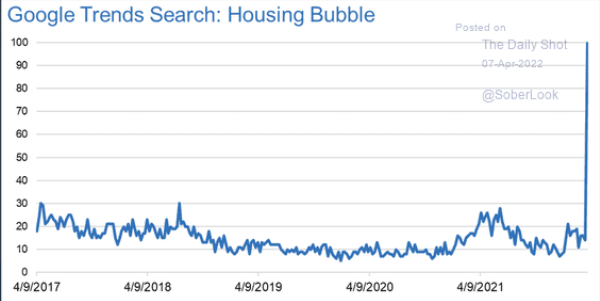

Housing bubble? Certainly based on the surge in searches of the topic, many are thinking so.

Stay tuned!