Market Notes – April 26/22

Another rough day for stock markets globally. Most markets opened lower and after making a few feeble efforts to rally, they could not gain any traction. Lots of headwinds for the markets: inflation, central banks aggressively raising rates, Covid lockdowns in China, and the fear of escalation in the Russian-Ukraine war. Most of these markets are getting close to being oversold, so we should soon get a relief rally very soon.

The Nasdaq-100 Index tumbled 3.95%. It has fallen 22.37% since the November high and 14.64% in the last month. The Nasdaq is now officially in a bear market. Note that the March low did not hold support. Looking at the bottom of the chart, we can see based on RSI, the Nasdaq is close to being oversold.

The S&P 500 is now testing key support, where it held twice in March (green arrows).

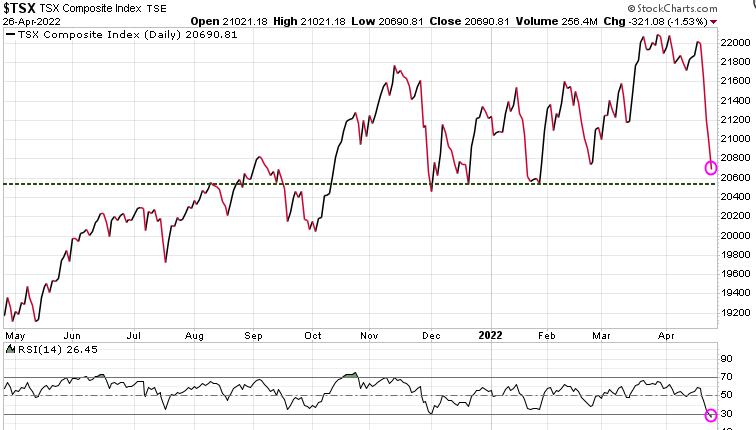

The Canadian TSX has been the strongest market globally, up until the recent decline thanks to the spike in energy and commodity prices. But in the last few days, even those sectors sold off. Note at the bottom of the chart, that the TSX is oversold now based on RSI.

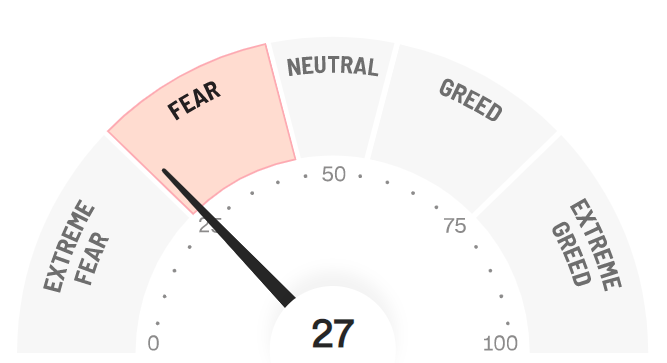

Sentiment is very weak. The CNN Fear & Greed Index looks at 7 indicators that affect investors’ sentiment and as we can see, it is very close to an ‘Extreme Fear’ reading. These indicators tend to be quite contrarian, suggesting that at minimum, we should see a relief rally very soon. But such a rally could be a sucker rally.

Stay tuned!